Jio BlackRock Mutual Fund Receives SEBI Approval: A New Era in India’s Asset Management Industry

Discover the impact of Jio BlackRock mutual fund's SEBI approval. Get details on their asset management plans, potential launch date, and leadership under Sid Swaminathan.

JioBlackRock Asset Management Receives SEBI Approval for Mutual Fund Business, Appoints Sid Swaminathan as MD & CEO

Mumbai, May 27, 2025 – In a significant development for India’s financial sector, Jio BlackRock Asset Management Private Limited, a 50:50 joint venture between Jio Financial Services Limited (JFSL) and BlackRock, has received regulatory approval from the Securities and Exchange Board of India (SEBI) to commence operations as an investment manager for its mutual fund business. The newly registered entity, JioBlackRock Mutual Fund, aims to revolutionize India’s asset management landscape by combining Jio’s digital-first approach with BlackRock’s global investment expertise.

In tandem with this regulatory green light, JioBlackRock has also announced the appointment of Sid Swaminathan as its Managing Director and Chief Executive Officer (CEO). former Head of International Index Equity at BlackRock with responsibility for $1.25 trillion in assets under management, as its Managing Director and Chief Executive Officer With over two decades of asset management experience, including leadership roles at BlackRock, Swaminathan is expected to bring robust global expertise and a digital-first approach to the Indian investment landscape.

The joint venture aims to revolutionize India's investment ecosystem by combining BlackRock's global investment expertise and proprietary technology platform Aladdin with Jio Financial Services' digital reach and deep understanding of the local market, targeting both retail and institutional investors with competitive pricing and innovative products.

[Jio Financial Services] 50% + [BlackRock Inc.] 50%

|

[JioBlackRock Asset Management]

JioBlackRock Regulatory Approval and Market Entry

The SEBI approval represents the culmination of a regulatory journey that began with the joint venture announcement on July 26, 2023. JioBlackRock Asset Management had previously received in-principle approval from SEBI for the mutual fund foray on October 4, 2024, before securing the final authorization. This regulatory milestone enables the firm to act as an investment manager, catering to both individual and institutional investors in the Indian market.

The entry of JioBlackRock into India's mutual fund space is particularly significant given the country's rapidly growing investment landscape. India currently hosts 44 asset management companies managing a total of ₹69.50 trillion (approximately $813.8 billion), according to SEBI data. The addition of JioBlackRock brings this number to 48 players, intensifying competition in an already dynamic market.

The approval comes at a time when India is experiencing a transformation from a nation of savers to a nation of investors, driven by increasing financial literacy, digital adoption, and growing aspirational goals among the new generation. This shift presents substantial opportunities for asset management companies that can effectively bridge the gap between sophisticated investment products and retail accessibility.

JioBlackRock aims to revolutionize the Indian mutual fund market by combining JFSL’s expansive digital ecosystem and local market insights with BlackRock’s global investment acumen and advanced risk management technologies, including its flagship platform Aladdin.

The partnership is targeting both retail and institutional investors, with a strong emphasis on affordability, accessibility, and transparency. The digital-first strategy, according to JFSL, will make investment solutions available to even the most remote parts of India.

“India’s rapid growth is driven by a new generation with bold aspirations. Our partnership with BlackRock is a powerful combination of global investment expertise and Jio’s digital-first innovation,” said Isha Ambani, Non-Executive Director of JFSL.

JioBlackRock Leadership and Strategic Vision

Appointment of Sid Swaminathan as MD & CEO

JioBlackRock Asset Management has strategically appointed Sid Swaminathan as its Managing Director and Chief Executive Officer, bringing over 20 years of asset management experience to the role. Swaminathan's impressive track record includes his previous position as Head of International Index Equity at BlackRock, where he was responsible for managing assets under management (AUM) of $1.25 trillion. Prior to this role, he served as the Head of Fixed Income Portfolio Management for Europe at BlackRock, overseeing Systematic and Indexed strategies.

Swaminathan's extensive background in the financial sector will be crucial in navigating the complexities of the Indian market and executing the company's strategic vision. His leadership will be instrumental in shaping the product offerings, distribution strategies, and overall growth trajectory of Jio BlackRock.

Swaminathan's deep understanding of investments across asset classes, investment styles, and geographies positions him well to lead JioBlackRock's mission of delivering innovative investment products to millions of investors in India. His appointment reflects the joint venture's commitment to combining global expertise with local market insights. In his statement, Swaminathan emphasized that "JioBlackRock Asset Management aims to digitally deliver institutional quality investment products to investors across India and contribute to the growth of the country's investment ecosystem".

