Trump’s Tariff Threat: Will India Strike Back with Reciprocal Trade Measures?

As Trump threatens new tariffs, India weighs reciprocal trade measures. Will this spark a trade war? Explore the impact on Indian exports, economy, and global trade relations

Trump’s Tariff Threat: How India Could Strike Back – Full Analysis

Overview: Trump’s New Tariffs & India’s Possible Response

U.S. President Donald Trump has reignited trade tensions by proposing reciprocal tariffs on countries, including India, if re-elected. His plan suggests imposing equal or higher tariffs on nations that levy duties on U.S. goods.

India, a key trade partner of the U.S., could face significant economic repercussions—but it also presents opportunities for domestic industries like solar manufacturing and exports. Meanwhile, global markets, including oil and equities, are already reacting to the uncertainty.

How Trump’s Tariffs Could Impact India

1. Trade War Risk: Will India Retaliate?

-

The U.S. is India’s largest trading partner ($128 billion in bilateral trade in 2023).

-

India may impose counter-tariffs on American goods like almonds, apples, and machinery.

-

Past trade disputes (e.g., 2019 U.S. steel tariffs) led to India raising duties on 28 U.S. products.

Key Concern: A prolonged trade war could hurt Indian exporters and disrupt supply chains.

2. Solar Energy Boom: A Silver Lining?

A Bright Spot for Solar?

-

Trump’s proposed 60% tariff on Chinese solar panels could benefit Indian solar manufacturers.

-

Companies like Adani Solar, Waaree Energies, and Vikram Solar may gain market share.

-

Risk: Cheaper Chinese dumping in India could still undercut local players.

3. Oil Prices Crash to 4-Year Lows

-

Trump’s tariffs + OPEC’s supply surge have sent Brent crude below $75/barrel.

-

India, a major oil importer, could save billions—boosting inflation control.

-

But falling oil prices also signal weakening global demand, raising recession fears.

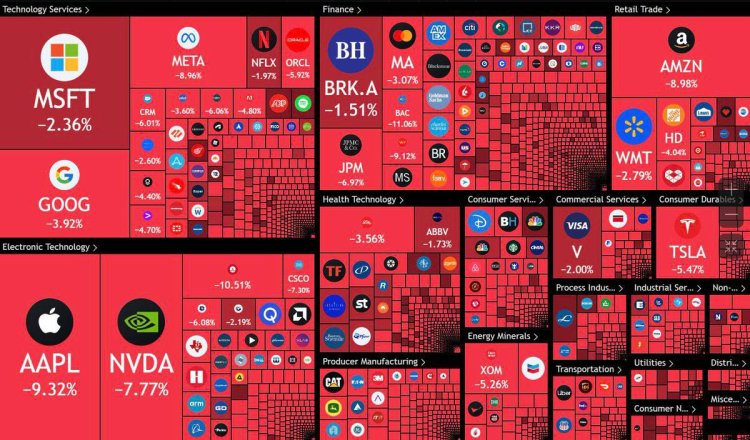

4. Stock Market & FII Sentiment

Markets in Meltdown Mode

-

U.S. markets fell for 2 straight days on tariff fears.

-

India remains better placed than other EMs due to strong domestic demand.

-

But Foreign Institutional Investors (FIIs) may stay cautious amid global volatility.

Dow Jones down 1000 points

NASDAQ down 4%

S&P down 3%

Apple down 8%

Reason - Recession fears after Trump announced reciprocal tariffs on all the countries.

If a country is imposing tariffs, ultimately the cost is passed onto consumer. Trump by announcing these tariffs, without having much manufacturing (in US) has created a lot of chaos for both consumers and the countries.

Oil Prices Plunge - Good News or Bad?

What’s This Mean for You?

