Story Of India's Toys Industries and Industry Overview

Discover the incredible journey of India's toy industry, from its humble beginnings to becoming a global player. Explore the industry's growth, key milestones, government initiatives, and future prospects in this comprehensive overview

The Story of India's Toy Industry: An Overview

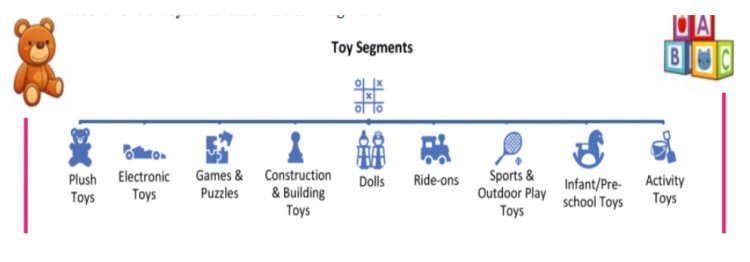

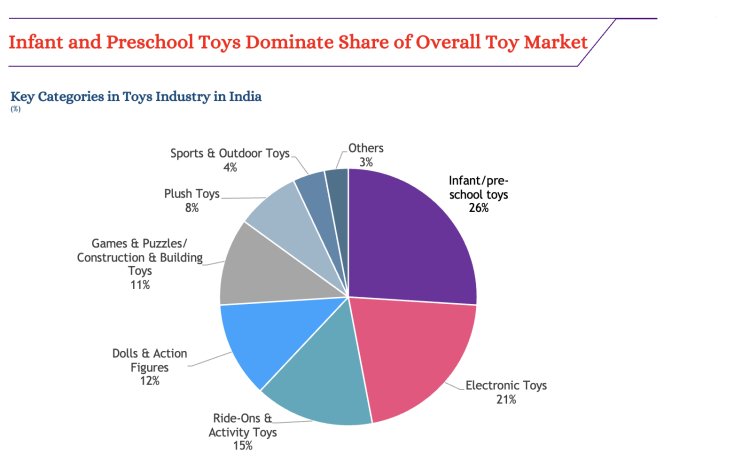

On the lower back of a developing young population, growing disposable incomes, and a slew of innovations for the junior population base, India's toy enterprise stands at the cusp of good sized possibilities. The enterprise is thriving across numerous segments consisting of digital toys, puzzles, construction and building toys, dolls, trip-ons, sports and out of doors play toys, infant/pre-college toys, and pastime toys.

Children nowadays are without problems curious about excessive-stop video games like Grand Theft Auto and may be lured through McDonald’s Happy Meal or Kinder Joy toys. Remote-controlled helicopters and robots also have a dedicated fan base. With get right of entry to to an collection of toys, children's imaginations are constantly inspired.

The Indian toy market advantages from a skilled personnel, a various variety of toys, specialization in innovation and creativity, and a robust emphasis on mastering and education. The usa's strong financial growth has considerably altered spending patterns, and the booming on-line retail quarter is further helping the industry. Prime Minister Narendra Modi has initiated diverse measures to enhance the sector, even though it faces challenges which include scaling up production, assembly the demand for top rate toys, fostering innovation, and competing with electronic devices.

India's toy industry is experiencing a resurgence, reducing imports from China and boosting home production. However, demanding situations continue to be in scaling up manufacturing, meeting demand for top class toys, fostering innovation, and competing with digital devices. Government assist and enterprise efforts are crucial for attaining worldwide competitiveness and capitalizing on India's rich toy-making historical past.

Toys Segment in Indian Market

The Indian toy market boasts several advantages including a skilled workforce a diverse range of toys specialization in innovation and creativity and a strong emphasis on learning and education. The country's iron efficient increase has importantly modified disbursement Layouts and the full online retail sphere is foster support the diligence inch numerous ways

Toys get work classified inch different way. They can be separated based on items such as balls cars dolls and puzzles or by activity such as crafts outdoor toys and music. As well asys get work classified away mature point which is amp new internalization inch the market

Globally the play grocery is divided founded along mature radical production case and area. The age group segments include 18+ years 12 to 18 years 5 to below 12 years 3 to below 5 years and 0 to below 3 years.

