Essential Guide to Cybercrime Prevention: Dos and Don’ts to Stay Safe Online

Learn how to protect yourself online with our Essential Guide to Cybercrime Prevention. Discover key dos and don’ts to stay safe and secure in the digital world

Cybercrime is a growing threat in today’s digital world, with scammers constantly devising new ways to exploit unsuspecting victims. From phishing scams to deepfake fraud, cybercriminals target individuals, businesses, and even government agencies. To help you stay safe, we’ve compiled a comprehensive guide based on the Cyber Crime Prevention Handbook, covering the latest scams, essential precautions, and actionable steps to protect yourself.

India's Cybercrime Watchdog Issues Crucial Safety

Guide to Combat Online Scams

With cybercrimes growing more sophisticated by the day, the Indian Cyber Crime Coordination Centre (I4C), under the Ministry of Home Affairs, has released a comprehensive handbook titled “Dos and Don’ts”—a powerful weapon to empower citizens in the digital age.

The guide meticulously outlines 27 prevalent cyber scams in India and offers preventative strategies, practical tips, and reporting mechanisms. From phishing and online job fraud to sophisticated scams involving deepfakes and SIM swapping, the handbook is a one-stop toolkit for anyone navigating the digital world.

Common Cyber Scams in India

-

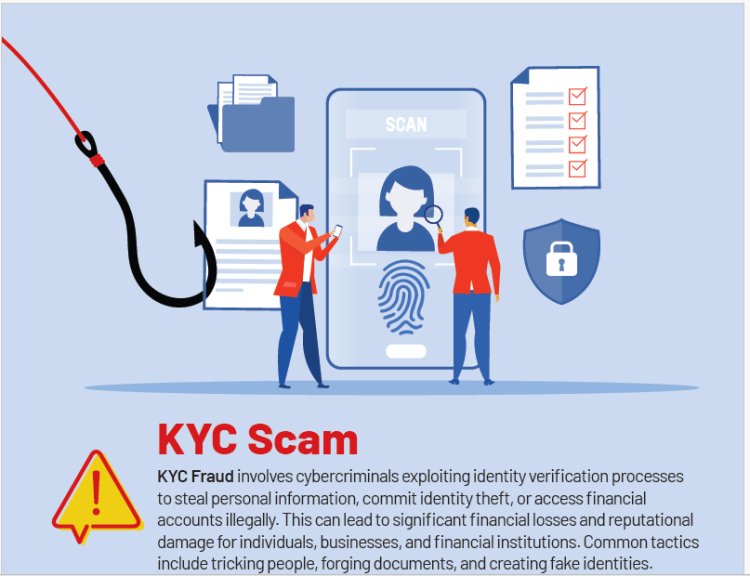

KYC Scam – Fake messages to update bank KYC.

-

Online Job Scam – Too-good-to-be-true offers via fake recruiters.

-

Shopping Fraud – Bogus sites and social media shops.

-

Digital Arrest – Video calls pretending to be police or tax officials.

-

Investment Scam – Ponzi-style schemes with false promises.

-

Online Gaming Fraud – Real-money games exploiting user data.

-

Phishing, Vishing, Quishing – Fake emails, calls, QR codes.

-

APK & App Scams – Fake banking apps stealing credentials.

-

Deepfake Cybercrime – AI-generated videos for manipulation.

Latest Cybercrime Trends & How to Avoid Them

1. KYC Scam in India

What Happens? Fraudsters impersonate bank officials, asking victims to update their KYC (Know Your Customer) details via fake links or calls.

✅ Dos:

✔ Verify requests directly with your bank.

✔ Use official contact details from the bank’s website.

✔ Report suspicious activity immediately.

❌ Don’ts:

✖ Never share OTPs, PINs, or passwords.

✖ Avoid clicking on unverified links.

These scams involve fraudsters who exploit the "Know Your Customer" verification processes to steal personal information and gain illegal access to financial accounts.

