Trade War Turmoil: How Deep Could It Cut & How Traders Can Navigate the Chaos

Explore the impact of the ongoing trade war turmoil on markets and discover expert strategies for traders to navigate extreme volatility. Learn how to adapt your trading approach in uncertain times

Amid rising economic tension and a volatile global market, traders and investors are asking one question: How bad could this trade war get?

Recent escalations in tariff announcements have sent shockwaves across international markets. The S&P 500 has plunged by 20% from its February highs, triggering fears of a looming recession.

The recent market sell-off has been significantly influenced by escalating concerns over U.S. trade policies, particularly the proposed tariffs.

Trade war Trading Systematic Approach Steps:

-

Assess current sentiment

-

Identify key events fueling the sentiment

-

Analyze market reactions to recent events

-

Study historical precedents and understand market reaction

-

Project what to expect going forward

-

Any de-escalation could trigger a relief rally.

-

Further tariffs may lead to deeper sell-offs.

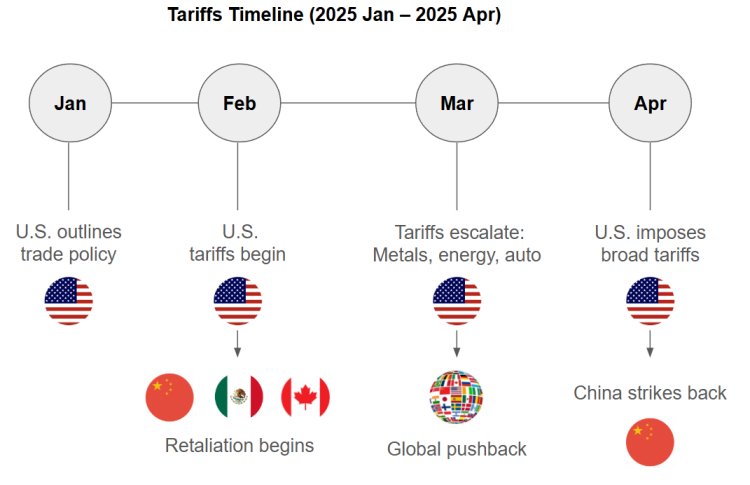

Timeline of Tariff Escalation in 2025

Recent key tariff announcements since early 2025 have created market uncertainty.

| Month | Key Events |

|---|---|

| January | U.S. outlines “America First” trade agenda. trade priorities, setting the tone for 2025. |

| February | First wave of tariffs on Canada, Mexico, and China. with retaliations from China and others. |

| March | Global retaliation against U.S. steel and auto tariffs, leading to global retaliation. |

| April | U.S. implements 10–25% tariffs; China retaliates with 34% tariffs, U.S. rolls out broad-based tariffs (10% universal, 25% on foreign autos), |

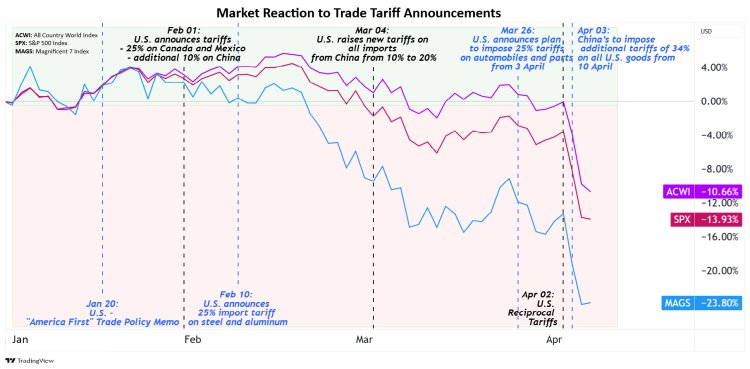

Market Reactions to Trade Tensions

Current market volatility and drawdowns indicate prevailing fear and uncertainty.

Tariff-related announcements since the beginning of 2025 have significantly impacted the markets:

-

S&P 500: ↓ 13.74%

-

Magnificent Seven Stocks: ↓ 23.4%

-

Global Markets Index: ↓ 10.49%

On April 3rd, the announcement of "reciprocal tariffs" by the U.S. triggered sharp global declines. China’s 34% retaliatory tariffs further deepened the sell-off, although markets attempted a rebound on April 8.

These figures highlight the widespread impact of trade tensions on global markets.

Trade War Precedents: Lessons from History

| Trade War | Countries | Outcome |

|---|---|---|

| Chicken War (1962) | USA vs. EEC | Long-standing agriculture conflict. tariffs on cheap U.S. poultry imports. |

| Lumber War (1982–Present) | USA vs. Canada | 40+ years unresolved. U.S.A claims of unfair subsidies on Canadian lumber. |

| Auto Tariffs (1987) | USA vs. Japan | 100% tariffs imposed. Japan's non-compliance with semiconductor trade agreements. |

| Banana War (1993–2012) | USA vs. EU & LATAM | Ended with WTO mediation. U.S., EU, and Latin America over EU favoring Caribbean/African banana producers. |

| Steel War (2002–2003) | USA vs. EU | EU threatened $2.2B retaliation. U.S. vs. European Union to protect the struggling U.S. steel industry. |

| Trump-China Trade War (2018–) | USA vs. China | Major disruption in global trade. U.S. vs. China, primarily over trade imbalance and intellectual property issues. |

Economic & Market Impacts of Trade Wars

Trade wars have several significant economic impacts:

-

Increased costs for businesses and consumers due to higher import prices.

