CreditBulls Stock market Financial Scam in Jamnagar Gujarat

A major financial scandal has unfolded in Jamnagar, Gujarat, with CreditBulls Investments at the center. The company is accused of defrauding over 2000 investors through a Ponzi scheme, leading to an estimated loss of 200 to 300 crore Rupees

The CreditBulls Financial Scam: An Overview

In early 2024, the National Stock Exchange of India Limited (NSE) issued a warning against CreditBulls, a multi-crore investment company. The warning highlighted the company's unrealistic claims of 'No Risk, High Returns' money return guarantee plans, which are prohibited by law. The NSE advised investors to be cautious and not to fall prey to such scams.

Discover the shocking details of the financial fraud orchestrated by Creditbulls Investments, Jamnagar, Gujarat, India leaving thousands of investors devastated. This video exposes the elaborate scheme led by Mr. Dhaval Solani, along with his accomplices, which has resulted in the loss of hard-earned money amounting to over 100 crore. From false promises of high returns to shutting down operations without returning investors' capital, explore the intricacies of the Creditbulls Investments scam and the challenges faced by affected investors.

The Fallout

The CEO of CreditBulls, Dhaval Solani, reportedly fled to Dubai and then to Morocco, taking with him a significant amount of investors' money. It is estimated that around 30-40 crores have disappeared after the founders locked the firm and vanished.

Impact on Investors

The scam affected over 500 people from Jamnagar and Rajkot, with victims spread across India, including Kolkata, Bengaluru, Patna, and Chandigarh. These individuals, who ranged from retired elderly to working women and students, reported losing their savings.

CreditBulls scammed individuals who lost lakhs, including retired elderly, regular middle-class families, working women, and students. They are all ordinary people like you and me, with small savings to spare.

Legal Actions On Creditbulls

CreditBulls Scam Aftermath: Limited Government Action and Investor Struggles

The situation regarding the CreditBulls scam presents a bleak picture for investors seeking recourse. Here's a detailed breakdown of the current developments and the challenges faced:

- Slow Government Response: As of July 6, 2024, there seems to be a lack of significant progress from the government in taking action against CreditBulls. While an investigation is supposedly underway, the pace appears sluggish, leaving investors in a state of uncertainty.

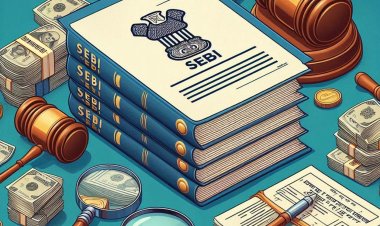

- NSE Clarification and Investor Risk: In January 2024, the National Stock Exchange of India (NSE) issued a crucial announcement. They clarified that Creditbulls India was not registered with them, essentially exposing them as unauthorized

- stockbrokers. This revelation has severe implications for investors involved. Since CreditBulls wasn't a legitimate player, investors cannot rely on the standard legal protections typically offered by the NSE.

- Investor Vulnerability: The CreditBulls scam exemplifies the unfortunate reality of investment scams in India. Decades of experience show that recovering lost funds can be an uphill battle for individual investors. The sheer scale of the scam is evident by the staggering amounts involved, with victims reportedly investing anywhere between five lakh rupees (₹500,000) to a much higher fifty lakh rupees (₹5,000,000) in these fraudulent accounts.

This information paints a concerning picture for those affected by the CreditBulls scam. The lack of swift government action and the limitations imposed by CreditBulls' unregistered status make it an arduous process for investors to recover their losses.

An FIR was filed by the victims, leading to the arrest of the manager, Pankaj Vadgama, on March 30th, 2024.

Understanding Ponzi Schemes

CreditBulls operated a Ponzi scheme, where they promised high interest rates to investors for entrusting money, which they claimed would be invested in the stock market. Instead of generating revenue, the scheme paid returns to older investors using the capital from new investors, eventually leading to its collapse.

