Unlock the Secrets of No Cost EMI: How It Works and What You Need to Know for Online Shopping

Discover the benefits and workings of No Cost EMI for online shopping. Learn how this interest-free payment option can help you manage your budget and make big-ticket purchases more affordable.

What is No Cost EMI and how does it work?

No Cost EMI, a popular online shopping financial option, allows you to purchase items in installments without paying any interest. It's a convenient way to spread out payments over time, making larger purchases more accessible. By understanding how No Cost EMI works, you can make informed financial decisions while shopping online.

What is No Cost EMI?

Zero cost EMI is a type of financing where you can purchase a product and repay the amount in installments without incurring any interest charges. It's a popular option in the e-commerce industry, offering a more flexible way to pay for online purchases.

No Cost EMI, or No Cost Equated Monthly Installment, is a financing option that allows consumers to purchase high-value items and pay for them in monthly installments without any additional interest charges. This means that the total amount paid over the EMI period is equal to the product's original price, with no extra cost added for the convenience of paying in installments.

How Does No Cost EMI Work?

When you opt for a No Cost EMI, the retailer or the financial institution absorbs the interest cost that would typically be charged on an EMI. Here’s how it generally works:

1. Selection of Product: Choose a product that offers a No Cost EMI option.

2. Payment Option: At checkout, select the No Cost EMI payment method.

3. EMI Tenure: Choose the EMI tenure, which can range from 3 to 12 months or more, depending on the retailer and the financial institution.

4. Monthly Installments: The total product price is divided into equal monthly installments, which you pay over the selected tenure.

Benefits of No Cost EMI

• Interest-Free Payments: You pay only the product price, with no additional interest.

• Budget Management: Spread the cost of expensive items over several months, making it easier to manage your budget.

• Wide Availability: Many retailers and online platforms offer No Cost EMI options on a variety of products, from electronics to home appliances.

How Does No Cost EMI Work?

No Cost EMI involves a simple process:

- Choose a product: Select the item you want to purchase.

- Select No Cost EMI: Choose the No Cost EMI option at checkout.

- Repayment tenure: Select the desired repayment period, typically ranging from 3 to 12 months.

- Monthly installments: The total purchase amount is divided into equal monthly installments.

- Repayment: Make regular monthly payments until the full amount is repaid.

Types of No Cost EMIs:

No Cost EMIs have become a popular financing option for consumers looking to make big-ticket purchases without the burden of upfront costs. Here are the primary types of No Cost EMIs:

- Discounted Interest: The retailer absorbs the interest charges, offering a discounted price to the customer.

Here, the retailer offers a discount equivalent to the interest amount. For example, if a product costs ₹10,000 and the interest for a 6-month EMI is ₹1,000, the retailer might offer the product at ₹9,000 for No Cost EMI customers. The consumer pays ₹9,000 in installments, effectively making it interest-free. - Bundled Interest: The interest is included in the product's price, but the customer doesn't pay any additional interest.

In this type, the interest cost is borne by the retailer or the manufacturer. The consumer pays the product price in equal monthly installments without any additional interest. This is often facilitated through partnerships between retailers and financial institutions. - Interest Subvention:

In this variant, a third party, such as a bank or financial institution, covers the interest cost. The consumer pays the principal amount in installments, while the interest is subsidized by the third party. - Credit Card No Cost EMI:

Many credit card companies offer No Cost EMI options on select purchases. The interest is either borne by the retailer or adjusted through discounts. This type is convenient for consumers who prefer using their credit cards for purchases. - Debit Card No Cost EMI:

Similar to credit card No Cost EMIs, some banks offer this facility on debit cards. The process is straightforward, and the interest cost is managed by the bank or retailer, making it an attractive option for debit card users.

Benefits of No Cost EMIs

• Affordability: Allows consumers to purchase high-value items without immediate financial strain.

• Flexibility: Offers various tenure options, making it easier to manage monthly budgets.

• Convenience: Available on multiple payment methods, including credit and debit cards.

The Role of Retailers and Financial Institutions

Retailers partner with financial institutions to offer No Cost EMI options to customers. The retailer provides the product, while the financial institution handles the financing. This collaboration ensures a smooth repayment experience for the customer.

Eligibility Criteria

To qualify for a No Cost EMI offer, you typically need:

- Good credit score: A high credit score indicates financial reliability.

- Minimum income: You may need to meet a certain income threshold.