Dos: Verify KYC requests directly with your bank or financial institution using official contact details.

Don'ts: Never share account login details, card information, PINs, passwords, or OTPs on unauthorized platforms.

2. Online Job Scams In India

What Happens? Fake job offers lure victims with high-paying, work-from-home opportunities, only to steal money or personal data.

✅ Dos:

✔ Use trusted job portals (Naukri, LinkedIn).

✔ Verify company details before applying.

❌ Don’ts:

✖ Never pay upfront fees for "job processing."

✖ Avoid clicking on sponsored job ads blindly.

Scammers deceive job seekers by posting fake job offers with high pay and minimal effort.

Dos: Use trusted sources such as newspapers, job portals, or government websites for job listings.

Don'ts: Avoid paying upfront fees and be skeptical of unsolicited job offers.

3. Digital Arrest Scam In India

What Happens? Scammers pose as law enforcement, threatening victims with arrest unless they pay a fine via video call. Scammers impersonate government officials and use video calls to extort money from victims by claiming they are under "digital arrest."

✅ Dos:

✔ Know that police never conduct arrests via video calls.

✔ Be aware that law enforcement agencies do not conduct arrests via video calls.

✔ Report such calls to cybercrime.gov.in.

❌ Don’ts:

✖ Don’t panic or transfer money. Do not panic or send money to these scammers.

✖ Don’t engage in long suspicious calls.

The digital arrest scam involves scammers impersonating government officials via video calls to extort money by falsely claiming the victim is under digital arrest. To avoid this, remember that police or government officials never conduct interrogations via video calls or ask for money. If you receive such calls, report them immediately on the "Report Suspect Tab" of cybercrime.gov.in. There is no such thing as a "digital arrest" process in India, so stay calm and do not engage for long with suspicious callers or send money if pressured.

4. Phishing & Quishing (QR Code Scams)

What Happens? Fraudsters send fake emails or malicious QR codes to steal login credentials or money. Fraudsters use phone calls to deceive victims into revealing personal or financial information. Scammers use QR codes to redirect victims to phishing sites or initiate unauthorized financial transactions. Cybercriminals use deceptive tactics to trick individuals into clicking on fake links that steal sensitive data.

✅ Dos:

✔ Hover over links to check URLs. Exercise caution with unexpected messages and verify the authenticity of links and senders.

✔ Scan QR codes only from trusted sources. Only scan QR codes from trusted sources and verify before making payments.

❌ Don’ts:

✖ Never enter banking details after scanning a QR code. Avoid clicking on suspicious links and ensure you are on the official website for transactions.

✖ Avoid clicking on suspicious email links. Avoid scanning QR codes from unknown sources, especially to receive money.

5. SIM Swapping & Mobile Scams In India

What Happens? Criminals transfer your mobile number to their SIM to intercept OTPs and access accounts.Fraudsters transfer a victim's phone number to their SIM card to gain access to personal information and accounts.

✅ Dos:

✔ Enable 2FA (Two-Factor Authentication).

✔ Report lost SIM cards immediately.

✔ Never share OTPs or identity details linked to your SIM card.

❌ Don’ts:

✖ Never share SIM-related details with strangers.

✖ Avoid using public Wi-Fi for banking.

Additional Threats and Scam to Watch Out For

| Scam Type | Risk | Prevention Tip |

|---|---|---|

| Investment Scams | Ponzi schemes promising high returns | Only invest via SEBI-registered entities |

| Lottery Fraud | Fake prize claims asking for fees | Never pay to claim a "prize" |

| Deepfake Scams | AI-generated fake videos/audio | Verify media before sharing |

| Juice Jacking | Malware via public USB ports | Use your own charger |

Online Shopping Fraud In India:

Fraudsters create fake websites or manipulate legitimate ones to deceive victims into making fraudulent purchases.

Dos: Compare prices across different platforms and use cash-on-delivery options when possible

Don't: Avoid using public networks for online transactions and do not save sensitive information on unreliable websites.

