14 years of Zerodha – Complete Case Study Of India's largest discount broker

Explore the 14-year journey of Zerodha, India's largest discount broker. This comprehensive case study delves into Zerodha's innovative strategies, growth milestones, and its impact on the Indian stock market

This August, stock broking platform Zerodha marked its 14th anniversary, a major milestone in its journey to becoming India's largest discount broker. Founded by billionaire brothers Nikhil and Nithin Kamath, Zerodha has transformed the stock broking industry with its innovative business model. Over the years, it has grown into a powerhouse, driving financial inclusion and democratizing stock market access. As Zerodha celebrates this anniversary, it represents a significant chapter for both the company and its customers, symbolizing trust, innovation, and continued progress in India’s financial sector.

The Journey of Zerodha: From Startup to Industry Leader

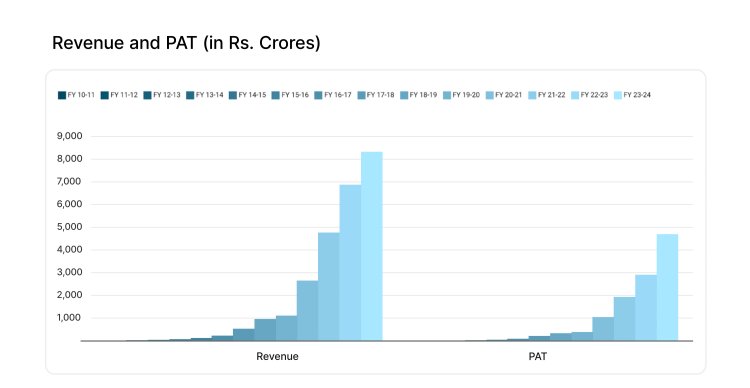

Zerodha was born in 2010 out of a vision to simplify investing for retail investors in India. Nikhil and Nithin Kamath, both seasoned traders, recognized the barriers that high brokerage fees posed for small investors and decided to disrupt the traditional model. What began as a bootstrapped startup is now an industry leader, valued at billions. The company’s meteoric rise is marked by significant milestones, including becoming the largest discount broker in India, a robust customer base of millions, and a high-profit, zero-debt model. Zerodha's success highlights the Kamath brothers' entrepreneurial spirit and commitment to creating a cost-effective and transparent investing environment.

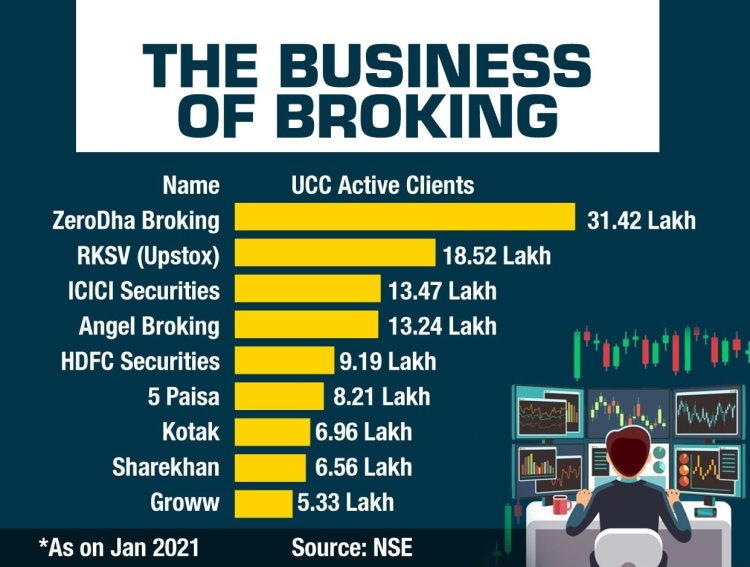

Disrupting the Brokerage Landscape: Zerodha’s Innovative Business Model

Zerodha redefined stock broking with its discount brokerage model, which offers a flat fee structure—a game-changer for the Indian market. Traditionally, brokerage firms charged commissions based on trade volumes, making it expensive for retail traders. Zerodha flipped the script by charging a fixed fee per transaction, making stock trading affordable. This innovation attracted a wide customer base, ranging from small-scale traders to large investors. The flat fee structure is cost-effective, transparent, and a testament to Zerodha's dedication to breaking down barriers in investing.

Empowering Traders with Technology: The Evolution of Zerodha’s Trading Platform

Zerodha’s flagship Kite trading platform has been a cornerstone of its technological prowess. Launched as a sleek, user-friendly interface, Kite offers advanced charting tools, seamless trading features, and real-time market data, providing users with a smooth and efficient trading experience. Zerodha has consistently focused on technological advancements, ensuring that its platforms evolve to meet the growing demands of traders. With a mobile-first approach and a robust infrastructure, Kite remains a preferred choice for traders across India, helping Zerodha stand out in a competitive market.

Building a Knowledgeable Investor Community: Zerodha's Educational Initiatives

Recognizing the importance of financial literacy, Zerodha has been proactive in educating its users through platforms like Varsity, an online learning portal, and TradingQnA, a community-driven forum. These initiatives aim to empower retail investors with knowledge, making stock markets more accessible to the masses. Varsity’s structured educational content on investing and trading has become a go-to resource for both beginners and seasoned traders. Meanwhile, TradingQnA fosters an engaged community where traders share insights, ask questions, and discuss strategies. Zerodha’s commitment to education underscores its focus on not just being a broker but also a guide for retail investors.

Navigating Challenges in a Dynamic Market: Regulatory Risks and Volatility Management

Like any player in the financial industry, Zerodha has faced its share of regulatory challenges. The stock broking sector in India is tightly regulated, and Zerodha has had to navigate these hurdles while maintaining its innovative edge. Additionally, market volatility poses risks to its revenue and business operations, but Zerodha’s leadership has been strategic in managing these challenges. By staying compliant with regulatory standards and adopting advanced risk management techniques, Zerodha has maintained its stability, even during turbulent times.

Looking Ahead: Future Prospects for Growth and Potential IPO Plans

As Zerodha moves forward, growth remains a priority. With whispers of a potential IPO, the company could soon make its stock market debut, offering investors a chance to own a piece of India's top discount broker. Zerodha is also exploring avenues for expanding its services and tapping into new markets. Whether through diversifying into different financial products or strengthening its technological capabilities, Zerodha’s growth trajectory is poised for further success. The IPO, if it materializes, could mark a new phase in the company’s already impressive journey.

The Team Behind the Success: Beyond Nikhil & Nithin Kamath

While the Kamath brothers are the public faces of Zerodha, the company’s success is driven by a talented and dynamic team behind the scenes. Zerodha has invested heavily in building a leadership team that champions innovation in technology, marketing, and customer service. From engineers shaping the next version of Kite to marketing teams reaching new audiences, every member plays a pivotal role. Their contributions have helped establish Zerodha as not just a brokerage firm but a tech-driven financial services company.

Conclusion: Join the Revolution with Zerodha!

As Zerodha celebrates its 14th anniversary, it invites investors to become part of its revolutionary approach to stock broking. With a proven track record, transparent pricing, and cutting-edge technology, Zerodha has redefined how Indians engage with the stock market. While the journey ahead will bring challenges, those willing to explore investment opportunities through Zerodha stand to benefit in the long term. As always with investments, risks are involved, but Zerodha’s commitment to innovation ensures it remains a strong player in India's fintech landscape.

Editor

Editor