Is ONDC a Failed Experiment or a Digital Success Story? Full Analysis Case Study Inside

Explore whether ONDC is a digital revolution or a failed attempt. Full case study with insights, growth data & real analysis inside.ONDC Performance and Current Progress

ONDC: A Case Study on Success, Failure, and Challenges

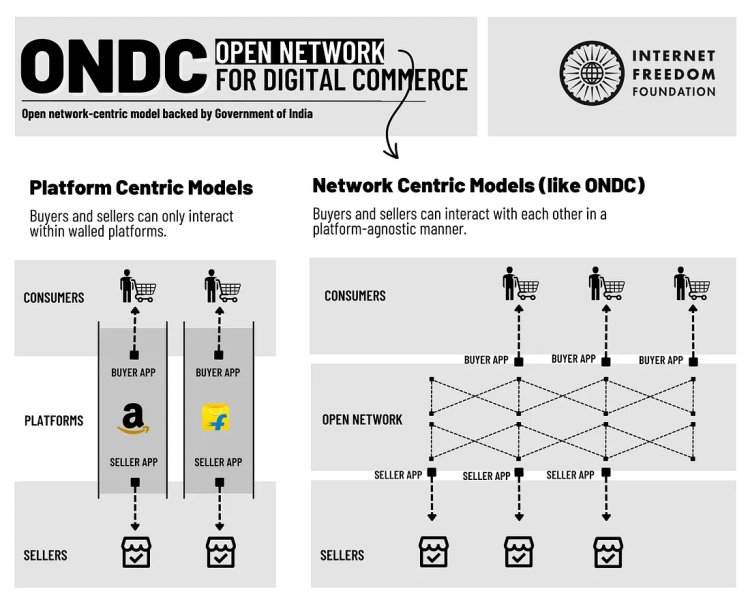

The Open Network for Digital Commerce (ONDC) was launched by the Indian government with the ambitious goal of democratizing e-commerce, removing the dominance of platform monopolies, and empowering MSMEs across India. Positioned as the "UPI for Commerce," ONDC set out to transform how buyers and sellers interact digitally, offering an interoperable platform designed to level the playing field.

ONDC Performance and Current Progress

-

Initial Growth: ONDC started with pilot projects in five cities in 2022 and rapidly expanded to over 600 cities, onboarding 6 lakh (600,000) merchants.

-

Order Volume: In 2024, ONDC processed over 14 million transactions in October, up from 12.9 million the previous month. The mix included both mobility and non-mobility sectors, with rapid growth in fashion, food, and grocery.

-

Category Breakdown: Mobility services now drive the majority (about 56%) of transactions, while traditional retail categories (food, groceries, fashion) have seen slower and more volatile adoption.

-

Geographic Reach: More than 800 cities have seen ONDC transactions, with top states being Delhi, Uttar Pradesh, and Maharashtra. UP and Bihar, for example, saw the fastest-growing order volumes in 2024.

ONDC Impact and Benefits for MSMEs

ONDC’s open network model has provided several benefits, particularly for MSMEs:

-

Lower Costs: Unlike big platforms that charge commissions of 25–40%, ONDC’s near-zero platform fees allow small sellers to improve their margins.

-

Broader Reach: Listing once on ONDC allows products to surface across a network of buyer-side apps, increasing exposure for MSMEs.

-

Access to Credit: The ecosystem connects MSMEs with a broader set of financial service providers, increasing their chances for credit access.

-

Reduced Dependence: MSMEs are not beholden to a single e-commerce platform’s rules or algorithms, which improves their bargaining power and sustainability.

-

Inclusive Innovation: Government events like ONDC Startup Mahotsav have fostered collaboration between startups, unicorns, and MSMEs, driving ecosystem growth.

ONDC Barriers and Challenges

Despite its promise, ONDC has encountered significant obstacles:

1. Long and Complex Integration

-

ONDC’s interoperability depends on complex technical integration between buyer apps, seller apps, logistics, and payment providers. Many businesses—especially MSMEs—find this process confusing, time-consuming, and technically demanding.