Online shopping fraud in India is a growing concern, with complaints having surged approximately 575% in the last four years. Scammers employ various deceptive tactics, including creating fake websites that resemble legitimate online stores, sending phishing emails, and using social media ads to promote fake products. Common scams include fake shipping alerts prompting victims to update their information on fraudulent sites and offering deep discounts to lure victims into entering payment details.

To protect yourself, shop from well-known retailers, verify website legitimacy, avoid suspicious links, and look for security indicators like "https://" in the URL. Using a credit card offers better fraud protection than debit cards. If victimized, immediately inform your financial provider, block your card, highlight fraudulent transactions, and file a complaint with the National Consumer Helpline or the nearest police station/cyber cell.

Investment Scams In India:

These scams promise high returns with little to no risk, often operating as Ponzi schemes.

Dos: Invest through SEBI-registered intermediaries and verify investment products.

Investment Fraud in India lure victims with promises of high returns that seem too good to be true, often operating as Ponzi schemes where earlier investors are paid with money from new investors rather than legitimate profits. Scammers may promote these schemes through social media groups and dubious trading apps.

To protect yourself, only invest with SEBI-registered entities, verify investment products, and stay informed through trusted sources. Be cautious of schemes promising consistently high returns with no risk, and report any suspicious activity on cybercrime.gov.in or call 1930.

Online Gaming Scams In India:

Online gaming platforms are increasingly targeted by cybercriminals who engage in virtual theft, account breaches, and financial fraud.

Dos: Parents should supervise children's access to online games and be cautious with real money gaming apps.

Don't: Avoid downloading gaming apps from untrusted sources and sharing personal information with unknown players.

Online gaming in India is increasingly risky, with a 2021 Norton report indicating that 4 out of 5 Indian gamers lost an average of ₹7894 to cyberattacks. Approximately 41% of gamers have been tricked into compromising their security or sharing account information online. A recent Enforcement Directorate (ED) investigation uncovered a Rs 400-crore fraud involving Chinese nationals through an online gaming app, leading to the freezing of approximately Rs 25 crore in accounts. Scammers often use malware to steal account details, including credit card information, and exploit chat functions to gather personal details. It's crucial to protect your accounts and be wary of sharing personal information while gaming online.

Lottery Fraud And Scam In India:

Scammers deceive victims into believing they have won a lottery to extract money or personal information.

Dos: Be cautious of unsolicited claims and remember that legitimate lotteries do not require upfront fees.

Don't: Never provide personal details or make payments for lottery winnings.

Lottery fraud scams aim to trick individuals into believing they've won a prize in order to extract money or personal information. Authorities emphasize that legitimate lottery organizations, like the Kerala lucky draw, never require winners to pay a fee or share personal details to claim a prize. To avoid these scams, be skeptical of unsolicited lottery win notifications, never pay fees for lottery claims, and report suspected fraud to the police immediately. Remember, no one gives away large sums of money for free.

Spam/Vishing Calls Scam In India:

Fraudsters use phone calls to deceive victims into revealing personal or financial information.

Dos: Use call blockers and be cautious when answering calls from unknown numbers.

Don't: Never share personal information with unknown callers.

In India, vishing scams, or voice phishing, are a significant concern, with one scammer making over 202 million spam calls in 2021. KYC scams, where fraudsters impersonate bank officials to obtain personal details, are particularly prevalent. The Indian government is addressing this issue through a new platform for reporting unsolicited calls and messages, along with a Data Intelligence Unit to coordinate between law enforcement, banks, and service providers. India is among the countries most affected by spam calls, and to protect yourself, remain vigilant, recognize warning signs, and report any suspicious calls to the appropriate authorities. Legitimate organizations should be able to provide verifiable information to support their claims.

Search Engine Fraud And Scam In India:

Fraudsters manipulate search engine results to display fake contact information, leading victims to reveal sensitive data.

Dos: Always verify contact details through official websites.

