SEBI Removes 15,000 Finfluencer Content Sites to Protect Investors for unregulated entities

SEBI has removed over 15,000 content sites from unregulated financial influencers to protect investors. This decisive action aims to curb misleading financial advice and ensure investor safety.

In a recent move to safeguard investors, the Securities and Exchange Board of India (SEBI) has taken decisive action against unregulated financial influencers, also known as "finfluencers." According to Kamlesh Varshney, SEBI's whole-time member, the regulator has successfully removed over 15,000 unauthorized content sites associated with these finfluencers within the last three months. These content removals were facilitated through the cooperation of various technological platforms, underscoring SEBI’s commitment to investor protection and the regulation of misleading online financial advice.

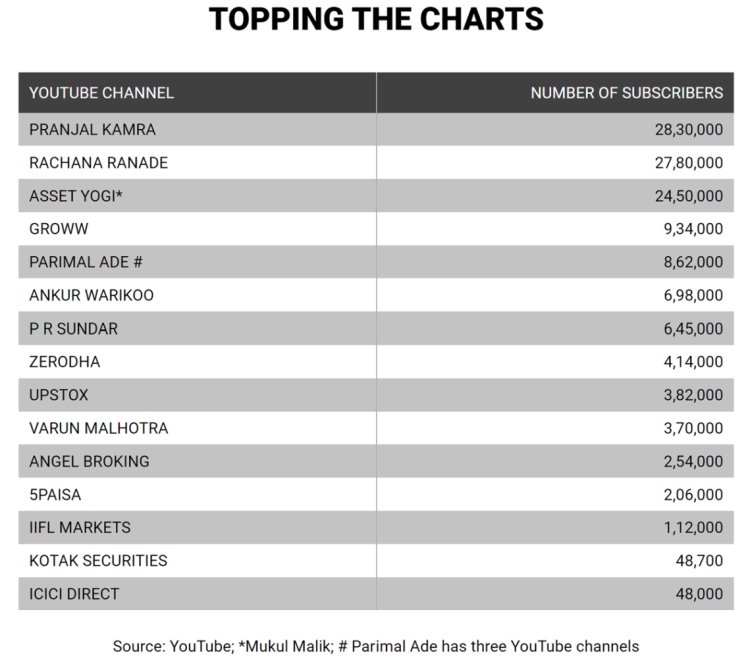

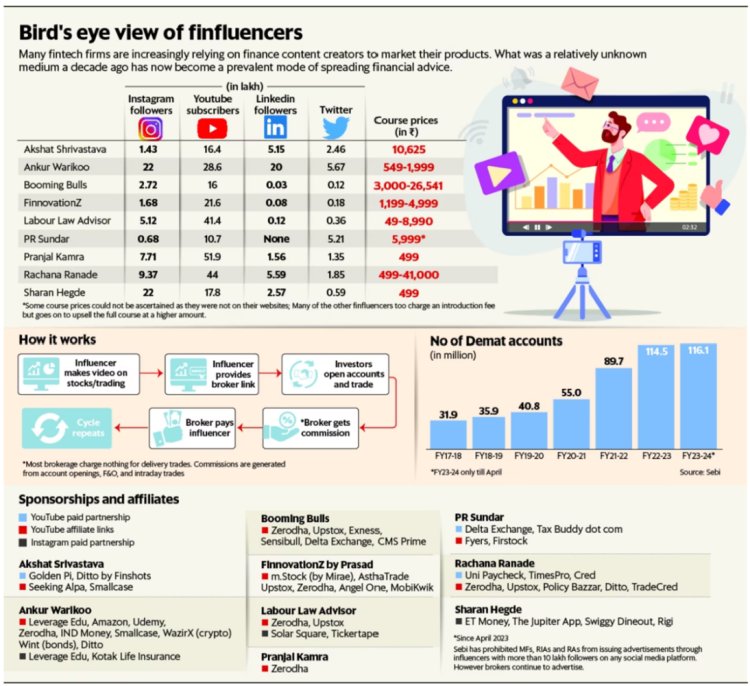

Understanding Finfluencers

Finfluencers are individuals who share investment advice on social media platforms, often without formal financial qualifications or regulatory oversight. As their popularity has grown, so has their influence on retail investors seeking quick profits in stock market trading and other financial avenues. However, this rise of unregulated financial advice poses significant risks to inexperienced investors who may follow speculative recommendations without understanding the potential consequences. The lack of accountability and regulation surrounding these entities further complicates the situation.

SEBI's Actions Against Unregulated Financial Influencers

SEBI’s recent crackdown on finfluencers highlights the regulatory body's growing concern over the proliferation of unverified financial advice online. Kamlesh Varshney, in his statement, emphasized SEBI’s determination to eliminate unauthorized content sites that pose a risk to investors. Over 15,000 such sites have been identified and removed, marking a significant milestone in SEBI's ongoing efforts to protect the financial well-being of the public. The swift action reflects the urgency of the situation, given the increasing number of investors who are influenced by unregulated content.

Methodology Behind the Removal of Unauthorized Content Sites

SEBI’s approach to removing these content sites involved collaboration with various technological platforms. By partnering with tech companies, SEBI was able to identify and target sites linked to unregulated finfluencers that were spreading misleading or harmful financial advice. Varshney highlighted the role of technology in this effort, stressing how digital tools have been instrumental in SEBI's strategy to track and eliminate these unauthorized platforms. This technological partnership exemplifies how regulators are leveraging modern solutions to combat emerging threats in the financial ecosystem.

