Kisan Credit Card: A Lifeline for India’s Farmers

The Kisan Credit Card (KCC) has become a financial lifeline for millions of Indian farmers, offering timely credit for agricultural needs. However, accessibility gaps and implementation challenges still hinder its full potential.

The Kisan Credit Card: Lifeline for India’s Farmers, Challenges Remain

In a country where agriculture remains the backbone of the economy and the largest employer, access to affordable credit is critical for millions of farmers. The Kisan Credit Card (KCC) scheme, launched in 1998, has emerged as a transformative tool, providing timely and adequate financial support to farmers across India. With recent policy updates and increased attention, the KCC continues to make headlines as a cornerstone of rural finance.

In the drought-stricken village of Jalna, Maharashtra, farmer Rajendra More faced ruin in 2023. Then, a ₹1.5 lakh Kisan Credit Card (KCC) saved his soybean crop. "Without KCC, I’d have sold my land," he says in a NDTV testimonial. His story mirrors millions across India, where the KCC has revolutionized farm finance since its 1998 launch. Designed by NABARD and RBI, this scheme offers timely, affordable credit to farmers. Yet, 27 years on, gaps persist.

What is the Kisan Credit Card?

The KCC is a flexible credit line providing farmers with loans for crops, equipment, and emergencies. Key features include:

-

Revolving Credit: Up to ₹3 lakh at 4-7% interest (PM-KISAN beneficiaries get 4% with interest subvention).

-

Insurance Coverage: Mandatory ₹50,000 accident insurance and crop insurance linkage.

-

Multi-Year Validity: 5-year cards with annual renewals (myscheme.gov.in).

-

Digital Access: SMS alerts, ATM withdrawals, and online applications via banks like SBI.

Over 7 crore active cards exist today, with ₹10 lakh crore sanctioned (RBI, 2024).

How Kisan Credit Card Works: Simplified

Eligibility:

-

All farmers (owners, tenants, sharecroppers) and fishery/poultry workers.

Application:

-

Approach any bank (public/private/cooperative) or Common Service Centres.

-

Submit land papers, ID, and cultivation proof.

-

Receive in-principle approval in 2 weeks (SBI portal).

Usage:

-

Withdraw cash via ATMs or bank branches.

-

12-month repayment after harvest.

Kisan Credit Card Background and Objectives

The Kisan Credit Card was introduced to address the persistent challenge of farmers being forced to rely on informal lenders, who often charge exorbitant interest rates, trapping borrowers in cycles of debt. The scheme’s primary objective is to provide farmers with easy access to institutional credit for their cultivation expenses, post-harvest needs, and even personal requirements such as education and healthcare.

The Kisan Credit Card offers a single-window credit facility, allowing eligible farmers to withdraw funds as needed throughout the year. The scheme covers a broad spectrum of beneficiaries, including individual farmers, joint borrowers, owner-cultivators, tenant farmers, sharecroppers, and those engaged in allied agricultural activities such as animal husbandry, dairy, and fisheries.

Key Features of Kisan Credit Card

-

Eligibility: Individual farmers, joint borrowers, owner cultivators, tenant farmers, sharecroppers, and groups involved in allied activities are all eligible for Kisan Credit Card loans.

-

Loan Purposes: Short-term credit for cultivation, post-harvest expenses, marketing, transportation, cold storage, equipment maintenance, and even personal needs like education and marriage.

- Loan Limit: As of 2025, farmers can avail loans up to ₹3 lakh for crop cultivation, with the government proposing to increase this limit to ₹5 lakh. For allied activities, the limit is ₹2 lakh.

- Interest Subvention: The government provides an interest subvention (discount) of 1.5% per annum, reducing the effective interest rate for farmers to 7%. An additional 3% subvention is available for prompt repayment, bringing the effective interest rate down to 4%

- Prompt Repayment Incentive: Farmers who repay their loans on time receive further interest relief, making the scheme even more attractive.

- Digital Transparency: The government has launched the Kisan Rin Portal to streamline subsidy claims and enhance transparency for both banks and farmers.

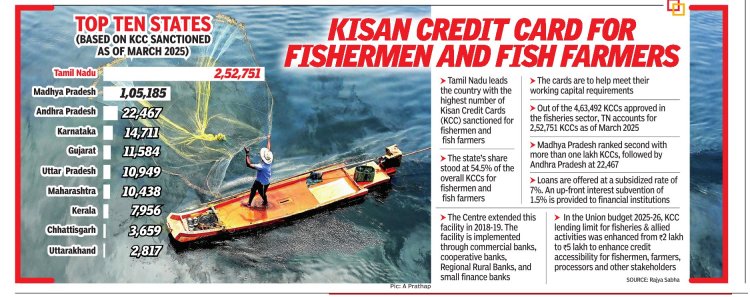

Recent Developments and Government Initiatives

In the Union Budget 2025, Finance Minister Nirmala Sitharaman announced plans to raise the Kisan Credit Card loan limit from ₹3 lakh to ₹5 lakh, reflecting the government’s commitment to supporting farmers’ evolving needs. However, as of mid-2025, this increase is still under consideration and not yet implemented.

The Union Cabinet, headed by Prime Minister Narendra Modi, recently approved the continuation of the interest subvention component under the Modified Interest Subvention Scheme, ensuring that farmers continue to receive affordable loans through the Kisan Credit Card.