Don't: Never call numbers listed in search engine results.

Search engine fraud and scams in India are on the rise, affecting individuals and businesses alike. These scams often involve financial fraud, phishing, and other cybercrimes exploiting the stock market rally and digital payment systems. Scammers manipulate search engine results to display misleading websites offering fake tech support or fraudulent services, tricking users into sharing personal information or downloading malware.

They also use phishing tactics, creating fake login screens to steal passwords and credit card details, and employ SEO tricks to rank their fraudulent sites higher in search results. To protect yourself, be cautious when visiting unfamiliar websites, especially those with excessive pop-ups, and use reliable security software with pop-up blockers. Always verify contact details on official websites rather than trusting search results.

Social Media Impersonation Scam In India:

Scammers create fake social media accounts to impersonate individuals or organizations for various nefarious purposes.

Dos: Verify accounts for authenticity and be cautious of unsolicited messages.

Don't: Avoid making payments to unknown individuals or unverified charities.

Social media impersonation scams are a significant threat in India, where fraudsters create fake accounts that mimic legitimate profiles to deceive users and damage brand reputations. These scams can result in both financial losses and reputational harm for businesses and individuals.

To protect yourself, avoid clicking on suspicious links and never share personal or financial information with untrustworthy accounts. Always verify the authenticity of information through official sources, such as company websites, and watch for subtle differences in business names and URLs. Businesses can enhance their security by using strong passwords, enabling two-factor authentication, and regularly monitoring their social media accounts for any unauthorized activity. If you suspect an impersonation scam, report it immediately to the social media platform.

SMS, Email & Call Scams In India:

Fraudsters use these communication methods to deceive victims with fake offers, often impersonating trusted entities.

Dos: Always verify sender details and be wary of unsolicited loan offers.

Don't: Never share sensitive information without confirming the legitimacy of the offer.

SMS, email, and call scams are widespread in India, with fraudsters employing diverse methods to steal personal and financial information. The RBI has cautioned against these scams, especially those involving OTPs, and has released a booklet titled "BE(A)WARE - Be Aware and Beware!" to promote awareness.

To safeguard yourself, never share personal or financial details without verifying the legitimacy of the requester through official channels. Avoid clicking links or replying to promotional messages, and never open emails from unknown sources with attachments. Always use official websites for banking services, ensuring the URL is secure, and never share OTPs or PINs. The government has also launched Chakshu, a feature on the Sanchar Sathi portal, where users can report fraudulent activities, providing screenshots and personal details. If you receive a spam call or message, report it to your Telecom Service Provider (TSP) within three days for investigation.

Debit/Credit Card Fraud Scam In India:

This involves unauthorized use of card details for transactions.

- Dos: Monitor card activity and protect your PIN.

- Don'ts: Avoid sharing card details or using cards on unsecured networks.

Debit/Credit card fraud in India is on the rise, involving unauthorized transactions using stolen or misappropriated card details. Recent data indicates a significant increase in cases, with 12,069 incidents involving INR 630 crore reported between April and September 2023-24, compared to 2,321 cases involving INR 87 crore during the same period the previous year.

To protect yourself, report any suspected fraudulent activity immediately. RBI rules state that if the breach is reported within three days of the transaction, the customer's liability is nil; otherwise, liability is limited based on the reporting timeline and bank policy. Report fraud by giving a missed call to 14440 or sending an SMS 'BLOCK XXXX' to 5676791, contacting your bank's customer care, or using net banking to block your card. In case of a lost or stolen card, block it immediately through your mobile banking app or bank helpline to ensure zero liability for fraudulent transactions.

Mobile Application APK Scams In India:

Cybercriminals create fake mobile banking apps to steal credentials and personal data.

- Dos: Download apps from official stores and verify app authenticity.

- Don'ts: Avoid downloading apps from unofficial links or sharing sensitive information on unknown apps.

