Hindenburg Report: New Evidence Points to Adani-SEBI Battle Intensifies as Whistleblower Exposes Alleged Ties

Discover the latest developments in the ongoing Adani-SEBI controversy as a whistleblower reveals alleged connections between SEBI's chairperson and offshore entities linked to the Adani Group. Uncover the implications of these revelations on the regulatory landscape and corporate governance in India

The Hindenburg Report has sparked significant controversy regarding the Adani Group and its relationship with SEBI, India's market regulator. Whistleblower documents highlight alarming allegations of financial manipulation, implicating key figures within SEBI. This report raises critical questions about the integrity of financial oversight in India.

Key implications include:

- Allegations of financial misconduct: The report suggests a broader scheme involving money siphoning and undisclosed transactions linked to the Adani Group.

- Whistleblower significance: Such revelations play a crucial role in maintaining transparency and accountability in financial regulation, emphasizing the need for rigorous scrutiny.

The ongoing developments highlight the vital intersection of corporate governance and regulatory oversight, underscoring the importance of stakeholder trust in India's financial systems.

Understanding the Hindenburg Report

The Hindenburg Report, published by Hindenburg Research, has brought to light serious allegations against the Adani Group, particularly concerning financial manipulation and money siphoning. Key findings include:

- Financial Manipulation: The report alleges that the Adani Group engaged in a scheme designed to inflate stock prices through undisclosed transactions.

- Offshore Entities: It highlights the involvement of offshore companies allegedly controlled by members of the Adani family, which facilitated these manipulative practices.

These revelations contribute to a growing concern regarding corporate governance standards in India, especially given the significant power and influence of the Adani Group within the country’s economic framework.

Contextually, this scandal unfolds against a backdrop of increasing scrutiny on financial regulations in India. The role of regulatory bodies like SEBI is under examination as stakeholders question their effectiveness and integrity.

The implications of these allegations extend beyond just one corporate entity; they challenge the very foundations of trust in India's financial markets. As investigations progress, the focus remains on how these revelations will reshape regulatory oversight and corporate accountability moving forward.

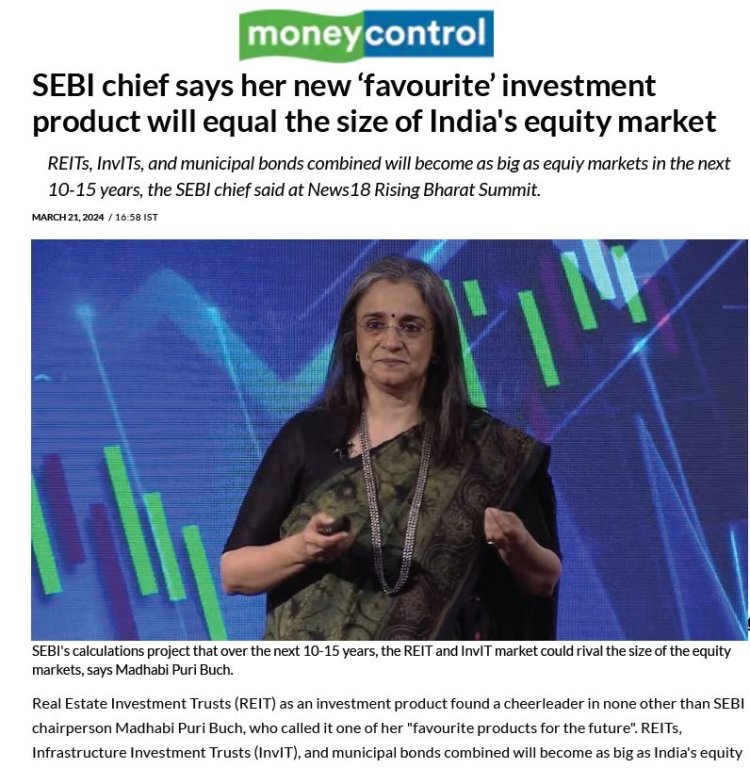

The Role of SEBI and Allegations Against Its Chairperson

Madhabi Puri Buch

The Securities and Exchange Board of India (SEBI) is the main regulatory authority that oversees financial markets in India. Its responsibilities include:

- Protecting investor interests

- Promoting fair trading practices

- Ensuring the integrity of the securities market

SEBI has a mandate to maintain transparency and accountability, which is crucial for building trust in India's financial system.