-

Comprehensive testing and frequent API issues further slow onboarding.

2. Specialized Skills Required

-

Successful onboarding to ONDC, particularly for manufacturers and sellers, often requires in-depth technical knowledge, leading to dependency on specialist agencies (and extra costs)

3. Technical and Platform Maturity

-

The underlying tech infrastructure still faces reliability and user experience issues: real-time inventory management, order cancellations, returns, and customer support are not as seamless as in dominant platforms like Amazon or Zomato.

-

Early attempts to incentivize adoption with discounts have faded, exposing weaker UX and diminishing buyer interest.

4. Unclear Execution and Leadership Instability

-

A leadership vacuum has emerged with the exit of multiple senior ONDC executives, undermining confidence in execution and long-term strategy.

-

Execution planning is perceived as ambiguous, especially regarding dispute resolution and customer experience standards.

5. Fragmented Responsibility and Multiple Parties

-

ONDC’s open, multi-party structure (unlike closed platforms) creates ambiguity over responsibility during order fulfillment, customer complaints, and dispute resolution. There are currently no uniform standards or robust redressal systems, causing delays and friction.

-

Customers and sellers have reported frustration over clunky interfaces and poor service, especially compared to market leaders.

6. Regulatory and Data Governance Gaps

-

The Digital Personal Data Protection Act (2023) has yet to deliver clear frameworks for data processing, security, and liability, exposing participants to potential risks and undermining trust.

7. Market Behaviour and Consumer Preferences

-

Consumers, accustomed to the polished and integrated experiences on platforms like Amazon, Flipkart, Swiggy, and Zomato, see little incentive to switch—especially once ONDC’s discount-driven incentives ended.

-

The same factor has encouraged exits or reduced activity from influential participants such as PhonePe’s Pincode.

Has the ONDC Experiment Failed?

It is premature to entirely label ONDC as a failure, but it has not achieved the widespread disruption or mass adoption many hoped for. The initiative has succeeded in establishing a large digital marketplace presence and onboarding a vast number of small businesses. However, key segments are not scaling as anticipated, order volumes in retail are falling, and user experience lags far behind industry standards.

Notable points:

-

Successes: Rapid growth in logistics and mobility; MSME participation increased; network coverage expanded to tier-2, tier-3 cities.

-

Setbacks: Diminishing order volumes in core retail, sluggish consumer adoption, recurring operational and strategic challenges.

ONDC success stories in Indian retail

Empowering Small Retailers and MSMEs

-

Women Entrepreneurs and Artisans: ONDC has significantly boosted the digital sales of women-led businesses and traditional artisans. Notably, a group of nine Kanchipuram saree sellers who previously sold only 10–12 sarees a month achieved ₹21 lakh in sales in just 10 months after onboarding to ONDC. The platform now hosts over 400 women-led businesses, including major collectives like Kudumbashree and Jharcraft, promoting products from across India and helping over 5 million women find sustainable livelihoods.

-

Wider Reach for Local Businesses: ONDC has enabled MSMEs to expand beyond their physical markets. For example, local sellers from famed craft regions like Lucknow (Chikankari), Moradabad (brassware), and others have found nationwide customers via ONDC, democratizing access to digital commerce for traditionally offline sectors.

ONDC Growth Metrics and Broader Impact

-

Transaction Volume: ONDC’s transaction volume rose sharply, reaching over 20 crore transactions in March 2025. Sectors like grocery saw 52% order growth, while the network’s restaurant segment spanned 95,000+ restaurants in 347 cities.

-

Investment & Collaboration: ONDC received over ₹255 crore in investments from prominent Indian banks and quality councils—fueling support infrastructure for small sellers. E-commerce platforms like Meesho and logistics players like Ecom Express and Shiprocket have amplified the network’s reach, offering end-to-end digital commerce solutions for retailers previously left out of online growth.