Impact and Reach Of Kisan Credit Card

The Kisan Credit Card has revolutionized agricultural credit in India. Over 7.75 crore farmers now hold Kisan Credit Cards, and the total agricultural credit disbursed under the scheme has grown exponentially—from ₹4.26 lakh crore in 2014 to over ₹10 lakh crore today. The broader agricultural credit ecosystem has reached nearly ₹25.5 lakh crore in the last financial year, demonstrating the scheme’s significant impact.

By providing institutional credit at affordable rates, the KCC has reduced farmers’ dependence on informal lenders and improved their financial resilience. The scheme also supports farmers in allied sectors, recognizing the importance of diversification in rural livelihoods.

-

Punjab: Farmer Gurpreet Singh doubled wheat yield using KCC for drip irrigation (YouTube: "KCC Success").

-

Odisha: Fisherwoman Parvati Nayak bought new nets, increasing income by 40% (NABARD case study).

-

Tamil Nadu: Tenant farmer Meena secured her first loan via Aadhaar-linked KCC, defying land-ownership barriers.

Government data shows KCC boosted average farm incomes by 22% in 2023-24.

Case Example Of Kisan Credit Card

Consider the story of a smallholder farmer in rural Uttar Pradesh. Before the Kisan Credit Card, he relied on local moneylenders to finance his wheat cultivation, paying interest rates as high as 24% per annum. After enrolling in the Kisan Credit Card scheme, he now accesses up to ₹3 lakh at an effective interest rate of 4% (with prompt repayment), enabling him to invest in better seeds, fertilizers, and even his children’s education. The flexibility to withdraw funds as needed, coupled with the low interest rates, has transformed his farming operations and improved his family’s standard of living.

Recent upgrades address these gaps:

-

KCC Satyagraha (2023): A saturation drive added 1.3 crore new beneficiaries, focusing on women and tribal farmers.

-

Digital Push: Apps like Kisan Sarathi enable chatbot-assisted applications.

-

Expanded Coverage: Now includes cattle feed, transport, and post-harvest needs (myscheme.gov.in).

NABARD plans to integrate KCC with e-mandis and warehousing receipts by 2026.

Kisan Credit Card Challenges and the Way Forward

Despite its success, the Kisan Credit Card scheme faces challenges such as ensuring last-mile delivery to all eligible farmers, especially tenant farmers and those in remote areas. Digital literacy and awareness campaigns are essential to maximize the scheme’s reach and effectiveness.

The government’s commitment to expanding the loan limit and enhancing digital infrastructure signals a continued focus on empowering farmers and strengthening India’s agricultural sector.

Despite successes, hurdles remain:

-

Exclusion: Only 45% of tenant farmers have KCCs due to documentation issues (NITI Aayog, 2024).

-

Awareness Gaps: Per a video testimonial (YouTube: "KCC Explained"), 68% of Bihar farmers don’t know KCC covers non-crop expenses like storage.

-

Delays: Loan disbursals take 30-60 days in UP/Odisha versus 14 days in Punjab.

-

Digital Divide: Elderly farmers struggle with ATM/online banking.

How does the Kisan Credit Card scheme help farmers access affordable credit

The Kisan Credit Card (KCC) scheme helps farmers access affordable credit by offering a streamlined, institutionalized mechanism for short-term and investment loans tailored to agricultural needs. Here’s how it achieves this:

-

Institutional Access to Credit: The KCC allows farmers to obtain loans directly from banks and cooperative societies, reducing their reliance on informal lenders who often charge exorbitant interest rates.This ensures that farmers have a reliable and regulated source of funds for their cultivation, post-harvest, and even allied activities.

- Concessional Interest Rates: Under the Modified Interest Subvention Scheme (MISS), farmers are provided short-term agricultural loans at a concessional interest rate of 7% per annum for loans up to ₹3 lakh. With an additional 3% prompt repayment incentive, the effective interest rate can drop to as low as 4%. This makes borrowing significantly cheaper for farmers.

- Simplified and Flexible Repayment: The scheme offers a comfortable 12-month repayment schedule, with flexibility to adjust repayment dates based on harvest cycles and natural calamities. This aligns loan repayments with farmers’ cash flows, reducing financial stress.

- Collateral-Free Loans: For loans up to ₹1 lakh (in some cases ₹1.6 lakh for allied activities), no collateral is required. For tie-ups up to ₹3 lakh, collateral is often waived, making it easier for small and marginal farmers to access credit.

- Digital and Transparent Process: The introduction of the Kisan Rin Portal ensures faster and more transparent processing of interest subvention claims, reducing delays and improving accountability in the credit delivery system.

- Coverage for Diverse Needs: The KCC covers not just crop cultivation but also post-harvest expenses, marketing, transportation, and allied activities such as animal husbandry, dairy, and fisheries. This broad coverage supports the holistic financial needs of farmers.

- Insurance Benefits: The scheme provides insurance coverage (up to ₹50,000 in some cases) for permanent disability or death, adding a layer of financial security for farmers and their families.

By offering these features, the Kisan Credit Card scheme ensures that farmers have timely, affordable, and hassle-free access to credit, thereby improving their financial stability and agricultural productivity

Conclusion

The Kisan Credit Card stands as a beacon of hope for India’s farmers, offering them a lifeline of affordable, flexible, and transparent credit. With ongoing policy support and digital innovations, the KCC is poised to play an even greater role in transforming rural India and securing the future of its agricultural community.

Editor

Editor