10 years of Jan Dhan scheme: Impact on Indian Economy in Its First Decade

Explore the transformative impact of the Pradhan Mantri Jan Dhan Yojana on the Indian economy over its first decade. Learn about financial inclusion, economic growth, and key milestones achieved.

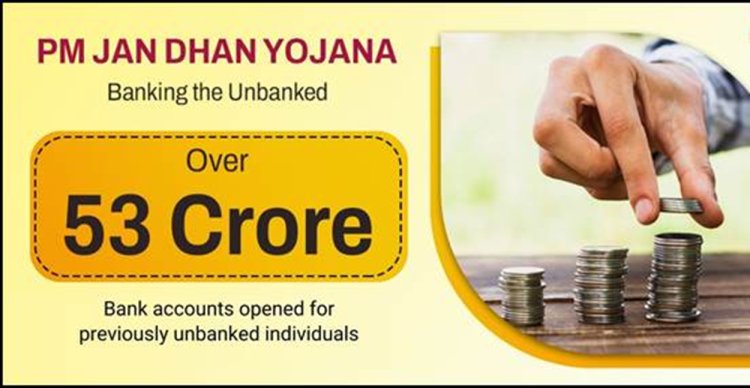

10 years of Jan Dhan program: 53 million accounts, 230,000 crore deposits Of India's over 173 million CASA accounts, 53 million are active Pradhan Mantri Jan Dhan Yojana accounts. The program aims to open over 3 million more accounts this fiscal.

10 Years of Jan Dhan Yojana: Pradhan Mantri Jan Dhan Yojana (PMJDY) today completed 10 years of "successful implementation".

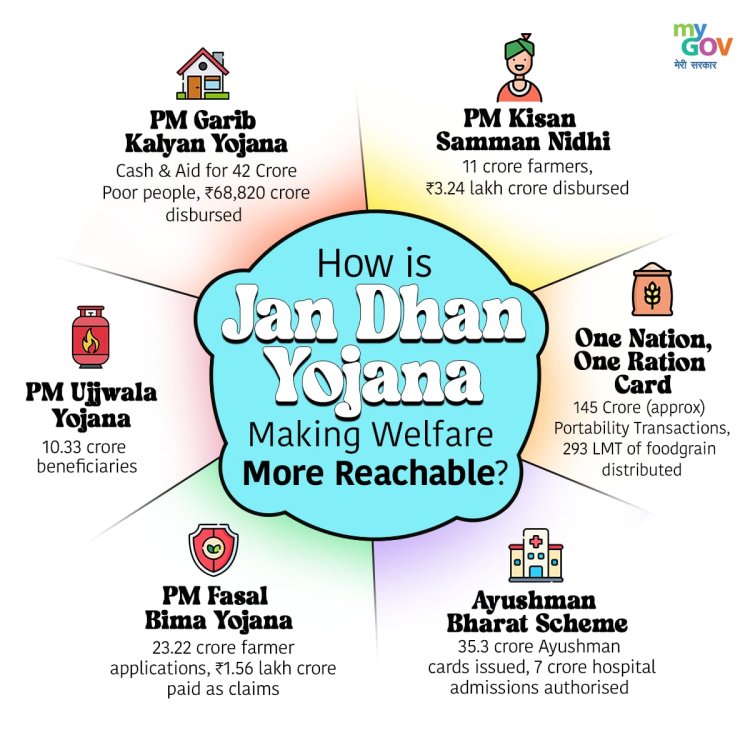

Touted to be the world's largest financial inclusion initiative, the programme was created with an aim to bring marginalised and economically disadvantaged sections of society into the banking sector.

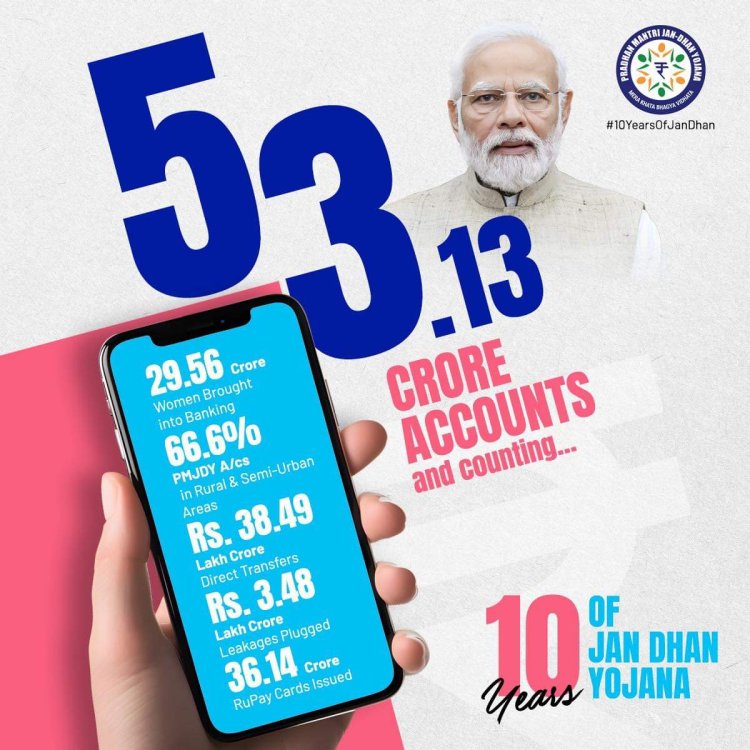

As of August 14, 2024, the total number of PMJDY accounts is 5,313 crore. Of this, 55.6% (2,956 crore) of Jan Dhan account holders are women and 66.6% (3,537 crore) of Jan Dhan account holders live in rural and semi-urban areas.