-

Reduced Barriers for MSMEs: The platform enables MSMEs to access digital commerce with minimal upfront costs, decreasing their dependence on big tech platforms and empowering sustainable business models

Impact of open networks ONDC on e-commerce

-

Open networks, exemplified by India's ONDC (Open Network for Digital Commerce), are having a profound impact on the e-commerce landscape. Here are the key ways this model is transforming digital commerce:

-

Democratizing Access: Open networks like ONDC allow any seller—regardless of size—to connect with any buyer through a standardized, interoperable system. This breaks down the walled gardens of traditional e-commerce platforms, leveling the playing field for small businesses and promoting entrepreneurship and local economic growth.

-

Increased Competition, Lower Costs: By enabling direct interaction between buyers and sellers and reducing dependence on intermediary platforms, open networks drive healthy competition, lower transaction fees, and can significantly reduce operational or commission costs for both sellers and buyers.

-

Enhanced Discoverability and Reach: Sellers can list their products on multiple platforms simultaneously through the network, vastly expanding their reach and visibility—especially for MSMEs (micro, small and medium enterprises) and rural entrepreneurs who were previously marginalized from digital commerce.

-

Interoperability and Standardization: Open networks set common technical standards (APIs, data structures), allowing seamless integration across platforms, payment systems, and logistics. This makes transactions smoother and makes the supply chain more efficient and cost-effective.

-

Personalization and Local Relevance: By pooling inventory and customer data across the network (with consent), platforms can provide more personalized recommendations, hyper-local listings, and regionalized experiences, enhancing customer satisfaction.

-

Empowerment and Inclusion: Open networks foster transparency and allow consumers to retain control over their data, promoting trust and privacy. This model also enables marginalized groups—such as artisans, women entrepreneurs, and underserved communities—to benefit from the digital economy.

-

Innovation and Economic Growth: Open networks encourage innovation by allowing any business, logistics provider, or fintech startup to participate, spurring the development of new services and business models. Analysts project the ONDC-driven e-commerce market in India could reach $340 billion by 2030, substantially contributing to the nation’s economic growth.

-

Challenges and Regulatory Complexity: While open networks hold great promise, they face challenges including regulatory compliance, data privacy, cybersecurity, and ensuring a consistent customer experience given the diversity of participants. Effective collaboration among businesses, technology providers, and regulators is critical for realizing their full potential.

In summary, open networks are transforming e-commerce by expanding access, reducing costs, driving competition, and fostering innovation, with significant benefits for small businesses, consumers, and the wider digital economy.

Regulation challenges for open networks ONDC

Open networks, such as ONDC and Open RAN, present unique regulatory challenges that require careful, evolving frameworks to balance innovation, competition, user protection, and financial sustainability.

Key Regulatory Challenges for Open Networks

-

Balancing Regulation and Flexibility: Open networks demand a regulatory approach that prevents overregulation (which can hinder growth and innovation) but still ensures long-term stability and oversight. Regulatory policies must be robust enough to provide confidence, yet flexible enough to accommodate rapidly changing technology and business models.

-

Governance Structure: Effective open networks often rely on independent, nonprofit entities to develop and maintain protocols, using voluntary contracts rather than direct government control. Governance is multilayered: digitally signed contracts at the base, network participant agreements and open-network policies in the middle, and overarching national laws at the top.

-

Data Governance and Privacy: Open networks face heightened risks surrounding data governance and personal data protection. As data flows across more participants, embedded mechanisms for consent, transparency, and data minimization become critical to prevent privacy violations and maintain trust.

-

Security Risks: The increased diversity and openness of these systems raise new security vulnerabilities. For example, disaggregated network architectures (as in Open RAN) enlarge the threat surface and complicate oversight, making regulatory vigilance over cyber security and system integrity especially important.

-

Liability and Dispute Resolution: Determining liability in disputes is complex when multiple independent actors collaborate via a decentralized protocol. Networks like ONDC now require independent appellate mechanisms and transparent peer-review processes for addressing grievances and compliance failures.