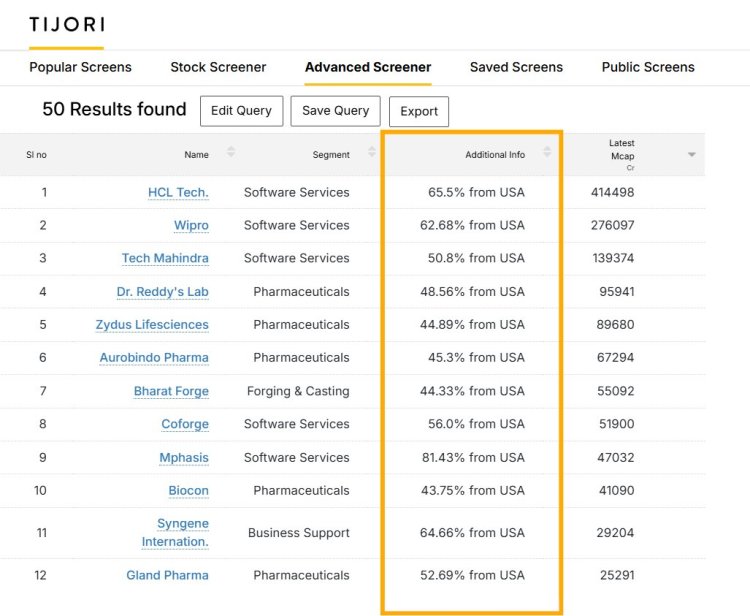

Breaking: U.S. Tariffs Loom – India’s Top Exporters in the Crosshairs

U.S.A President Donald Trump has reignited global trade tensions by threatening reciprocal tariffs on nations that impose duties on American goods. If implemented by April 3, this could severely impact Indian companies with high U.S. revenue exposure.

With just one day left for Commerce Minister Piyush Goyal to negotiate a temporary deal, here’s a sector-wise breakdown of the most vulnerable Indian firms and what’s at stake.

Why This Matters for India?

-

The U.S. is India’s largest export market (~18% of total exports).

-

$128 billion in bilateral trade (2023) could be disrupted.

-

Pharma, textiles, and auto parts sectors face the highest risk.

High-Risk Sectors & Companies

1. Pharmaceuticals (Most Vulnerable)

U.S. contributes 30-70% revenue for major Indian pharma firms:

-

Natco Pharma (70%)

-

Aurobindo Pharma (50%)

-

Dr. Reddy’s (45%)

-

Lupin (40%)

-

Sun Pharma (35%)

-

Cipla (30%)

- Cadila / Zydus (40%)

- Glenmark (35%)

- Torrent Pharma (25 - 30%)

- Biocon (30%)

Impact: Higher tariffs = lower margins or price hikes for U.S. consumers.

2. Textiles & Garments (Extreme Exposure)

-

Welspun India (60% exports to U.S.) – Supplies to Walmart, Target.

-

Indo Count (70%) – Top home linen exporter.

-

Trident (40%) – Major towel/bedding supplier.

- Arvind - (25%) - ₹7,738 crore (approximately $926.69 million) in FY24

- KPR Mill (30%) - Export Sales - 1,52,427

- Vardhman (25 - 30%) - overall export percentage indicates a significant portion of their business comes from international markets

- Page Industries - (20%)

- Raymond - (20%) Raymond James Financial with headquarters in the United States amounted to 12.99 billion U.S. dollars in 2023

- Himatsingka Seide Limited - (50%) The US is a major market for Himatsingka, with over 80% of their turnover coming from this region.

- Alok Industries (25%) Alok Industries exports 26% of its products to over 90 countries, including the US

- Indo Count (70%) Indo Count has a strong presence in the US market, with a US subsidiary

Impact: Retaliatory tariffs could push buyers to Bangladesh/Vietnam.

3. Auto Components (Moderate-High Risk)

-

Sona BLW (45% U.S. revenue) – EV parts maker for Tesla, Ford.

-

Bharat Forge (25%) – Critical forgings for U.S. automakers.