Mobile application APK scams involve fraudsters distributing malicious APK files through various channels, such as package delivery scams or deceptive messages on WhatsApp or email. These files are disguised as legitimate packages but, once installed, can severely compromise your mobile device's security.

Scammers can then access personal data, including banking information, and potentially control your phone remotely. If you suspect you've been a victim, immediately report it to the relevant authorities or your bank. Staying informed about these scams and adopting preventive measures is crucial to minimizing your risk.

Cyber Slavery Scam In India:

Individuals are exploited through digital platforms and forced to work without fair compensation.

Dos: Apply for jobs through verified agents and be cautious of "too good to be true" offers.

Don'ts: Never use a tourist visa for work or trust unverified social media ads.

The cyber slavery scam in India involves organized crime syndicates, often based in Southeast Asia, luring Indian job seekers with fake promises of overseas employment. Victims are enticed by false job offers, such as "Digital Sales and Marketing Executives," only to have their passports confiscated upon arrival and be forced into illegal activities like phishing, loan schemes, and cryptocurrency fraud.

Confined to isolated facilities, these individuals endure long hours and poor conditions, often facing physical abuse while being forced to create fake social media profiles to scam unsuspecting people back in India. The Indian government is addressing this issue through advisories, task forces, and coordination with local authorities to rescue and repatriate victims, with over 5,000 Indians already affected in Cambodia alone. Efforts also include disconnecting mobile connections and blocking international "spoofed calls" to disrupt these criminal operations.

Money Mules Scams In India:

Individuals are used to launder illegally obtained funds.

- Dos: Be cautious of unsolicited job offers involving money transfers.

- Don'ts: Never share accounts or handle unauthorized money for a fee.

Money mule scams in India involve individuals being deceived into transferring illegally obtained funds on behalf of criminals. Scammers often recruit victims through fake online job postings, social media messages, or romantic scams, promising easy money or work-from-home opportunities.

Once recruited, victims are instructed to receive money into their accounts and then transfer it elsewhere, often internationally, helping criminals launder money and evade detection. Victims may face severe legal consequences, financial losses, and have their bank accounts frozen or closed. Collaboration among the government, financial institutions, technology providers, and internet users is essential to combat these scams and protect digital trust.

Juice Jacking Scams In India:

This involves cyber risks at public USB charging stations where hackers can install malware or steal data.

- Dos: Use your own charger and opt for AC outlets.

- Don'ts: Avoid using public USB ports.

Juice jacking scams are an increasing threat in India, where cybercriminals exploit public charging stations to steal sensitive data from unsuspecting users. By installing malware on public USB ports or cables, hackers can access personal information like contact details, login credentials, messages, and photos stored on the device. To protect yourself, CERT-In advises avoiding public USB ports whenever possible and using a wall outlet with your own adapter. Carrying a power bank and using charging-only cables can also help, though vigilance is key: only charge in trusted locations and inspect unfamiliar ports for tampering before plugging in. Falling victim to juice jacking can lead to severe consequences, including unauthorized transactions, identity theft, and significant emotional and financial distress.

Deepfake Cybercrime In India:

Cybercriminals use AI to create fake videos or audio clips to deceive viewers and spread misinformation.

Dos: Verify content and rely on reputable sources.

Don'ts: Avoid sharing unverified media and be cautious of content that seems exaggerated.

Deepfake cybercrime is a rising concern in India, with approximately 22% of Indians surveyed reporting encounters with political deepfakes that were later identified as fake. These deepfakes are frequently used for cyberbullying, an issue that worries 55% of those surveyed. Celebrities and political figures, including Rashmika Mandanna, Aamir Khan, and Virat Kohli, are often targeted.

While India lacks specific legislation for deepfakes, existing laws like Section 66D and 66E of the IT Act can be used to address related offenses, such as cheating by personation and breaches of privacy. The Indian government has introduced strict rules and penalties for propagating deepfake content, but current legislation may still be inadequate. Vigilance and reporting suspicious content through official channels are crucial in combating deepfake cybercrimes.