The CEO's vision aligns with the company's broader objective of transforming asset management in India by empowering investors to directly harness the potential of investing. His leadership will be crucial in navigating the complexities of the Indian market while maintaining the high standards associated with BlackRock's global operations.

-

Sid Swaminathan Career Highlights

-

20+ years in asset management

-

Managed $1.25 trillion AUM

-

Head of Intl. Index Equity, BlackRock

-

ESG & Data-driven investment pioneer

-

Isha Ambani, Non-Executive Director, JFSL

"India’s rapid growth is driven by a new generation with bold aspirations. Our partnership with BlackRock combines global investment expertise with Jio’s digital-first innovation. Together, we are committed to making investing simple, accessible, and inclusive for every Indian."

Rachel Lord, Head of International, BlackRock

"The opportunity in India’s asset management sector is tremendously exciting. JioBlackRock’s digital-first proposition will enable more Indians to access capital markets, transforming the nation from savers to investors."

Sid Swaminathan, MD & CEO, JioBlackRock Asset Management

"Our goal is to digitally deliver institutional-quality investment products across India. I am honored to lead this initiative and contribute to the growth of India’s investment ecosystem."

JioBlackRock Partnership Dynamics and Competitive Advantages

Leveraging Dual Strengths

The 50:50 joint venture structure between Jio Financial Services Limited (JFSL) and BlackRock represents a strategic combination of complementary strengths. JFSL brings its extensive digital reach, deep understanding of the local Indian market, and innovative digital-first approach to financial services. The company operates a full-stack financial services business through various customer-facing entities, including Jio Finance Limited, Jio Insurance Broking Limited, and Jio Payments Bank Limited.

BlackRock contributes its global investment expertise, industry-leading risk management capabilities, and sophisticated technology infrastructure.The partnership particularly leverages BlackRock's proprietary technology platform Aladdin, which unifies the investment management process through a common data language.This globally renowned platform will be instrumental in providing institutional-quality risk management and investment analytics to Indian investors.

-

Product Launches: JioBlackRock plans to roll out a range of mutual funds, including index funds, ETFs, and thematic funds, in the coming months.

-

AI & Tech Integration: Leveraging BlackRock’s Aladdin platform for risk analytics and portfolio management.

-

Financial Inclusion: Targeting millions of first-time investors through Jio’s digital reach (JioFinance app, UPI integration).

-

Wealth Management & Broking Services: Expanding into advisory and brokerage services in partnership with Jio Financial.

JioBlackRock Digital-First Innovation Strategy

The joint venture's digital-first customer proposition represents a significant differentiator in the Indian market.This approach aims to deliver institutional quality products at lower costs directly to investors, enabling broader access to capital markets.

The strategy aligns with India's rapid digital transformation and the growing comfort of investors with technology-enabled financial services.

Isha Ambani, Non-Executive Director of JFSL, highlighted this vision by stating, "India's rapid growth is driven by a new generation with bold aspirations. Our partnership with BlackRock is a powerful combination of global investment expertise and Jio's digital-first innovation. Together, we are committed to making investing simple, accessible, and inclusive for every Indian"

JioBlackRock Technology Integration and Product Innovation

Aladdin Platform Implementation

A key technological advantage for JioBlackRock lies in the implementation of BlackRock's Aladdin platform, which represents one of the most sophisticated risk management and investment analytics systems in the global asset management industry.

Aladdin's integration will enable JioBlackRock to offer institutional-quality risk management capabilities to retail investors, democratizing access to sophisticated investment tools that were previously available only to large institutions.

The platform's common data language approach will streamline investment management processes, enabling more efficient portfolio construction, risk assessment, and performance analysis.This technological foundation will support JioBlackRock's mission to deliver transparent and competitive pricing while maintaining high-quality investment management standards.

Data-Driven Investment Capabilities

JioBlackRock plans to launch investment products that apply BlackRock's industry-leading capabilities in data-driven investing.These products will leverage advanced analytics, machine learning, and systematic investment approaches to identify opportunities and manage risks across various market conditions. The data-driven approach represents a significant advancement in the Indian mutual fund landscape, where traditional investment methodologies have dominated.

The company's focus on innovative products extends beyond conventional mutual fund offerings, with plans to introduce investment solutions that cater to the evolving needs of Indian investors.This innovation-first approach positions JioBlackRock to capture market share among tech-savvy investors who value transparency, efficiency, and performance.