- Samvardhana Motherson (20%) exports accounted for around 29% of industry revenues in the financial year 2023-24

- Minda Industries (20%) He expects to produce components for around 4.5 to 5 million passenger vehicles

- Endurance Technologies (25%) They routinely ship their tubulars and components throughout North America and internationally

- Suprajit Engineering Limited (20%) USA as a key market and is actively seeking to expand its presence there.

- Jamna Auto Industries (20%) JAI Brand has successfully designed and manufactured springs for Ford Transit in Europe and General Motors Hummer in the United States of America

- Sansera Engineering Limited (25%) Exports to the USA with notable customers including General Motors, Harley-Davidson Motor, and Polaris Industries Inc

- Balkrishna Industries Limited (30%) The company exports its products to the USA, maintaining a North American office in Akron, Ohio, and a warehouse in Wando, South Carolina, primarily serving the farm and replacement markets

- Motherson Sumi Wiring India Limited (20%) Providing products/services to customers worldwide, including North and South America, Europe, Africa, the Middle East, Asia-Pacific, and Australia

Impact: Supply chain delays and costlier auto parts in the U.S.

4. Processed Food & Agri (Mixed Risk)

-

Apex Frozen Foods (50%) – Shrimp exporter.

-

ITC (20%) – Basmati rice, spices.

- Godrej Agrovet (20%) The company exports crop protection and animal feed to the U.S. and collaborates with Tyson Foods through a joint venture to produce processed poultry products

- LT Foods (25%) LT Foods has a strong export focus, particularly in the U.S. market. Its subsidiary, LT Foods Americas (previously Kusha Inc.), handles local distribution and operations, supported by a Houston-based warehouse managed by Henry Okorie.

- KRBL Limited (20%) With 822 export shipments of India Gate Basmati Rice, the company solidifies its role as a top U.S. basmati rice supplier and a dominant player in the market.

- Balrampur Chini Mills Limited (20%)

-

Avanti Feeds (30%) - Revenue from North America contributed 69% to Avanti Feeds' total earnings this quarter, marking a drop from 82% in the corresponding quarter of the previous year.

- Apex Frozen Foods (50%) - The U.S.A accounted for 52% of Apex Frozen Foods’ total revenue, as disclosed in the company’s December quarter investor presentation

- Waterbase Limited (40%) The company focuses its export operations on three major markets: Japan, Europe, and the United States

- Venky's India Limited (20%)

- Jain Irrigation Systems Limited (25%) JISL has consolidated its U.S. market position by acquiring Chapin Watermatic (drip irrigation innovator), NuCedar Mills (homebuilding sector), and an 80% stake in micro-irrigation leaders AVI and IDC—now merged into a unified distributor. Jain Irrigation Inc., its U.S. arm, reflects robust activity with 646 imports and 104 exports.

- Nestlé India (20%) Accounting for 17.73% of India's total exports, the United States maintains its position as the country's most significant export partner

- Mrs. Bector's Food Specialities Ltd (25%)

- Tata Consumer Products (20%) With 5 established brands in the U.S. market - including Eight O'Clock Coffee (market leader), Tetley USA (tea category), Good Earth (herbal segment), and Tata Waters - the company commands XX% share in the [specific] beverage sector.

- Heritage Foods (20%)

- Kohinoor Foods Limited (30%) FY 2013-14 financials show Kohinoor Food USA Inc. growing its turnover by 13.45 million from a base of $11.49 million

Impact: American restaurants & retailers may shift suppliers.