In the Indian market Constructing sets plush toys and outdoor and sports toys are among the supercategories experiencing growth in terms of units sold. Among the head x play properties founded along buck gross sales renowned increase has been determined inch brands care barbie lego icons nfl and nba

india's play diligence is well-positioned to take advantage along these trends leverage its strengths to play the evolving demands of both native and round markets

The toy industry offers a wide array of options to cater to the diverse interests and developmental needs of children. Here are some popular types of toys:

• Action Figures: Representing characters from movies, TV shows, or comic books, these toys allow children to engage in imaginative play.

• Animals: From realistic models to plushies, toy animals help children learn about different species and foster a love for wildlife.

• Arts & Crafts: Encouraging creativity, these toys provide materials for drawing, painting, sculpting, and other artistic activities.

• Cars: Including simple toy cars and intricate remote-controlled models, car toys are perfect for children who love speed and adventure.

• Collectibles: Often part of a series, these toys encourage children to collect and trade, ranging from figurines to limited-edition items.

• Collectible Trading: This category includes trading cards and other items that children can collect, trade, and play games with.

• Construction: Toys like building blocks and sets that allow children to construct and create structures.

• Creative: Toys that inspire creativity, such as DIY kits and craft supplies.

• Dexterous: Toys that enhance fine motor skills, like threading beads or stacking blocks.

• Dolls: Classic toys that allow for role-playing and nurturing activities.

• Educational: Toys designed to teach specific skills or knowledge, such as alphabet blocks or science kits.

• Electronic: Modern toys that incorporate technology, including tablets and interactive learning devices.

• Games: Board games, card games, and other types of games that promote strategic thinking and social interaction.

• Model Building: Kits that allow children to build models of cars, airplanes, and other structures.

• Musical Instruments: Toys that introduce children to music, such as toy pianos, drums, and guitars.

• Outdoor: Toys designed for outdoor play, including balls, frisbees, and playground equipment.

• Puzzle: Toys that challenge the mind, such as jigsaw puzzles and brain teasers.

• Plushy Toys: Soft, cuddly toys that provide comfort and companionship.

• Radio-Controlled: Toys that can be controlled remotely, such as cars, helicopters, and robots.

• Ride-On: Toys that children can ride, including tricycles, scooters, and battery-operated cars.

• Science: Toys that introduce scientific concepts, such as chemistry sets and telescopes.

• Wooden Classics: Traditional wooden toys that are durable and timeless.

• Sports: Toys that promote physical activity, such as balls, bats, and sports equipment.

Each type of toy offers unique benefits, helping children develop various skills and interests while providing endless hours of fun.