JioBlackRock Market Context and Competitive Landscape

India's Growing Investment Ecosystem

The timing of JioBlackRock's entry into the Indian market coincides with a period of unprecedented growth in the country's investment ecosystem. India's mutual fund industry has experienced substantial expansion, driven by increasing investor awareness, regulatory support, and growing disposable incomes among the middle class.The total assets under management of ₹69.50 trillion reflect the substantial opportunity available to new entrants who can effectively differentiate their offerings.

The demographic advantage of India, with a large population of young, digitally native investors, creates a favorable environment for technology-enabled investment platforms.This demographic shift supports JioBlackRock's digital-first strategy and positions the company to capture long-term growth as these investors mature and accumulate wealth.

Competitive Positioning

With 48 players now operating in the Indian mutual fund market, competition for market share and investor attention has intensified.JioBlackRock's competitive positioning relies on several key differentiators: competitive and transparent pricing, innovative products supported by BlackRock's risk management expertise, and a digital-first customer proposition for retail investors.

The combination of global expertise and local market understanding provides JioBlackRock with a unique value proposition. While established players benefit from brand recognition and distribution networks, JioBlackRock's technology-enabled approach and cost-effective delivery model may appeal to price-conscious and digitally savvy investors.

JioBlackRock Future Plans and Strategic Roadmap

Product Launch Timeline

JioBlackRock Asset Management aims to launch a comprehensive range of investment products over the coming months, with a focus on both retail and institutional investor segments.The company's product development strategy emphasizes innovation, leveraging BlackRock's expertise in systematic investing, index strategies, and alternative investments to create offerings tailored to Indian market conditions and investor preferences.

The phased approach to product launches will likely begin with core equity and debt mutual fund schemes, gradually expanding to more sophisticated products such as exchange-traded funds (ETFs), international investment options, and thematic investment strategies.This gradual rollout allows the company to establish operational capabilities while building investor confidence and market presence.

Digital Platform Development

A critical component of JioBlackRock's future plans involves the development and deployment of a comprehensive digital investment platform that seamlessly integrates with Jio's existing financial services ecosystem.This platform will enable investors to access investment products, monitor portfolio performance, and receive personalized investment recommendations through a unified digital interface.

The digital platform development aligns with the broader trend toward financial technology innovation in India, where investors increasingly expect seamless, mobile-first experiences. The integration with Jio's digital infrastructure provides JioBlackRock with a significant advantage in reaching and serving retail investors across India's diverse geographic and demographic landscape.

Market Expansion Strategy

Rachel Lord, Head of International at BlackRock, emphasized the transformative potential of the Indian market opportunity, stating, "The opportunity in asset management in India today is tremendously exciting. JioBlackRock's digital-first customer proposition, delivering institutional quality products at a lower cost directly to investors, will enable more people in India to enjoy the many benefits of access to the capital markets"

The company's expansion strategy focuses on democratizing access to sophisticated investment solutions, particularly targeting underserved segments of the Indian investor population.This approach includes developing products and services that cater to investors with varying risk profiles, investment horizons, and financial objectives.

JioBlackRock Industry Impact and Transformat.ion Potential

Democratization of Investment Management

JioBlackRock's entry into the Indian market represents a significant step toward democratizing access to institutional-quality investment management.By combining BlackRock's sophisticated investment capabilities with Jio's digital reach and cost-effective delivery model, the joint venture aims to make advanced investment tools and strategies accessible to a broader range of investors.

This democratization extends beyond product access to include pricing transparency and cost efficiency. The company's commitment to competitive and transparent pricing challenges traditional fee structures in the Indian mutual fund industry, potentially driving industry-wide improvements in cost efficiency and investor value.

Technology-Driven Industry Evolution

The integration of BlackRock's Aladdin platform and data-driven investment capabilities represents a technological advancement that may accelerate the overall modernization of India's asset management industry.As other players respond to JioBlackRock's technology-enabled approach, the industry is likely to experience increased adoption of systematic investing, advanced analytics, and digital distribution models.

This technological evolution benefits investors through improved risk management, more precise portfolio construction, and enhanced transparency in investment processes.The broader adoption of these technologies across the industry will likely lead to better investor outcomes and increased confidence in mutual fund investments.

JioBlackRock Future Plans: What Lies Ahead

JioBlackRock's strategic blueprint includes:

1. Product Launches (2025–2026)

-

Introduction of mutual fund schemes across equity, debt, and hybrid categories.