Remote Access Fraud And Scams In India:

Scammers impersonate trusted entities and trick individuals into granting unauthorized access to their devices.

- Dos: Only grant remote access to trusted parties and verify the caller's identity.

- Don'ts: Never download software at someone's request unless you are certain of its legitimacy.

Remote access scams in India involve tricking individuals into granting scammers remote access to their devices, often through phishing or creating a false sense of urgency. Once access is gained, the scammers can steal personal data, install malware, or lock the device and demand a ransom. This tactic is particularly effective because it allows attackers to operate through the victim's device, masking their actions behind a trusted IP address. To stay safe, be wary of unsolicited contacts, verify senders' identities, use strong passwords, and keep your software updated. If you receive unsolicited tech support calls, hang up and contact the company directly using verified contact information. Never share online banking login details or passwords with anyone. If you suspect you've been scammed, immediately disconnect your device from the internet, contact your bank, and report the incident to the authorities.

Secure Browsing Scams In India:

Practices and tools to protect against online threats.

- Dos: Use secure browsers and verify URLs.

- Don'ts: Avoid clicking on unknown links and using unsecured public Wi-Fi.

Ransomware Scams In India:

Malicious software that locks a victim's files and demands a ransom for their release.

- Dos: Regularly back up data and keep systems updated.

- Don'ts: Do not pay the ransom or provide personal information to unfamiliar sources.

Ransomware attacks surged to 5,414 globally in 2024, marking an 11% increase from the previous year. Notably, India emerged as a major hotspot, accounting for over half of the world’s phishing activity linked to these attacks. This trend highlights a growing cyber threat landscape, with attackers increasingly targeting Indian users and organizations through sophisticated phishing campaigns to deploy ransomware and extort money. The data underscores the urgent need for enhanced cybersecurity awareness and stronger protective measures across India’s digital ecosystem.

Smartphone Scams In India:

Scammers use fake calls, malicious apps, and SIM-related frauds to steal data and money.

- Dos: Report stolen phones, check SIM registrations, and use verified app stores.

- Don'ts: Avoid downloading apps from unknown sources and engaging with spam calls.

Smartphone scams in India are rapidly increasing, with fraudsters constantly inventing new tricks to steal personal and financial information. These scams typically start with a phone call, SMS, or a fake app that looks like it’s from a trusted source—such as your bank, a government agency, or a delivery service. Some of the most common tactics include fake TRAI disconnection alerts, calls from people pretending to be authorities, digital arrest scams, and UPI payment frauds.

Scammers use urgency and fear to pressure victims into sharing sensitive data or making payments. For example, you might get a call warning that your mobile number will be disconnected unless you verify your identity, or a message claiming you’re under “digital arrest” by law enforcement. Others may send phishing links or malicious apps that steal your banking credentials.

To protect yourself, always verify unexpected requests directly with the official organization, never share OTPs or passwords, and avoid clicking on suspicious links. If you suspect a scam, report it immediately on cybercrime.gov.in or call the national helpline at 1930. Staying alert and informed is your best defense against these evolving smartphone threats.

Conclusion:

Cybercriminals are becoming more sophisticated, but awareness and caution can prevent most scams. Always STOP, THINK, and VERIFY before sharing personal or financial details online. Stay updated with the latest cyber threats and share this guide to help others stay safe!

By following the recommended "Dos and Don'ts," individuals can significantly enhance their online safety and protect themselves from falling victim to these pervasive threats. Staying informed and vigilant is key to navigating the digital landscape securely.

Additional Information:

- Reporting Cybercrimes: Victims of cybercrime can report incidents at the national cybercrime reporting portal, www.cybercrime.gov.in.

- Staying Updated: It is crucial to stay informed about the latest cyber threats and preventive measures. Citizens can follow "CyberDost" for updates and educational content.

Citizens are urged to stay informed, remain skeptical, and act swiftly in the face of digital deception.

Editor

Editor