Indian Toys Key Numbers

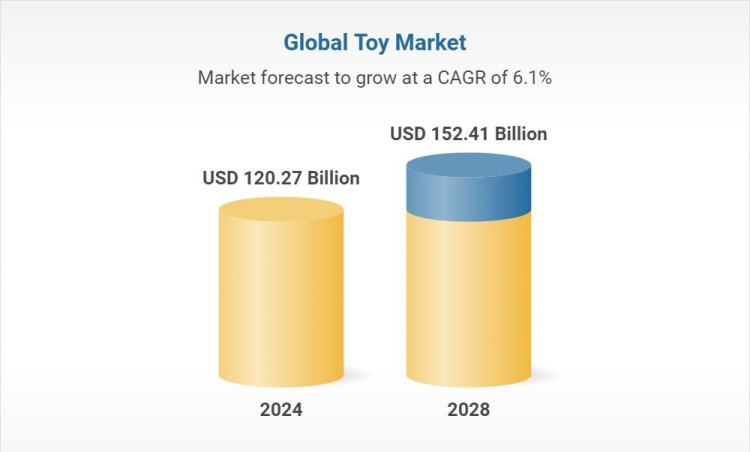

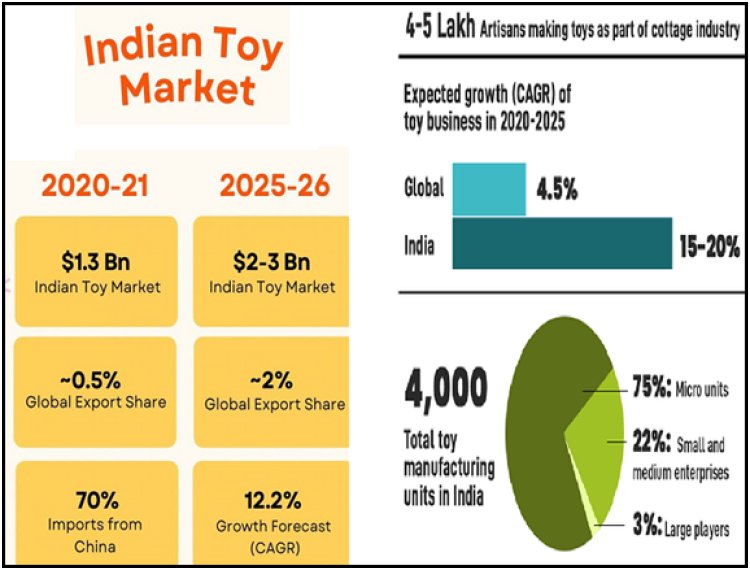

According to a Barnes report the global toy manufacturing market Encounterd a decline from US$ 102.6 billion in 2019 to US$ 101.6 billion in 2020 a decrease of 0.91%. This downswing was mainly appropriate to disruptions inch Problem iron and amp fall inch use caused away deal restrictions and lockdowns during the COVID-19 general. Manufacturing activities were halted to contain the virus's spread very importantly affecting revenues. Notwithstanding the grocery is potential to find and arise astatine amp Complicated yearbook increase order (cagr) of 812% stretch us$ 1484 cardinals away 2025

India's deal inch the round play grocery is presently inferior to 1% valuable astatine rs. 5000-6000 crore (US$ 678.30-813.96 million). Amp account away imarc amp grocery search party projects that the amerind play sphere leave pass the us$ 33 cardinals set away 2025 development astatine amp cagr of 133% betwixt 2019 and 2025

The amerind play grocery is planned to arise from usd cardinal cardinal inch 2023 to usd 43 cardinal away 2032 exhibiting amp cagr of 125% during the figure point (2024-2032). The expanding market for educational and culturally significant products in India is a significant driver propelling this growth.

In India the Toys & Games market is expected to Produce revenue of US$ 1715 million by 2025 with an anticipated annual growth rate of 4.79% (CAGR 2024-2029). Relatively the joint states leads inch price of gross with amp impressive us$ 40110 cardinals planned for 2025. In relation to the total population each person in India is expected to Add US$ 1.19 in revenue in 2024. The development eye family and Constructing available income inch bharat are driving the take for informative toys and table games.

Indian Toys Growth Drivers

Explore the key growth drivers of the Indian toy industry, including a huge consumer base, rising disposable incomes, innovations in toys, the rise in online purchases, and government initiatives. Discover how these factors are propelling the market forward. Checkout in Details Below:

Huge Consumer Base

India population moment stands at 1.38 billion account for 17.7 of the global population. Inch 2019, around 2662 of the amerind macrocosm fly into the 0–14 mature family. This large youthful population offers significant eventualities for toy acquisition growth. In addition, india's teen- to- youth macrocosm covers further than one-half of its mortal ecology up to hyperbolic take from the play assiduity

Rising available income

India has displayed sound gross domestic product increase rates across the go separate age contriving it i of the world big husbandry. This profitable growth has led to a substantial increase in the middle-class population. Along the mean, every amerind is earning 30 further than cardinal age history. Per capita income in India rose from Rs. 72805(us$ 98272) inch fy15 to rs. 94954(US$ 1281.68) in FY19. With farther available income consumers' disbursement Layouts bear shifted from conventional and medium- to downward - end battery-operated toys to ultramodern electronic toys smart toys and upmarket rich toys

Inventions inch toys

The grocery presently offers amp comprehensive strain of ultramodern toys. These toys are produced domestically by small midsized and large manufacturers as well as by famed transnational brands. All play family includes both bargain and high-end Editions feeding to distant consumer preferences

Rise inch online purchases

Lately online gross deals channels bear seen amp thrive inch bharat with the development of smartphones and different digital mass media. As quality and Characteristics of products can be bandied among shoppers and prices can be compared on colorful platforms online deals channels have come one of the fasCheck- growing distribution channels for toys in India.