- Age: There might be age restrictions for eligibility.

Pros and Cons of Using No Cost EMIs

Pros:

- Affordability: Lower monthly payments make larger purchases more manageable.

- Easy budgeting: Predictable monthly installments help with financial planning.

- Access to bigger purchases: Buy items you might not be able to afford upfront.

Cons:

- Hidden charges: Some No Cost EMI offers may include processing fees or other charges.

- Risk of overspending: The ease of purchasing on credit can lead to overspending.

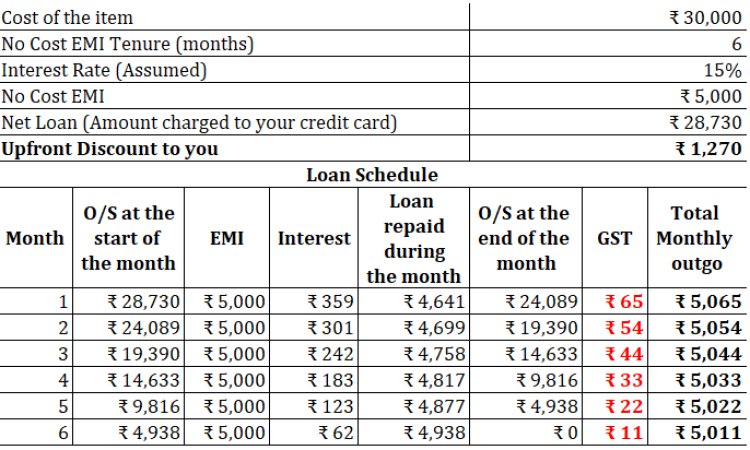

Understanding Hidden Costs Of No Cost EMI

While No Cost EMI offers interest-free financing, there might be hidden costs involved. These can include:

- Processing fees: Charges for processing the EMI application.

Even though the EMI is advertised as "no cost," many banks and financial institutions charge a processing fee. This fee can range from 1-2% of the product's price. For example, on a ₹50,000 purchase, a 2% processing fee would add ₹1,000 to your total cost - Late payment fees: Penalties for missing or late payments.

- Minimum transaction amount: There might be a minimum purchase amount required.

- GST on Interest

Although the interest is waived, the Goods and Services Tax (GST) on the interest amount may still be applicable. This means you might end up paying GST on the interest that the bank or retailer has waived, increasing your overall expenditure. - Foreclosure or Prepayment Charges

If you decide to pay off your EMI before the tenure ends, you might incur foreclosure or prepayment charges. These charges can range from 2-4% of the outstanding balance, which can be a significant amount depending on the remaining principal. - Higher Product Prices

Sometimes, the cost of the interest is embedded in the product price. Retailers might increase the product price to cover the interest cost, meaning you might not get the best deal compared to paying upfront or using a regular EMI option. - Discount Forfeiture

In some cases, opting for a No Cost EMI might mean forfeiting other discounts or offers. For instance, a product might be available at a lower price if paid upfront, but choosing the No Cost EMI option could mean losing out on that discount.

Tips to Avoid Hidden Costs

• Read the Fine Print: Always check the terms and conditions to understand all applicable charges.

• Compare Prices: Look at the total cost of the product with and without No Cost EMI to see if you're getting a good deal.

• Ask Questions: Don't hesitate to ask the retailer or bank about any potential hidden charges before committing to a No Cost EMI.

Understanding these hidden costs can help you make more informed decisions and avoid unexpected expenses when opting for No Cost EMIs.

Comparative Analysis: Amazon vs. Flipkart

Amazon and Flipkart, two major e-commerce platforms in India, offer No Cost EMI options. While the specific terms and conditions may vary, both platforms provide customers with flexible payment options.

Using a No Cost EMI Calculator

A No Cost EMI calculator can help you estimate your monthly payments and total cost before making a purchase. By understanding the financial implications, you can make informed decisions.

Conclusion

No Cost EMI offers a convenient way to finance online purchases. By understanding how it works, the eligibility criteria, and potential hidden costs, you can make the most of this financial option and enjoy responsible online shopping.

While No Cost EMI can be a great way to finance purchases, it’s important to be aware of potential hidden costs, such as processing fees or GST on the interest amount. Always read the terms and conditions carefully to ensure you understand all aspects of the offer.

No Cost EMI provides a flexible and cost-effective way to make significant purchases without the burden of upfront costs, making it an attractive option for many consumers.

Editor

Editor