Break Down Budget 2025-26: Key Highlights and Economic Impact

Dive into a comprehensive analysis of Budget 2025-26. Explore the key highlights, major announcements, and their potential impact on the Indian economy. Understand how the budget's proposals may affect businesses, individuals, and various sectors.

The Union Budget 2025-26, presented in February 2025, outlines a strategic roadmap for economic growth, financial inclusion, and infrastructure development. With a focus on "Viksit Bharat" (Developed India), the budget prioritizes agriculture, MSMEs, investment, exports, and social welfare while maintaining fiscal discipline.

Focus Areas for Viksit Bharat in Budget 2025-26

-

Agriculture Modernization

-

MSME Growth

-

Infrastructure Expansion

-

Export Promotion

-

Social Inclusivity

-

Green Energy Transition

Key Targets for 2025-26 Budget

-

GDP Growth: 7.5%

-

Fiscal Deficit: 4.5% of GDP

-

Exports: $500 billion

-

New Jobs: 10 million

Indian 2025-26 Budget Allocation (in ₹ lakh crore)

| Sector | Allocation |

|---|---|

| Agriculture | 2.5 |

| MSMEs | 1.2 |

| Infrastructure | 10.0 |

| Social Welfare | 4.0 |

| Green Economy | 0.75 |

-

GDP Growth Target: 7.5% for FY 2025-26.

-

Fiscal Deficit: Maintained at 4.5% of GDP, aligning with the FRBM (Fiscal Responsibility and Budget Management) Act.

-

Revenue Growth: Projected at 12% through improved tax compliance and digitization.

1. Agriculture and Rural Development

- National Mission on High-Yielding Seeds: Focus on climate-resilient seeds and improved agricultural output.

- Makhana Board in Bihar: To promote production, processing, and marketing.

- PM Dhan-Dhaanya Krishi Yojana: Targeting 100 districts to enhance agricultural growth.

- Cotton Productivity Mission: A five-year plan to improve sustainability in cotton farming.

- Enhanced Kisan Credit Card (KCC): ₹5 lakh credit for 7.7 crore farmers, fishermen, and dairy farmers.

- Aatmanirbharta in Pulses: A six-year initiative to improve production of pulses.

-

Allocation: ₹2.5 lakh crore for agriculture and rural development.

-

Key Initiatives:

-

Doubling farmers' income by 2030 through technology adoption and market linkages.

-

Expansion of PM-KISAN scheme to include landless laborers.

-

Promotion of organic farming and FPOs (Farmer Producer Organizations).

-

-

Infrastructure: Development of 10,000 new agro-processing units and cold storage facilities.

2. MSME & Industrial Growth

- Credit Cards for Micro Enterprises: ₹5 lakh limit for small businesses; 10 lakh cards to be issued in the first year.

- ₹2 Crore Loans for First-time Entrepreneurs: Benefiting 5 lakh startups, especially among women and marginalized communities.

- Focus Product Scheme for Leather & Footwear: Aiming for ₹4 lakh crore turnover and 22 lakh new jobs.

- Boost for Toy Manufacturing: Cluster development and skill-building for ‘Made in India’ toys.

- Food Processing Push: National Institute of Food Technology to be set up in Bihar.

-

Allocation: ₹1.2 lakh crore for MSME sector.

-

Key Initiatives:

-

Extension of credit guarantee schemes for small businesses.

-

Introduction of a new "Startup India 2.0" program with tax incentives.

-

Skill development programs to enhance employability.

-

-

Digital Push: 100% digitization of MSME operations by 2026.

3. Infrastructure & Urban Development

- ₹1 Lakh Crore Urban Challenge Fund: Focus on cities as economic hubs and sanitation.

- Asset Monetization Plan (₹10 Lakh Crore): Funds to be reinvested into infrastructure projects.

- 50-Year Interest-Free Loans to States: ₹1.5 lakh crore allocated for state-level development.

- Maritime Development Fund (₹25,000 Crore): Long-term financing for port and logistics sector.

-

Allocation: ₹10 lakh crore for infrastructure projects.

-

Key Projects:

-

Expansion of National Highways by 25,000 km.

-

Development of 50 new airports under the UDAN scheme.

-

Green energy corridors and smart cities.

-

-

Public-Private Partnerships (PPP): Increased focus on attracting private investment.

4. Social Welfare & Human Resource Development

- Saksham Anganwadi & Poshan 2.0: Strengthening nutrition programs.

- 50,000 Atal Tinkering Labs: To be set up in government schools.

- Broadband for Schools & Rural Health Centers: Digital inclusion initiative.

- Expansion of IITs & AI Research Center: ₹500 crore allocated for an AI-focused educational hub.