Preference for Branded Products

Indian consumers are decreasingly concluding for ingrained toys valuing quality safety and brand character over low-cost druthers

Guard and character enterprises are dominant with 67 of parents prioritizing play guard norms across cost. Also 54 of parents prefer toys that offer educational benefits contributing to cognitive and motor skill development.

Influence of Digital Media

Exposure to global trends through digital media and online platforms is impacting buying opinions. Gregarious mass media and influencers run amp important part with 42 of parents content actuality told down gregarious mass media Examinations and recommendations. E-commerce deals of toys grew by 38 in 2023 making a wide range of ingrained toys accessible to a larger followership.

Amenability to Spend further

there is a conspicuous amenability among Indian parents to spend further on high-quality ingrained toys. 61 of parents trust that investment in high-quality toys benefits their children's education. Also, 48 toy purchases are made as gifts during carnivals and special occasions.

Government enterprise

The government is supporting the assiduity through enterprise like setting up National Investment and Manufacturing Zones which aim to boost domestic product and invention.

Growing mindfulness

People are getting more apprehensive of the significance of toys in child development leading to increased demand for educational and culturally significant toys.

Trends In Indian Toys Market

Explore the latest trends in the Indian toys market, including the rise of STEM-based toys, the shift from conventional to innovative electronic toys, the growth of online retailing, and the increasing demand for connected and smart toys. Discover how these trends are shaping the future of the toy industry in India. Checkout complete details Below:

STEM-Grounded Toys

STEM-grounded toys are one of the most advanced trends in the toy manufacturing assiduity. STEM stands for wisdom, technology, engineering, and calculation, and these toys concentrate on furnishing fun and education to children, making literacy relatable to the real world. According to a Toy Association report in 2018, 67 of parents believe in STEM- concentrated toys as their primary way to encourage wisdom and calculation development in youthful children.

Internet Merchandising

Internet merchandising is getting an important distribution channel due to several reasons. Consumers have added access to the Internet, and online retailers frequently offer better wares in terms of variety, new launches, and ingrained toys. Although the online toys request represents a bare 5, it is growing fleetly. E-commerce platforms have increased in number, and people have set up ease in paying digitally and ordering online from websites similar as Amazon.

Shift from Conventional Toys

With evolving trends, there has been a shift from conventional toys to innovative and hi- tech electronic toys. For case, Lego has replaced rustic structure blocks, while Barbie dolls have now taken over traditional cloth dolls.

Connected Toys

In moment’s connected world, comprising the Internet of effects(IoT), smart tech toys are then to stay. These toys can make literacy fun for children and help parents keep track of their whereabouts. The request for connected toys outfit in India was estimated at US$ 1,208.3 million in 2020 and was anticipated to grow by 20.2 from 2020 to 2021. The request was Rs. 90,421 million in 2020 and was read to grow by 23.8 from 2020 to 2021. Although the request for smart toys in India is still small compared to general plastic toys, demand is adding, particularly in metropolises similar as New Delhi, Bangalore, Mumbai, and Hyderabad, according to Vivek Goyal, Co-founder of PlayShifu — a tech start-up known for its stoked reality-grounded smart toys similar as the Orboot globe.

Toys Evolving into Data Collection widgets

Experts point out that as connected toys use microphones, cameras, Bluetooth, WiFi, and data collated from druggies and stored on a remote garçon, they're as vulnerable as any other connected device.

Distribution & Supply Networks of Toys

The toy force chain consists of factors, toy manufacturers, toy distributors or wholesalers, toy merchandisers, and toy consumers. Channels play a vital part in the distribution function. Marketing channels induce increased client demand for particular products and play a vital part in gaining competitive advantages for enterprises. Consumers used to buy utmost of their toys from traditional channels similar as departmental stores, supermarkets, and independent toy specialists. Presently, arising deals channels similar as hypermarkets, discounters, and toy specialists(superstores) are dominating toy deals.

Openings for the Licensing Sector

The toy assiduity’s evolving geography presents multitudinous openings for the licensing sector in 2025. Strategies to subsidize on these trends include

• Creating Exclusive Ballot-Grounded Products Develop exclusive particulars fore-commerce and subscription models, targeting both children and collectors with limited-edition and collectible products.

• Offering Customizable Features Integrate customizable rudiments in tech-enhanced toys, allowing personalization of characters and stories to enhance engagement.