CreditBulls Scam Details: Luring Investors with False Promises

CreditBulls, a company operating in Jamnagar, India, allegedly targeted working-class individuals and small business owners with a deceptive investment scheme. Their strategy focused on exploiting the desire for high returns by promising unrealistic interest rates.

Here's a breakdown of their tactics:

- Collective Investment Scheme (CIS) Focus: CreditBulls primarily dealt with CIS, a type of investment vehicle that pools funds from multiple investors.

- High Interest Rate Lure: They used the promise of exceptionally high interest rates to entice potential investors.

- False Stock Market Claims: They convinced people to invest their money, claiming they would manage it in the stock market.

- Guaranteed Returns with No Risk: To further manipulate investors, they made deceptive guarantees of consistent monthly income with zero risk involved.

- Fake Legitimacy: To create an illusion of legitimacy, CreditBulls might have provided seemingly official company documents and an online portal for investors to monitor their supposed investments.

However, these tactics are classic hallmarks of a Ponzi scheme. The promised high returns likely weren't generated through genuine stock market activity, but rather by using new investors' money to pay earlier investors. Once the inflow of new funds stopped, the scheme would collapse, leaving victims with significant financial losses.

Guarding Your Money: How to Avoid Investment Scams

The CreditBulls scam serves as a stark reminder of the importance of investor vigilance. Here are crucial steps you can take to protect yourself from similar fraudulent schemes:

- Guaranteed Returns - A Huge Red Flag: Any offer promising guaranteed returns on investments, particularly those involving the stock market, is a giant red flag. The stock market is inherently risky, and no legitimate professional can guarantee specific outcomes.

- Financial Knowledge is Power: Educate yourself about different investment options and the risks associated with each. Don't let financial ignorance leave you vulnerable to exploitation by scammers.

- Research Before You Invest: Never rush into an investment. Always conduct thorough research on any company or scheme before entrusting them with your hard-earned money. Legitimate organizations will readily provide detailed information about their operations and investment products.

- Verify Credentials, Not Just Appearances: Don't be fooled by a company having a business license or GST number. These are relatively easy to obtain. Instead, focus on verifying their SEBI registration number (for Collective Investment Schemes) and ensuring they operate under the regulatory framework of the Securities and Exchange Board of India (SEBI).

- Realistic Returns Matter: Be wary of promises of ridiculously high returns. Legitimate financial institutions offer realistic growth rates based on sound investment strategies. Avoid investments promising exorbitant compound interest, as it's a classic sign of a scam.

- Healthy Skepticism in the Digital Age: The internet is a powerful tool, but it can also be manipulated by scammers. Don't blindly trust everything you see online. Be skeptical of aggressive digital marketing tactics and any claims of "awards" or endorsements that seem dubious.

The Deception

CreditBulls tried to establish credibility by publishing journalistic articles about themselves, but these were unverified and part of their deceptive practices.

The CreditBulls case serves as a cautionary tale, exposing the devastating impact of Ponzi schemes that exploit unsuspecting investors. Here's a breakdown of the key issues and a call to action:

-

CreditBulls' Deception: CreditBulls operated a classic Ponzi scheme, luring investors with unrealistic promises of high returns. Their deceptive practices involved misleading clients about their investment activities and ultimately causing significant financial losses. This type of activity is not only illegal, but also blatantly unethical.

-

The Need for Stronger Regulations: The prevalence of such scams highlights the urgent need for the government to establish more robust legal frameworks to combat digital financial fraud. These frameworks should encompass stricter regulations and stronger enforcement mechanisms to deter potential scam artists.

-

Individual Investor Responsibility: While stronger regulations are crucial, individual investors also play a critical role in safeguarding their finances. It's essential to remain cautious of any company or scheme that makes exaggerated promises or engages in dubious practices.

-

Seek Professional Guidance: Don't be afraid to seek professional financial advice. Reputable financial advisors from established firms with a long-standing presence in the market can offer valuable guidance and help you make informed investment decisions.

By combining stronger regulations with increased investor awareness and a commitment to seeking professional advice, we can create a safer financial environment for everyone.

Find Out CreditBulls Press Release NSE Below attachment:

Editor

Editor