- Medical Education Expansion: 75,000 additional seats to be created over 5 years.

-

Allocation: ₹75,000 crore for green initiatives.

-

Key Initiatives:

-

Promotion of renewable energy projects (solar, wind, and hydrogen).

-

Incentives for electric vehicle adoption.

-

National afforestation program to increase green cover.

-

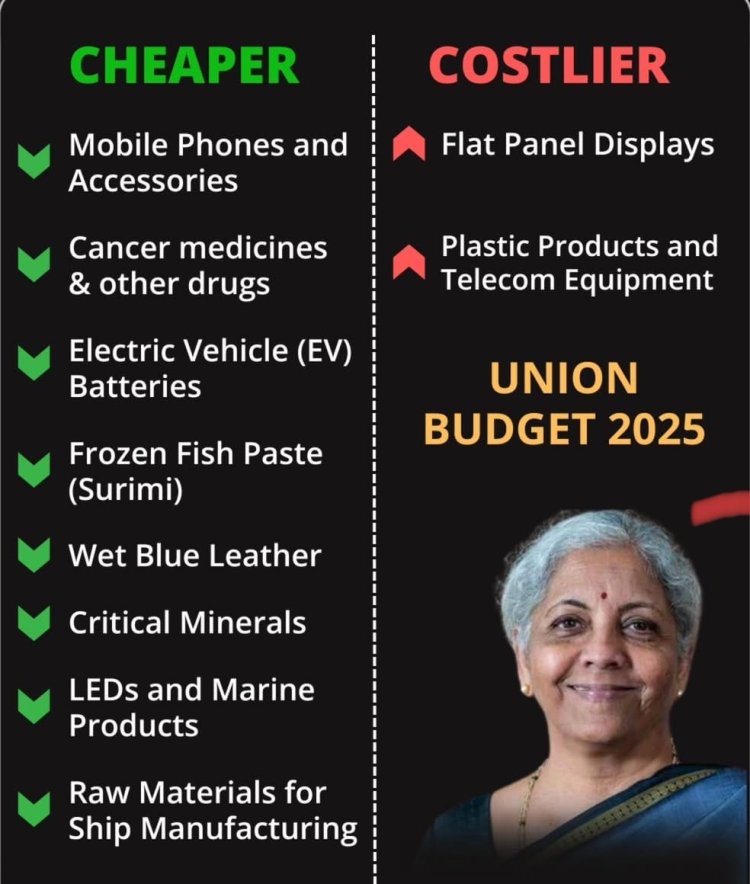

5. Tax Reforms & Financial Sector

- FDI Limit in Insurance Raised to 100%: Boosting foreign investments.

- Revamped Central KYC Registry: Streamlining financial transactions.

- Jan Vishwas Bill 2.0: Decriminalization of 100+ financial provisions.

- Direct Tax Benefits for Middle Class:

- Higher TDS Exemption for Senior Citizens: Increased from ₹50,000 to ₹1 lakh.

- No tax on income up to ₹4 lakh; revised tax brackets to encourage voluntary compliance.

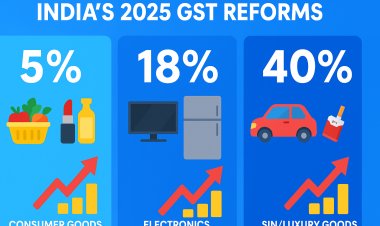

- GST & Customs Reforms: Simplification of tariffs, reduction of multiple cesses.

6. Revenue and Fiscal Health

- Projected Revenue Receipts: ₹34.2 lakh crore.

- Planned Capital Expenditure: ₹15.5 lakh crore.

- Fiscal Deficit Target: 4.4% of GDP.

- States’ Share of Tax Revenue: 22% of total revenue.

7. Green Economy and Sustainability

-

Allocation: ₹75,000 crore for green initiatives.

-

Key Initiatives:

-

Promotion of renewable energy projects (solar, wind, and hydrogen).

-

Incentives for electric vehicle adoption.

-

National afforestation program to increase green cover.

-

8. Exports and Global Trade

-

Target: $1 trillion in exports by 2030.

-

Key Initiatives:

-

Establishment of 20 new export hubs.

-

Incentives for labor-intensive sectors like textiles and handicrafts.

-

Strengthening trade ties with ASEAN and African nations.

-

This budget presents a balanced approach, focusing on economic resilience, sustainable growth, and social inclusion, ensuring India moves towards its "Viksit Bharat" vision.

The Union Budget 2025-26 lays a strong foundation for India's journey toward becoming a developed nation by 2047. By prioritizing key sectors, maintaining fiscal discipline, and promoting inclusivity, the budget aims to create a resilient and sustainable economy.

Editor

Editor