-

Compliance and Standardization: As networks span cross-border operations or new sectors, harmonizing standards and ensuring compliance across jurisdictions become difficult. Enforcing uniform performance, privacy, and ethical standards is challenging, especially with competing regulatory environments in play.

-

Financial Sustainability: Regulations must also address how open networks remain financially sustainable—balancing private investment, state support, and avoidance of conflicts of interest, all while ensuring that governing bodies themselves do not become de facto monopolies or gatekeepers.

-

Transparency and Consumer Protection: Ensuring transparency at every transaction layer is key for both sellers and buyers. Introducing performance-based scoring or badging for sellers while maintaining open, dispute-resolution channels helps mitigate risks and maintain consumer trust.

-

Vendor Support and Compatibility: Open networks may struggle with limited vendor support and compatibility issues, leading regulators to consider rules that promote interoperability without undermining system reliability or innovation.

The Role of the State and Private Sector In ONDC

-

The state's role is to provide policy support and set minimal governance standards without unduly controlling the ecosystem. Its involvement should encourage startups and innovation, but not stifle private sector initiative.

-

Private sector collaboration is vital for scaling and sustaining open networks, ensuring that development keeps pace with technological and market needs.

In summary: Regulation of open networks must strike a delicate balance: securing the ecosystem with strong privacy, security, and legal frameworks while fostering competition, innovation, and inclusion. Ongoing cooperation between independent governing bodies, private sector players, and state regulators will be critical for open networks to deliver on their promise.

Strategies to accelerate ONDC growth

Here are strategies to accelerate ONDC growth in India, drawing on recent industry insights and research:

1. Expand into Tier II and Tier III+ Markets

-

Promote onboarding of MSMEs and local retailers in smaller cities, going beyond Tier I metros. ONDC’s open network especially empowers hyperlocal businesses and bridges gaps previously left by major platforms.

2. Enhance Technical Onboarding and Support

-

Provide training, technical assistance, and integration resources to MSMEs and D2C brands for smooth participation in the ONDC network.

-

Create user-friendly storefront templates and clear technical documentation to lower integration barriers.

3. Build Brand and Consumer Awareness

-

Launch large-scale Information, Education, and Communication (IEC) campaigns to educate potential sellers, buyers, and other stakeholders about ONDC’s value proposition and ease of access.

-

Amplify success stories and benefits through targeted digital marketing and collaboration with industry bodies.

4. Simplify and Standardize Processes

-

Streamline seller onboarding, payments, and logistics to make joining ONDC fast and less cumbersome.

-

Develop automated compliance and grievance redressal systems to ensure seamless dispute resolution and participant trust.

5. Leverage Technology for Personalization and Reach

-

Encourage adoption of mobile apps for wider reach across diverse regions and languages.

-

Offer customized and regional storefronts to cater to local consumer preferences.

6. Innovate with Business Models and Partnerships

-

Enable cross-platform discoverability—allowing any buyer app to access the widest range of sellers, and vice versa, for maximum reach.

-

Facilitate partnerships with logistics, fintech, and value-added service providers to enrich the network.

-

Attract innovative startups by showcasing ONDC as a platform for building new solutions.

7. Empower the Community and Stakeholder Council

-

Establish a user council featuring participants, users, and experts to refine network rules, provide feedback, and represent diverse interests.

-

Foster an ecosystem where feedback directly influences policy and feature updates, driving rapid adoption.

8. Financial Incentives and Sustainability

-

Offer introductory incentives (such as reduced seller fees or digital marketing support) to encourage early adoption.

-

Ensure ONDC’s management operates independently and sustainably, able to attract talent and funding autonomously for continual innovation.

9. Continuous Network Evolution

-

Regularly update network protocols, compliance policies, and service offerings in collaboration with the startup ecosystem and user community.

-

Expand across sectors (e.g., grocery, food, mobility) and geographies to maintain momentum and coverage.