5. Solar/Engineering (Opportunity & Risk)

-

Adani Green (25% exports)

-

Waaree Energies (40%)

- Tata Power (20%)

-

Borosil Renewables (25%)

-

Premier Energies Limited (20-25%)

- Insolation Energy Ltd (10-20%)

-

Solex Energy Limited(10-15%)

- L&T (20%)

- Thermax Ltd (20%)

- BHEL (20%)

-

Kirloskar Brothers Limited (25%)

- Voltas (20%)

- APL Apollo (15-20%)

- Jindal Saw (25-30%)

- Welspun Corp (30-35%)

- Ratnamani (20-25%)

- Maharashtra Seamless (20%)

-

Surya Roshni Ltd(10-15)

- GoodLuck India (10-15%)

- Hi-Tech Pipes (10-15%)

- Man Industries (20-25%)

-

Cummins India Ltd (30%)

Silver Lining: Trump’s China solar tariffs may boost Indian manufacturers.

Market Fallout: What’s Next?

Short-Term: Stock volatility for high-exposure firms (Natco, Welspun, Aurobindo).

Long-Term: India may diversify exports to EU, Africa if U.S. tariffs persist.

Govt Response: Possible retaliatory tariffs on U.S. apples, almonds, Harley bikes.

Expert Opinions

-

Trade Analyst: "India must accelerate FTAs with EU, UK to reduce U.S. dependence."

-

Pharma CEO: "If tariffs hit, we’ll pass costs to U.S. patients or shift focus to Africa."

-

Market Expert: "FIIs may pull back from high-exposure stocks short-term."

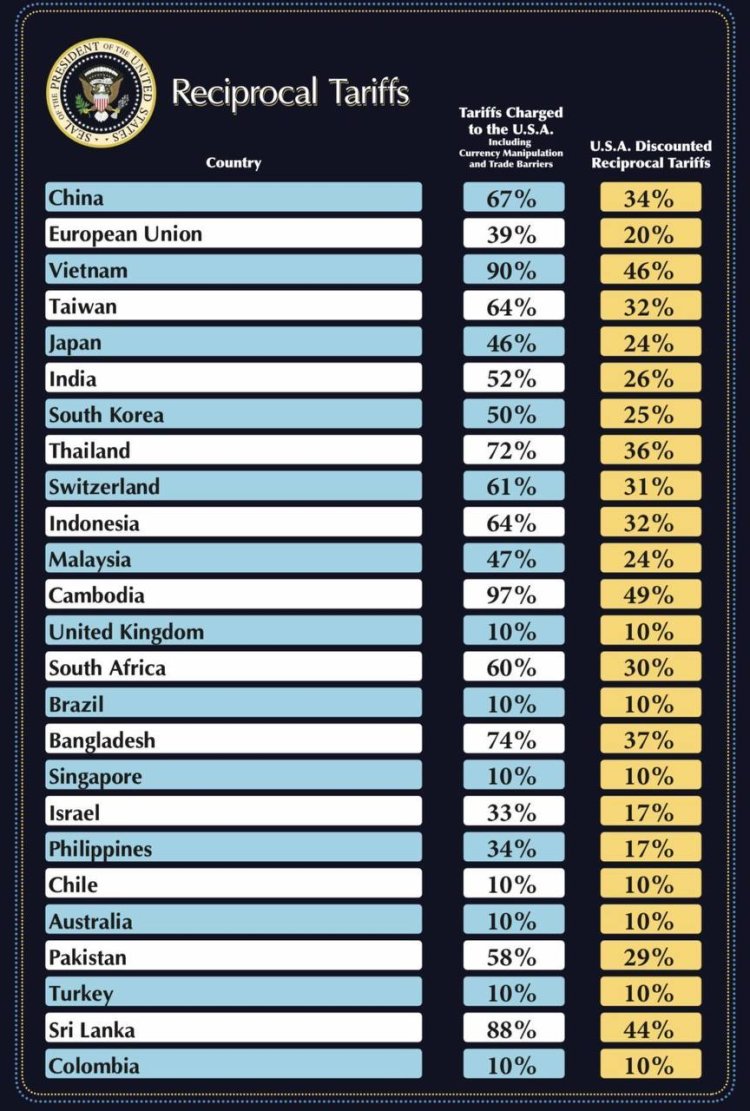

Trump's reciprocal tariffs:

