Life Insurance Corporation of India is the world's strongest insurance brand - Brand Finance Insurance 100 2024 report

Life Insurance Corporation of India ( LIC )is recognized as the world's strongest insurance brand in the Brand Finance Insurance 100 2024 report

According to the report titled Brand Finance Insurance 100 2024, Life Insurance Corporation of India (LIC) has emerged as the most powerful insurance brand in the world. Here you can find the complete list of the 10 most powerful insurance brands across the globe.

Notably, LIC has maintained its top position in the insurance sector and also secured the No. 1 position in the insurance brands ranking. Previously, according to the Brand Finance Insurance 100 2024 report, LIC was listed as the strongest insurance brand across the globe with a stable brand value of $9.8 billion.

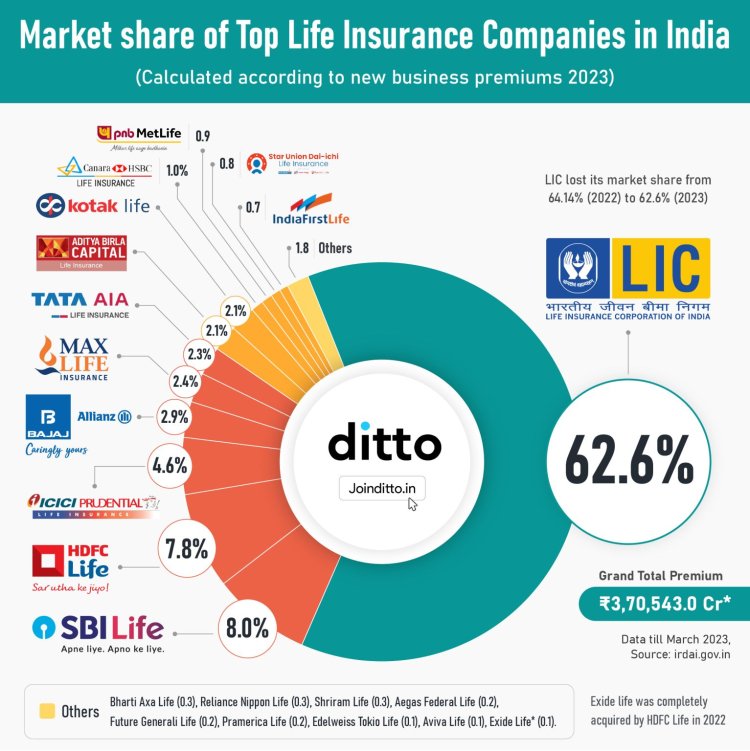

Further, in FY24, LIC recorded the highest first year premium income of Rs 39,090 crore, while SBI Life Insurance and HDFC Life Insurance led the private sector in new business premium income of Rs 15,197 crore and Rs 19,700 crore, respectively.

Commenting on the development, LIC Chairman Siddhartha Mohanty said, "LIC is grateful to all our policyholders and stakeholders for placing their trust in LIC for almost seven decades. We recognise our customers' needs and continuously develop new products to meet their insurance and investment needs. We remain focused on customer care and value creation for all stakeholders. We are proud to be ranked number one in Brand Finance Insurance's list of Strongest Insurance Brands 2024, which is an indication of the trust Brand Finance Insurance has in us.

Check below the list of the top 10 strongest insurance brands globally as released by Brand Finance.

|

Rank

|

Insurer

|

Country

|

Brand Strength Index

|

|

1

|

LIC

|

India

|

88.3

|

|

2

|

Cathay Life Insurance

|

Taiwan

|

87.7

|

|

3

|

NRMA Insurance

|

Australia

|

87.0

|

|

4

|

PZU

|

Poland

|

86.2

|

|

5

|

China Life

|

China

|

85.9

|

|

6

|

SBI Life

|

India

|

85.9

|

|

7

|

Samsung Life Insurance

|

South Korea

|

85.8

|

|

8

|

Gjensidige

|

Norway

|

85.8

|

|

9

|

UNIQA

|

Austria

|

84.5

|

|

10

|

ASR

|

Netherlands

|

84.4

|

Germany's Allianz and France's AXA retained their second and fourth positions to complete the top five.

Among the brands that saw the largest growth in brand value, Australia's NRMA Insurance stands out with an 82% increase to $1.3 billion, followed by Denmark's Tryg with a 66% increase to $1.6 billion.

Moreover, LIC India recorded the highest first year premium income of Rs 39,090 crore in FY23, while SBI Life Insurance and HDFC Life Insurance led the private sector with new business premium income of Rs 15,197 crore and Rs 10,970 crore, respectively.

Just recently, the government agreed to revise salaries for LIC employees by 17%, effective from August 2022, benefiting over 110,000 employees. LIC's share price also hit an all-time high of Rs 1,175, making the company India's most valuable PSU company, overtaking SBI by market valuation and reclaiming its position as India's fifth most valuable listed company.

Editor

Editor