10. Formalize and Digitize the Ecosystem

-

Help small businesses build digital transaction histories to improve access to finance and promote formalization.

-

Use ONDC to connect sellers directly to financial services like credit, insurance, and payments, enhancing economic inclusion.

By implementing these strategies, ONDC can accelerate its reach, reduce onboarding friction, foster vibrant competition, and fuel digital commerce growth across every segment and region of India.

Future trends in digital commerce India

Here are the future trends shaping digital commerce in India as of mid-2025, based on industry analysis and recent developments:

1. Rapid Growth in Tier II & III Cities and Rural Markets

-

The next wave of e-commerce expansion is driven by rising internet penetration and digital literacy outside metros. Orders from Tier-II, Tier-III, and even rural zones now make up a large share of total online orders, indicating broad digital adoption.

2. Quick Commerce (Q-Commerce)

-

Delivery in less than 30 minutes has become mainstream for groceries and is expanding into categories like electronics and apparel. This model is predicted to grow over 40% annually through 2030, enabled by hyperlocal hubs and streamlined logistics.

3. Mobile-First & Vernacular Commerce

-

The dominance of smartphones means most transactions are mobile-based. Platforms are increasingly offering interfaces in Indian languages, catering to local preferences and making digital commerce more accessible to diverse demographics.

4. AI, Personalization, and Advanced Tech

-

Artificial intelligence, machine learning, and automation power personalized recommendations, dynamic pricing, smart customer support, and predictive inventory—aiding both buyers and sellers. AR/VR tools are also rising for immersive product visualization in fashion, furniture, and home décor.

5. Social and Trend-First Commerce

-

Social media platforms (Instagram Shops, Facebook Marketplace, influencer-driven sales) are now central for product discovery and purchase, especially among Gen Z and millennials. Trend-first fashion—where new styles appear quickly and affordably—represents a major growth area.

6. Sustainability and Ethical Commerce

-

Consumers increasingly demand eco-friendly packaging, transparent supply chains, and responsible sourcing. Sustainability practices are becoming both a brand differentiator and a requirement for digital merchants.

7. Omnichannel Integration

-

Brands are blending online and offline experiences through seamless omnichannel strategies. Store pickups, hyperlocal delivery, and unified inventory are becoming the norm, meeting customer expectations for convenience and choice.

8. D2C (Direct-to-Consumer) and Hyper-Value Commerce

-

More brands are bypassing traditional retailers, selling directly to customers online for greater control and margins. Simultaneously, platforms offering ultra-low-price assortments (hyper-value commerce) are gathering large user bases, especially in smaller cities.

9. Digital Payment Innovations

-

UPI, mobile wallets, and “Buy Now, Pay Later” (BNPL) options are making online transactions frictionless, accelerating digital commerce adoption among a wide range of consumers.

10. Cross-Border and Global Commerce

-

Indian sellers increasingly tap international markets, while foreign brands exploit Indian online platforms to reach a growing, digitally-savvy population. Cross-border e-commerce is thus poised for major growth.

Key Point:

India’s digital commerce is at an inflection point—with new tech, inclusivity, hyperlocal and hyper-value models, and sustainability driving exponential growth and innovation for years to come.

Conclusion

ONDC remains a bold and innovative public infrastructure project with ongoing promise. However, persistent issues—complex integration, technical immaturity, execution gaps, diffuse accountability, inadequate consumer protection and lackluster user experience—currently limit its transformative ambition. Whether ONDC realizes its vision depends on addressing these structural hurdles, delivering seamless customer experiences, and establishing robust regulatory and dispute handling processes in the coming years.

ONDC’s journey demonstrates how a national digital network can democratize e-commerce in India, particularly for small retailers, MSMEs, and women entrepreneurs. By offering broader reach, simplified logistics, and lowered operational costs, ONDC is enabling businesses of all sizes to participate—and thrive—in the expanding digital economy.

Editor

Editor