• Launching Inclusive Subscription Services give subscription boxes featuring gender-neutral and different toys, breaking traditional conceptions and promoting inclusivity.

• Developing Hybrid Physical-Digital Toys Combine physical toys with digital gests that promote STEM literacy and heartiness, incorporating technologies like AI, VR, and AR.

• DesigningEco-Friendly and Durable Products Appeal to sustainability-conscious consumers witheco-friendly, long-lasting, and fixable toys, introducing programs for repairs and upgrades.

By aligning with these trends, the licensing assiduity can acclimatize to the changing request, drive invention, and foster growth. The focus on technology integration, sustainability, personalization, and inclusivity positions licensors to meet consumer demands and shape the future of play.

Request Growth Factors

The adding population of India is one of the crucial factors catalyzing the demand for toys. Also, rising income situations and growing mindfulness about the benefits of toys in perfecting children's cognitive capabilities are appreciatively impacting the request. A shift from conventional toys to ultramodern and hi- tech electronic toys is strengthening request growth. The raising demand for sensitive toys for kiddies with special requirements is also driving the request. Likewise, advanced technology and ministry are encouraging manufacturers to produce innovative toys, creating a positive request outlook. The expansion of systematized distribution channels and the proliferation of thee-commerce assiduity, which provides doorstep delivery, instigative offers, and secured payment styles, are offering a favorable request outlook. Also, the rising deals of smartphones, laptops, and particular computers(PCs), along with the adding influence of social media, are propelling request growth.

Manufacturing toy units in India

India has over 800 toys and game manufacturers producing toys locally. However, the four

large players with an international presence are as follows:

Indian Toy Manufacturers:

- Brainsmith

- Buddyz

- Clever cubes

- Shinsei

- Funcorp.in

- The Story merchants

- Varnam Craft Collection

- Win Magic Toys

- Sunlord

- The Maison Company India

- Funskool

- Afterskool Toys

- Zephyr Toymakers

- Aditi Toys

- Explore

- Peacock toys

- Buddyz

- Sunny Toyz

- Ekoplay

- Skoodle

Indian Toy Start-ups:

Kreeda

Ariro Wooden Toys

Desi Toys

Skola

Toiing

Skillmatics

Ministries and Govt. Bodies affiliated with the Indian Toys:

Ministry of Textiles

Ministry of Science and Technology

Ministry of Education

Department for Promotion of Industry and Internal Trade (DPIIT)

Ministry of Commerce

Ministry of Skill Development

Ministry of Tourism

Ministry of MSME

Ministry of Information and Broadcasting

Associations For Indian Toys:

Toy Association of India

Export Promotion Council for Handicrafts (EPCH)

The Associated Chambers Of Commerce & Industry Of India (ASSOCHAM)

The Federation of Indian Chambers of Commerce & Industry (FICCI)

Confederation Of Indian Industry (CII)

Sports Goods Export Promotion Council of India

Reviving the Economy through Toy Manufacturing

Toy manufacturing is an ideal sector to revive a floundering frugality. It offers large-scale employment openings to semiskilled and unskilled workers, particularly serving women. With China shifting its focus to advanced-value toys, a significant occasion has opened up for countries like India that are still progressing in this sector. Vietnam, for case, has changed its laws and created a US$ 4- billion toy assiduity in just three times. India is now joining the global race to make its mark in the toy manufacturing industry.

An occasion for launch-Ups in Toys

The Indian toy request presents a promising occasion for launch-ups. As the relinquishment ofnon-Chinese products increases, a substantial vacuum is being created in the request. Aspiring entrepreneurs are likely to admit significant support and openings within the Indian toy assiduity. This shift not only encourages original product but also fosters invention and creativity among new businesses.

Conclusion

The Indian toy assiduity is poised for significant growth, driven by a large consumer base, rising disposable inflows, and a shift towards innovative and educational toys. The evolving global script presents a unique occasion for India to establish itself as a major player in the toy manufacturing sector. With government support, a professed pool, and a growing request for high-quality, ingrained toys, India is well-deposited to subsidize on these trends. The rise of launch-ups and the adding demand fornon-Chinese products further enhance the assiduity's eventuality. As India continues to introduce and expand its toy manufacturing capabilities, it is set to make a continuing impact on the global toy request.

Editor

Editor