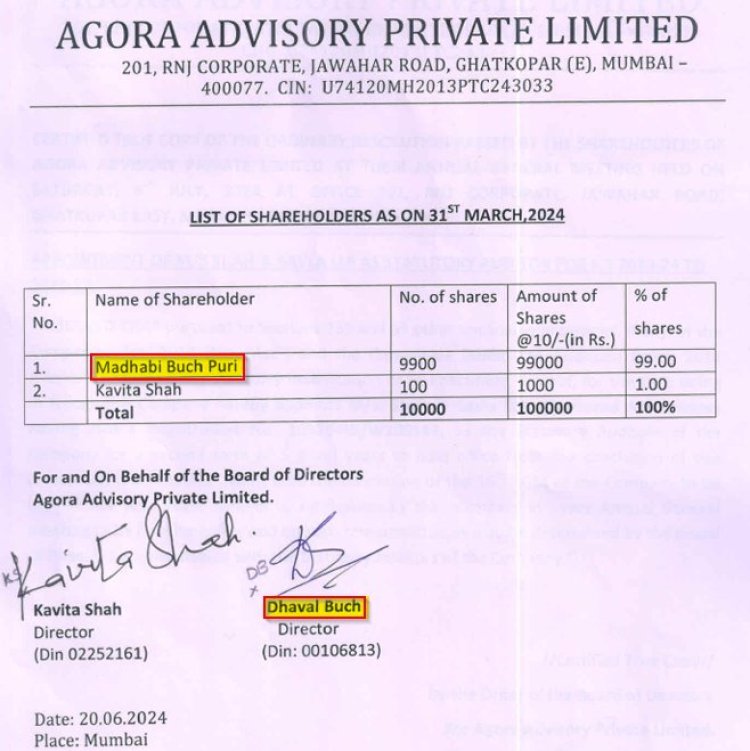

Recent allegations against Madhabi Puri Buch, SEBI's Chairperson, have raised serious concerns about potential conflicts of interest. Whistleblower documents reveal that Buch purportedly held stakes in obscure offshore entities linked to the Adani Group. These entities are alleged to have been involved in a broader scheme of money siphoning and financial manipulation.

Key points surrounding these allegations include:

- Undisclosed Financial Ties: Reports indicate that Buch failed to disclose her financial connections to these offshore entities while serving at SEBI, a situation that raises significant questions about undisclosed income.

- Conflict of Interest: The overlap between Buch's investments and her regulatory role, which can be defined as a conflict of interest, raises questions about her ability to impartially oversee Adani's activities.

- Implications for Regulatory Oversight: Such ties could undermine SEBI's credibility, especially amid ongoing scrutiny regarding its oversight of the Adani Group.

These developments challenge the integrity of SEBI's operations and highlight the need for rigorous examination of its leadership’s affiliations.

