RBI to launch Unedified Lending Interface: All You Need To Know lending to ease credit for MSMEs & farmers

Discover how the RBI's new Unedified Lending Interface aims to simplify credit access for MSMEs and farmers, enhancing financial inclusion and economic growth. Learn more about this innovative initiative.

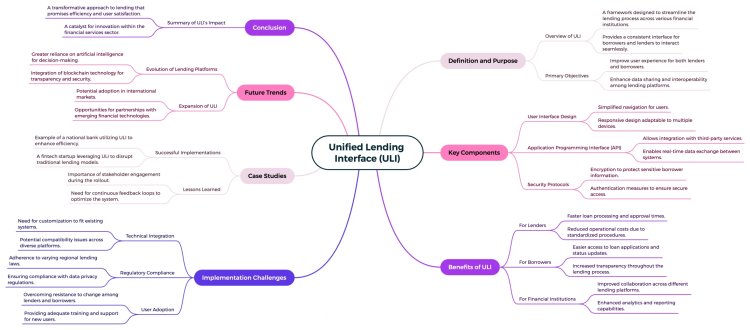

The Reserve Bank of India (RBI) is poised to launch a Unified Lending Interface (ULI), a groundbreaking initiative aimed at simplifying and accelerating the credit disbursement process for Micro, Small, and Medium Enterprises (MSMEs) and farmers. This digital platform, expected to go live in the near future, promises to revolutionize access to finance, empowering these vital sectors of the Indian economy.

The ULI will act as a single window for borrowers to access loan products from multiple lenders, eliminating the need for navigating individual applications and processes. This streamlined approach is expected to significantly reduce the time and effort required to obtain credit, thereby promoting financial inclusion and fostering faster economic growth.

The RBI has identified the complexities and challenges faced by MSMEs and farmers in accessing credit as a primary impediment to their growth. The ULI aims to address these issues by:

Simplifying the Application Process: ULI will standardize application procedures, reducing paperwork and streamlining data sharing between borrowers and lenders.

Promoting Competition: By providing a platform for diverse lenders to showcase their offerings, ULI will foster healthy competition, leading to more competitive interest rates and loan terms.

Expanding Credit Access: ULI will connect underserved segments of MSMEs and farmers with lenders, expanding the reach of financial services to previously excluded populations.

The ULI is expected to have a profound impact on the Indian economy, facilitating growth and innovation in the MSME and agricultural sectors. The RBI's commitment to this initiative underscores its dedication to building a more inclusive and resilient financial system for all.

What is Unified Lending Interface and how will it benefit borrowers

With rapid advances in digitization, India is embracing the concept of Digital Public Infrastructure to encourage banks, NBFCs, fintech companies and startups to develop and offer innovative solutions for payments, lending and other financial activities. For digital lending, data required for credit scoring is available to various actors like central and state governments, account aggregators, banks, credit reference agencies and digital ID authorities.

But these records reside in separate systems, hindering smooth and timely disbursement of rule-based loans. The RBI Governor said the ULI platform will enable seamless and consent-based flow of digital information including land records of various states from multiple data service providers to lenders.

This will reduce loan appraisal time, especially for small and rural borrowers. He said the ULI architecture has common standardized APIs (Application Programming Interfaces) designed for a "plug-and-play" approach that ensures digital access to information from various sources.

The platform reduces the complexity of multiple technology integrations, allowing borrowers to benefit from seamless loan disbursement and faster processing times without the need for extensive documentation.

"In summary, ULI is expected to address the large unmet lending demand for borrowers across sectors, especially agriculture and MSMEs, by digitizing access to financial and non-financial data of customers that were kept in different silos," Das emphasized. "The 'new trinity' of JAM-UPI-ULI will be a revolutionary step in India's digital infrastructure journey," he said. JAM Trinity (Jan Dhan, Aadhar, Mobile) is the tool used by the government to transfer cash benefits directly to recipients' bank accounts.

Benefits of ULI

Shaktikanta Das said ULI caters to a large unmet lending demand for borrowers across sectors, particularly agriculture and small and medium enterprises (SMEs).

According to news agency ANI, Das said, "Just as UPI has transformed the payments ecosystem, we expect ULI to play a similar role in transforming credit in India."

Frictionless lending: ULI aims to provide a smoother lending experience, especially for small and rural borrowers, by minimizing administrative procedures.

Reduced assessment time: ULI minimizes the time spent on credit assessment by consolidating data from multiple sources.

Centralized data access: The platform consolidates financial and non-financial data from multiple sources and makes it easily accessible for lenders.

Focus on Agriculture and MSME: ULI aims to meet the large unmet lending needs in sectors such as agriculture and Micro, Small and Medium Enterprises (MSMEs).

He added that the "new trinity" of JAM-UPI-ULI will be a revolutionary step in India's digital infrastructure journey.

How will Unified Lending Interface Will Work ?

ULI will have common standardized APIs designed for a "plug-and-play" approach that will ensure digital access to information from various sources, Shaktikanta Das explained. This will reduce the complexity of multiple technology integrations and allow lenders to access financial and non-financial data from various sources.

ULI aims to optimize the flow of information required by lenders to process loans. The aim is to enable seamless exchange of digital information covering financial parameters and including additional details such as land registry entries from various data providers. This comprehensive approach is expected to significantly reduce the time required for loan screening, which will especially benefit rural and small borrowers.

ULI is equipped with a plug-and-play architecture that allows quick access to information from various sources. It has standardized application programming interfaces (APIs) to ensure smooth data integration and retrieval from multiple channels. The ULI platform integrates data from various sources such as Aadhaar e-KYC, state government land records, PAN verification, account aggregators, etc.

Das noted that the Unified Payment Interface (UPI) was launched by the National Payments Corporation of India (NPCI) in April 2016. Similarly, the central bank had started piloting a technology platform for frictionless lending (now called ULI) last year. In the testing phase that began in August 2023, the platform focused on products such as Kisan Credit Card Loans, Milk Loans, SME Loans, Personal Loans and Housing Loans.

It will also link with services such as milk pouring data from dairy cooperatives and home and property search data. Post a Comment The RBI Governor said that the government is consistently working to ensure the safety of the country's financial system by formulating policies to make it stronger, more flexible and customer-centric.

Editor

Editor