Torres Jewelers Scam The Ponzi and MLM Hybrid Scandal - ED registers money laundering case

Uncover the details of the ₹1000 crore Torres Jewelers scam, a shocking Ponzi and MLM hybrid scandal that duped 125,000 investors. Learn about the ED's money laundering case and how to spot red flags in investment schemes

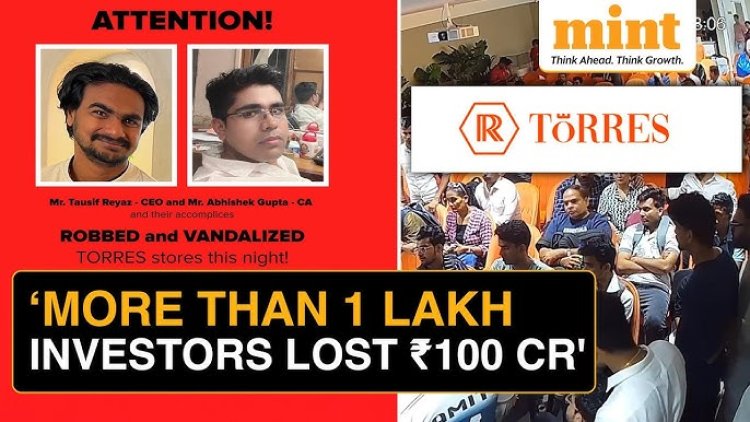

Mumbai’s ₹1000 Crore Jewelry Scam: 125,000 Investors Left Devastated

In February 2024, Torres Jewellery burst onto the scene with bold claims that captivated thousands of investors. The company promised jaw-dropping weekly returns, ranging from 6% to 20%, and dangled extravagant rewards like luxury flats in the Mumbai Metropolitan Region, high-end cars, iPhones, and precious gems.

For many, it sounded like a golden opportunity too good to pass up. But beneath the surface, a much darker reality was unfolding.

In early 2025, a shocking scam rocked Mumbai, India’s financial capital. Over ₹1000 crores vanished, defrauding more than 125,000 investors—many from modest, low-income backgrounds. The scandal, now one of India’s largest, has sparked debates on regulatory oversight and public awareness.

What Was the Torez Jewelers Scam?

While the company’s rewards seemed enticing, they were part of a carefully crafted multi-level marketing (MLM) scheme. Investors were encouraged—if not pressured—to bring in new recruits, fueling the operation’s cash flow. Behind the glitzy promises lay a Ponzi-like structure, where money from new investors was used to pay returns to earlier participants.

This wasn’t your average con. The Torez Jewelers scam was a dangerous cocktail of Ponzi schemes and multi-level marketing (MLM). By mixing the allure of high returns with a recruitment-driven business model, the scheme spread rapidly, pulling in unsuspecting victims.

Promises That Sounded Too Good to Be True

Torez Jewelers baited investors with promises of sky-high weekly returns—claims like 336% profit in just a week from their diamond sales. While this should’ve raised alarm bells, the dream of such wealth blinded many to the reality.

The Deceptive Diamond Sales

At the heart of the scam were "Moiz Night" diamonds, marketed at heavily inflated prices. Investors thought they were buying valuable assets, but these diamonds turned out to be worth far less than claimed—a key element of the deception.

How Did the Torez Jewelers Scam Work?

The Recruitment Trap

The scheme’s MLM structure played a huge role in its success. Investors were incentivized to bring in others, earning commissions for every new recruit. This referral system snowballed, expanding the scam’s reach exponentially.

Creating an Illusion of Success

To sustain the fraud, Torez Jewelers used clever tactics: flashy lucky draws, high-value gifts, and relentless marketing. These efforts created an illusion of legitimacy, encouraging victims to pour in even more money.

Leveraging Social Media

Social media, especially YouTube, became a key tool for the scammers. Videos featuring glowing testimonials and “success stories” misled thousands into believing in the scheme’s credibility.

Who Was Behind Torez Jewelers It All?

The Real Masterminds

Investigations uncovered that the scam was orchestrated by foreign nationals from Russia, Ukraine, and Uzbekistan—not the local businessmen who initially appeared to run the show. This international involvement added complexity and helped the fraud operate undetected for longer.

Arrests and Escapes

While one foreign national was arrested, others managed to evade capture, exposing the challenges of cross-border law enforcement. Indian collaborators, who acted as the public faces of the company, were also complicit but played secondary roles.

The police investigation has led to the arrest of three key figures: Sarvesh Surve, a director of Platinum Hern (Torres’ parent company), Valentina Kumar, a regional manager of Russian origin, and Tania Kasatova, an Uzbek national overseeing the stores. These individuals face serious charges under the Maharashtra Protection of Interest of Depositors (MPID) Act.

A lookout notice has been issued for 11 additional suspects, including Viktoriia Kovalenko, a Ukrainian national and another director of Platinum Hern. Investigators suspect the fraudsters intended to expand their operations to Sri Lanka and Nepal. Furthermore, the Enforcement Directorate (ED) has launched a probe into possible money laundering activities involving the defrauded funds.

Where Did the Torez Jewelers System Fail?

As 2024 came to a close, the shiny facade crumbled. Investors suddenly stopped receiving their promised returns, and the true nature of the operation became clear. Even the so-called "precious gems" handed out as rewards turned out to be fakes, adding insult to injury.

Early Warnings Ignored

Alarm bells started ringing as early as June 2024, when complaints of potential fraud reached authorities. However, these warnings were either ignored or acted upon too late, allowing the scam to grow unchecked.

Delayed Action

The government’s sluggish response and lack of regulatory vigilance gave the scammers time to siphon off funds and ruin lives. This failure highlights critical gaps in the system meant to protect investors.

Lessons We Must Learn from Torez Jewelers Scandal

The collapse of Torres Jewellery is a stark reminder of the dangers lurking behind schemes that promise unrealistically high returns and flashy rewards. The victims of this fraud, many of whom invested their life savings, were left with nothing but shattered trust and financial ruin.

Spot the Warning Signs

Scams like Torez Jewelers often share common traits:

- Unrealistic Returns: If it sounds too good to be true, it probably is.

- Recruitment Pressure: Pushing you to bring in others is a classic MLM or Ponzi red flag.

Empower Yourself with Knowledge

Building financial literacy is essential to avoid falling prey to such schemes. Understanding basic investment principles can help you make informed decisions.

Seek Professional Guidance

Before investing, consult a trusted financial advisor. They can help you evaluate opportunities and spot potential risks.

Final Thoughts

The Torez Jewelers scam is a painful reminder of how easily people’s trust can be exploited. It also exposes serious weaknesses in regulatory oversight. By staying informed and vigilant, we can protect ourselves and those around us from falling victim to similar traps.

Share this article to spread awareness and ensure others stay safe from financial fraud.

Best Videos Fro this scame Are here for more Understanding:

Editor

Editor