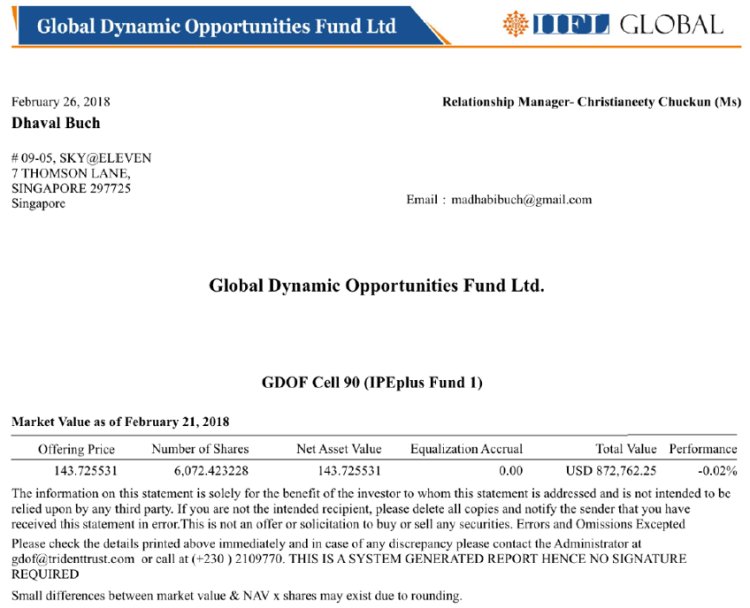

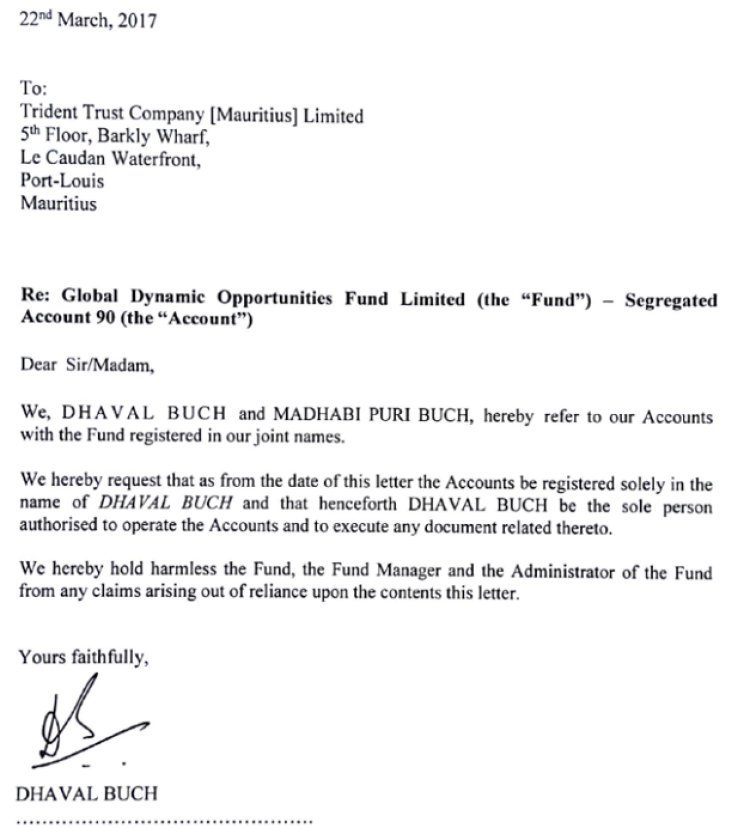

Investigation into Key Players: Dhaval Buch, IPE Plus Fund, and Vinod Adani

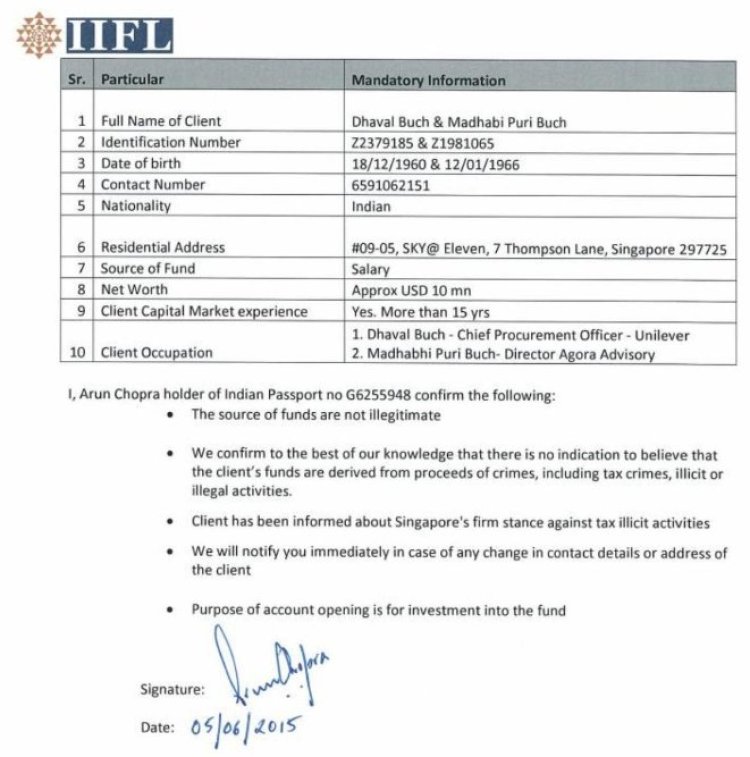

The allegations surrounding Dhaval Buch, particularly his investments, raise significant concerns regarding the integrity of regulatory oversight. Key points include:

- Investment Links: Dhaval Buch's purported financial ties to offshore entities have come under scrutiny. These connections are central to understanding the potential conflicts of interest involving SEBI and its chairperson.