-

Launch of data-driven and indexed products, leveraging BlackRock’s global algorithms and insights.

2. Digital Expansion

-

Full integration with the JioFinance app, offering an end-to-end investment experience alongside existing services like loans, savings, and bill payments.

-

AI-powered financial advisory tools to assist retail investors in goal-based investing.

3. Investor Education & Financial Inclusion

-

Nationwide campaigns aimed at converting India from a “nation of savers to a nation of investors”.

-

Partnerships with academic institutions and government bodies for financial literacy programs.

4. Sustainable and ESG Investments

-

Deployment of ESG-compliant mutual funds aligned with both global best practices and India’s developmental goals.

- Democratizing Investment: Utilizing technology to reach a wider audience, including those in smaller towns and rural areas, making investment more accessible.

- Innovative Product Offerings: Developing tailored investment solutions that cater to the specific needs and financial goals of Indian investors across different demographics.

- Leveraging Digital Capabilities: Building a seamless and user-friendly digital platform for investment, transactions, and customer support.

- Financial Literacy Initiatives: Investing in educating potential investors about the benefits of mutual funds and responsible investing.

- Sustainable Growth: Building a long-term, sustainable asset management business in India by focusing on investor trust and performance.

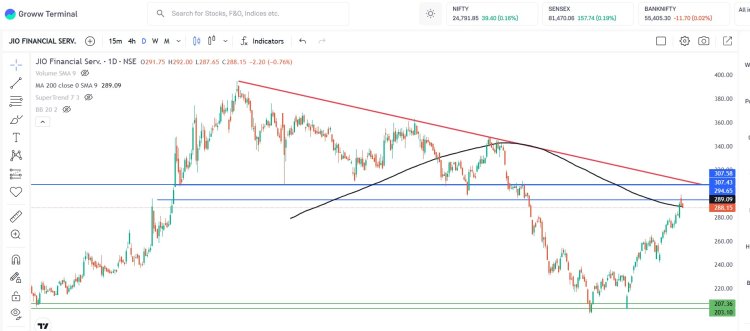

News : Jio Financial: received SEBI approval to establish 'Jio BlackRock Mutual Fund' and for 'Jio BlackRock Asset Management Pvt Ltd' to function as its Asset Management Company (AMC). Technically stock taken pause near 200sma 298-308 zone was acting as strong support earlier now same level will act as Resistance for stocks 1 yr Trendline Resistance at 310-315 zone avoid at cmp wait for breakout abv Trendline.

Valuation of Jio Financial Services:-

1)The company holds 6.1% of Reliance Industries' shares The holding is valued at 1.23 lakh crore Apply to this a 50-90% Holding company discount(Yes a holding company discount will be applicable) The value of the holding should be anywhere b/w 10,000cr to 50,000cr

2)Jio Financial does not have other big businesses They have applied for an insurance license They also have a Joint Venture with Blackrock to set up a Mutual Fund Business They also plan to be a Non-deposit taking NBFC with consumer lending as the main business Jio Financial has a m-cap of 2.12 lakh crores making it the second NBFC only after Bajaj Finance.

The market is betting big on the execution power of Reliance Just as Reliance ramped up Jio in telecom! The market is betting on the fact Reliance will also ramp up the Financial Services Business.

Conclusion

The SEBI approval for JioBlackRock Asset Management marks a pivotal moment in India's asset management landscape, introducing a formidable combination of global investment expertise and digital innovation to the country's growing investment ecosystem.With Sid Swaminathan's leadership and the strategic advantages of the Jio-BlackRock partnership, the company is well-positioned to capture significant market share while driving industry-wide improvements in technology adoption, cost efficiency, and investor accessibility.

The success of JioBlackRock will likely depend on its ability to execute its digital-first strategy effectively while maintaining the high investment management standards associated with BlackRock's global operations.As the company prepares to launch its initial product offerings in the coming months, investors and industry observers will closely monitor its impact on competitive dynamics, pricing structures, and technological innovation in India's mutual fund sector.

The broader implications of this development extend beyond immediate market competition to include the potential transformation of how Indians access and engage with investment opportunities.If successful, JioBlackRock's model may serve as a blueprint for other global asset managers seeking to enter emerging markets through technology-enabled, cost-effective distribution strategies, ultimately benefiting investors through increased choice, better pricing, and improved investment outcomes.

Editor

Editor