-

Disruptions to global supply chains, slowing production and trade.

-

Reduced exports as other countries retaliate with tariffs.

-

Lower investment due to uncertainty in global markets.

- Slowed overall economic growth, despite short-term protection for some industries.

Stock Market Impact in Trade Wars:

Trade wars also significantly affect the stock market:

-

Increased volatility with sharp swings in stock prices due to tariff announcements and trade tensions.

-

Lower corporate earnings, especially in manufacturing and tech, due to higher input costs and reduced exports.

-

Investor uncertainty leading to risk-off sentiment and market pullbacks.

- Global impact, with indices like Nifty50, SSE Composite, FTSE, Nikkei, and DAX also declining.

-

Sector-specific underperformance (e.g., industrials, exporters). Sector-specific effects, where export-heavy sectors underperform, while domestic-focused firms may be less affected.

Forecast: What's Coming Next?

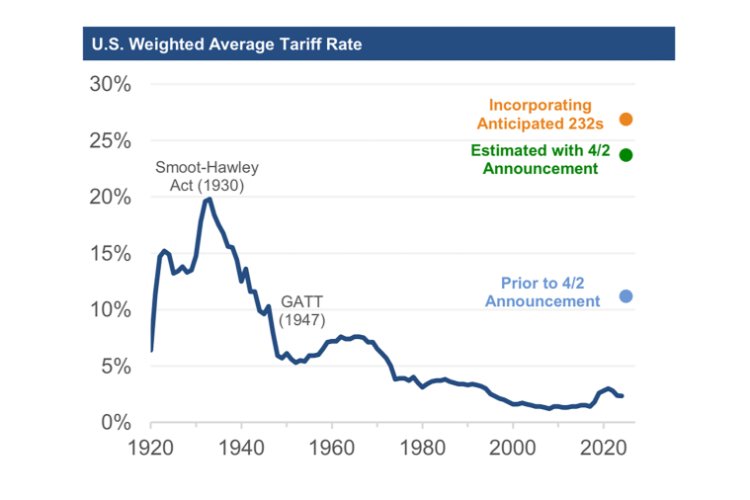

According to Evercore ISI, if additional tariffs under Section 232 are enacted (targeting semiconductors, pharma, minerals), the average U.S. tariff rate could reach 27%, the highest since the 1930s.

If tariff escalation continues, markets are likely to remain under pressure, with persistent or even increased volatility.

Potential Risks:

-

Prolonged market drawdowns

-

Collapsing global trade volumes

-

Recessionary pressures

-

Investor panic

Trading Strategy in Trade War Amid Chaos

Instead of betting on direction in a volatile market, experts recommend trading volatility. In such an uncertain market, focusing on trading volatility may be more effective than predicting price direction.

Tools & Strategies:

-

VIX Futures - Use VIX futures or options strategies (straddles, strangles).

-

Straddles & Strangles

-

Calendar Spreads

-

Options on Volatility ETFs

-

Hedge with gold, bonds, or defensive stocks

-

Assess Current Sentiment: Fear and uncertainty dominate, fueled by tariffs and geopolitical tensions.

-

Identify Key Events: Track tariff announcements and retaliations, like those in early April.

-

Analyze Market Reactions: Study recent declines (e.g., S&P 500’s 20% drop) to gauge impact.

-

Study Historical Precedents: Learn from past trade wars to anticipate outcomes.

-

Project Forward: Expect continued volatility unless trade tensions ease.

Such strategies help traders benefit from rising market uncertainty without needing to predict exact market movements.

Learn to Trade Systematically

For those looking to enhance their trading skills and prepare to trade systematically, the EPAT program offers a 6-month online course on developing algorithmic trading systems.

With volatility likely to persist, systematic, data-driven trading becomes crucial. QuantInsti’s EPAT program trains traders to:

-

Analyze markets quantitatively

-

Build algorithmic strategies

-

Backtest and automate trades

Final Thoughts

As the trade war deepens, traders must adapt quickly. Whether through historical insight or strategic volatility plays, navigating this market requires both caution and competence.

“You can’t control the storm, but you can learn to sail.” – Unknown

The market’s wild ride shows no signs of slowing. As tariffs pile up and global retaliation intensifies, volatility is the only certainty. For traders, a disciplined, data-driven approach—paired with a keen eye on historical patterns—offers the best chance to weather the storm. Whether this trade war de-escalates or spirals further, one thing is clear: adaptability will be the trader’s greatest asset in 2025.

Editor

Editor