- IPE Plus Fund's Role: This fund has been highlighted as a critical instrument in the financial activities of the Adani Group. Allegations suggest that it facilitated investments by Vinod Adani, which may indicate a broader pattern of financial manipulation.

Vinod Adani's involvement with these offshore entities is crucial for contextualizing the ongoing investigation. His connections to both the IPE Plus Fund and other financial vehicles raise questions about transparency in transactions linked to the Adani Group.

The latest news surrounding the Adani Group emphasizes the need for clarity regarding these relationships. Whistleblower revelations suggest that undisclosed dealings may have influenced regulatory actions—or lack thereof—by SEBI, thus highlighting essential issues in corporate governance and regulatory enforcement within India's financial landscape.

Impact on Regulatory Oversight by SEBI and Corporate Governance in India

The recent allegations against SEBI Chairperson Madhabi Puri Buch raise significant concerns regarding the integrity of regulatory oversight within India’s financial landscape. SEBI, tasked with ensuring fair practices in the securities market, faces scrutiny over its handling of the Adani Group's dealings. Key points include:

1. Regulatory Responsibilities

SEBI is responsible for monitoring market activities and safeguarding investor interests. Allegations of conflicts of interest involving Buch could undermine public trust in its ability to fulfill these duties effectively.

2. Impact on Financial Transparency

The whispers of undisclosed transactions and lack of action against the Adani Group may lead to calls for regulatory changes within SEBI aimed at enhancing financial transparency. Stakeholders are increasingly demanding clearer guidelines and accountability from regulatory bodies.

3. Implications for Corporate Governance

The situation reflects broader challenges in corporate governance across India. Companies are under pressure to adopt more stringent governance practices that prioritize ethical behavior and transparency to regain investor confidence.

As these developments unfold, the need for robust frameworks governing both regulatory authorities and corporations becomes increasingly evident. The potential shift towards greater scrutiny may herald significant changes in how corporate governance is perceived and implemented in India.

Political Reactions, Comparisons with Other Financial Scandals, and The Role of Blackstone Inc.

Political reactions to the Hindenburg Report and the allegations against SEBI Chairperson Madhabi Puri Buch have been significant. Key figures such as Nirmala Sitharaman, India’s Finance Minister, and D Raja, General Secretary of the Communist Party of India, have voiced their concerns.

Nirmala Sitharaman's Call for Transparency

Nirmala Sitharaman emphasized the need for transparency in regulatory practices, urging SEBI to uphold its mandate without bias. Her statements reflect a broader expectation for accountability within regulatory bodies.

D Raja's Demand for Inquiry

D Raja criticized the situation, calling for a comprehensive inquiry into the ties between SEBI officials and offshore entities linked to the Adani Group. His remarks highlight a growing demand among political parties for thorough investigations into potential conflicts of interest.

The current scenario has drawn comparisons to other notable financial scandals in India, such as the Satyam scandal. Similar to Satyam, where corporate governance failures led to significant financial discrepancies, the Hindenburg Report raises questions about regulatory oversight. Lessons learned from past failures emphasize:

- The necessity for stringent regulatory frameworks.

- The importance of maintaining independence among regulatory officials.

- The requirement for timely disclosures regarding financial ties that may influence decision-making.

Amidst these allegations, Blackstone Inc. has also come under scrutiny due to its investment activities in Indian markets. As Dhaval Buch became a senior advisor at Blackstone while his wife served at SEBI, concerns arise about potential favoritism towards Blackstone's interests during regulatory decisions.

This intricate relationship between private equity firms and regulatory bodies poses challenges for maintaining integrity within financial markets and underscores the urgent need for reform in corporate governance practices across India.

Conclusion: The Need for Transparency and Accountability in Regulatory Bodies

The recent events surrounding SEBI and the Adani Group highlight the critical need for transparency and accountability in regulatory institutions.

Key points to consider include:

- Restoring Trust: Public confidence in financial regulators depends on their integrity and impartiality.

- Future Implications: The allegations against SEBI’s leadership pose significant challenges, affecting both its credibility and its ability to oversee corporate governance effectively.

- Strengthening Regulations: Enhanced oversight mechanisms are essential to prevent potential conflicts of interest that could jeopardize market stability.

The ongoing scrutiny of SEBI's operations emphasizes that regulatory bodies must operate above reproach to maintain their role as guardians of fair market practices. Ensuring transparency is not just an ethical requirement but a fundamental principle for the future of India’s financial landscape.

Editor

Editor