Chile 10%

India 26%

Israel 17%

Brazil 10%

China 34%

Japan 24%

Turkey 10%

Taiwan 32%

Vietnam 46%

Pakistan 29%

Thailand 36%

Australia 10%

Malaysia 24%

Colombia 10%

Sri Lanka 44%

Singapore 10%

Indonesia 32%

Cambodia 49%

Philippines 17%

Switzerland 31%

Bangladesh 37%

South Korea 25%

South Africa 30%

United Kingdom 10%

European Union 20%

Trump says tariffs won't be a "full reciprocal tariff."

"Because we're very kind"

Looking Ahead

✔ Lower Risk: Diversified giants (ITC, L&T, Tata Consumer).

✔ Will India strike a deal or retaliate?

India Sees Opportunity Amid Global Trade Wars Triggered by Trump's Tariffs

As former US President Donald Trump's proposed reciprocal tariffs spark global trade tensions, India is positioning itself to benefit from shifting supply chains.

Key Developments:

-

Solar Sector Boost: Trump's 60% tariffs on Chinese solar panels could accelerate India's renewable energy manufacturing.

-

Export Opportunities: Indian pharmaceutical and textile exporters may gain market share as US-China trade declines.

-

Government Response: New Delhi is negotiating temporary trade deals to protect key industries while attracting diverted investments.

Sectors Poised to Gain:

-

Renewable Energy (Adani Green, Waaree Energies)

-

Pharmaceuticals (Sun Pharma, Dr. Reddy's)

-

Textiles (Welspun India, Trident)

China Strikes Back: 34% Tariffs on All US Imports Escalate Trade War

Breaking: China Retaliates with Sweeping 34% Tariffs on US Goods

In a dramatic escalation of the US-China trade war, Beijing has imposed a blanket 34% tariff on all American imports, retaliating against recent US restrictions on Chinese electric vehicles (EVs), semiconductors, and steel. The move, effective immediately, marks China’s strongest trade countermeasure yet and risks triggering a new global economic standoff.

Why Now? The tariffs come just days after the US hiked duties on Chinese EVs to 100% and blocked advanced chip exports.

What’s Targeted? Everything from US soybeans and Boeing jets to iPhones and Tesla cars assembled in America.

Market Impact: Asian stocks slumped, while the yuan weakened sharply as investors brace for fallout.

Which US Industries Get Hit Hardest?

1. Agriculture: Farmers in Crisis

-

Soybeans (China buys 60% of US exports)

-

Pork & Dairy (Major revenue source for Midwest states)

Impact: US farmers, already struggling, face $14B+ in lost sales.

2. Tech & Manufacturing: Apple, Tesla, Boeing at Risk

-

iPhones (Assembled in China but face new export costs)

-

Tesla EVs (Made in Shanghai but use US parts)

-

Boeing Jets (China is its largest overseas market)

Impact: Supply chain chaos and potential price hikes on gadgets.

3. Energy: LNG & Oil Exports Squeezed

-

Liquefied Natural Gas (LNG) (China is top global buyer)

-

Crude Oil (US shipments to China hit record highs in 2024)

Impact: Energy stocks (Cheniere, Exxon) tumble on demand fears.

SUMMARY OF PRESIDENT TRUMP'S RECIRPOCAL TARIFF ANNOUNCEMENT:

1. Tariffs imposed on 50+ countries in announcement

2. Tariffs are 50% of rates imposed on US, by country

3. 10% baseline tariff on all countries worldwide

4. 25% auto tariffs on all foreign made vehicles

5. Trump says tariffs will "give the US growth"

6. Trump plans to announce "largest tax cut in US history"

7. Baseline tariffs go into effect April 5th

8. Reciprocal tariffs go into effect April 9th

This is the largest tariff announcement in US history.

Editor

Editor