New Regulations Amended by SEBI for Financial Influencers

To further strengthen its efforts, SEBI has introduced new regulations aimed at controlling the activities of finfluencers. These rules impose restrictions on how regulated financial entities can interact with unregistered advisers, thereby limiting the spread of unverified financial advice. The regulations are part of SEBI’s broader effort to curb the influence of unregulated individuals in the financial advisory space, ensuring that investors receive guidance only from qualified and licensed professionals.

Implications of SEBI's Regulations for Investors and Registered Investment Advisers

The impact of SEBI's crackdown extends beyond finfluencers themselves. Registered investment advisers (RIAs), who often collaborate with finfluencers to disseminate educational content, are also affected by the new regulations. While RIAs can still provide educational resources, they must do so without offering specific financial recommendations in tandem with unregistered advisers. This shift may alter the way RIAs and finfluencers interact, ensuring that only credible advice reaches the public.

Investor Education and Protection Measures by SEBI

Beyond removing unauthorized content, SEBI is also placing a renewed emphasis on investor education. Varshney stressed the importance of teaching investors to recognize the risks associated with following unregulated financial advice. SEBI is actively working to enhance investor awareness about the potential dangers in financial markets, especially for those who may be tempted by the often sensationalized promises made by finfluencers.

Future Outlook: Ongoing Efforts by SEBI to Regulate Finfluencer Activities

SEBI’s crackdown is not a one-time event. Ongoing efforts to regulate finfluencer activities are expected, with more discussions planned at events such as the Global Fintech Fest. SEBI has also hinted at releasing a consultation paper aimed at further refining the rules governing the actions of financial influencers. These initiatives reflect SEBI’s long-term commitment to creating a safer investment environment.

Conclusion: Safeguarding Investors Through Regulation and Awareness

SEBI’s aggressive action against unauthorized finfluencer content marks a pivotal moment in the regulation of financial advice in India. By removing over 15,000 content sites, SEBI has taken a significant step towards protecting investors from the risks posed by unregulated sources. As SEBI continues to refine its regulations and collaborate with technological platforms, it sends a clear message to investors: stay vigilant, rely on trusted and licensed advisers, and avoid the potential pitfalls of misleading online content.

Editor

Editor