Deposits in PMJDY Accounts:

The total deposit balance in PMJDY accounts stands at Rs 2,312.36 crore as of August 14. Deposits have increased 15 times and number of accounts 3.6 times.

Average deposit per PMJDY account:

As of August 14, the average deposit per PMJDY account is Rs 4,352. The average deposit amount is increasing, indicating increased account utilization and formation of savings habit among account holders.

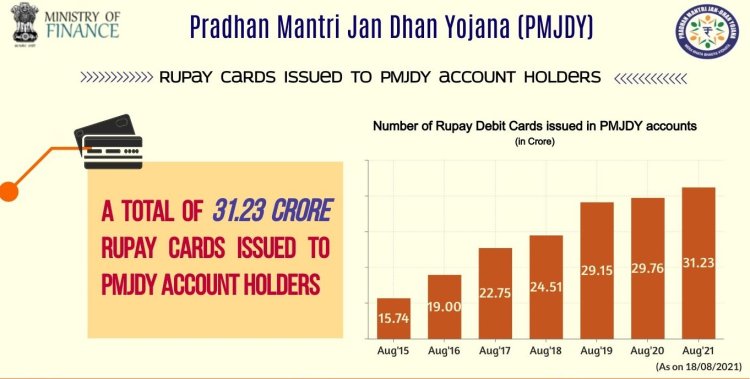

RuPay cards issued to PMJDY account holders

Around 3,614 crore RuPay cards have been issued to PMJDY account holders. The number of RuPay cards and their usage has also increased over time. With issuance of over 360.6 crore RuPay debit cards under PMJDY, installation of 89.67 million PoS/mPoS devices and launch of mobile payment systems such as UPI, the total number of digital transactions has increased to Rs 233.8 crore in FY 2018-19 and FY 2023-24.

The total number of UPI financial transactions has increased from 535 million in FY 2018-19 to 13,113 million in FY 2023-24. Similarly, the total number of RuPay card transactions in PoS and e-commerce has increased from 67 million in FY 2017-18 to 967.8 billion in FY 2023-24. The success of PMJDY highlights the importance of its mission-driven approach, regulatory support, public-private partnerships and digital public infrastructure such as Aadhaar for biometric authentication. Today, to mark the 10th anniversary of the Financial Inclusion Programme, Prime Minister Narendra Modi released a post highlighting the success of the programme with some staggering figures.

These figures are: 5,313 crore PMJDY accounts have been opened; 29.56 crore beneficiaries are women with 38 crore direct benefits transferred; 3,537 crore 1M DHAN accounts empowering rural and semi-urban livelihoods; Average deposit size has increased more than four-fold from Rs 1,065 in March 2015 to Rs 4,397 per account in June 2024; and 3,614 crore RuPay debit cards have been issued.

Women are among the most visible beneficiaries of the Pradhan Mantri Jan Dhan Yojana (PMJDY), launched by Prime Minister Narendra Modi in 2014.

Of the total 5.313 billion bank accounts under PMJDY, 55.6% are held by women, said M. Nagaraju, Secretary, Department of Financial Services, Ministry of Finance, in conversation with Shraddha Sharma, Founder and Managing Director, YourStory. "This is an incredible and unimaginable empowerment for women who live in rural areas and are very poor," she said.

Over the past decade, PMJDY has contributed to the penetration of banking across the country. The program was launched to ensure that every household in India has access to banking services and further expand the level of financial literacy and social security coverage. Nagaraju noted that the program has empowered rural women in the country to take control of their own economic situations and become independent from their husbands, families and sons. "This kind of freedom of choice, freedom of economic activity has really opened so many doors for rural women. Giving women the reins of economic freedom has a 'contagious effect'," he explained. Those who go to school and then join colleges will also open their own bank accounts.

Currently, there are over 173 million active CASA (current savings account) accounts in the country, including over 53 million active PMJDY accounts. As of August 14, 2024, accounts with deposit balances of Rs 5,313 crore have been opened.

The target is to open over 30 million PMJDY accounts during this fiscal year. Adults and youth who are yet to have bank accounts will be targeted. Moreover, under various schemes, the government can directly transfer funds to the bank accounts of the beneficiaries without any leakage, thus improving access to the schemes, the minister added.

Uttar Pradesh, Bihar, West Bengal and Madhya Pradesh are the largest beneficiaries of the PMJDY scheme.

According to various studies, PMJDY has not only enabled account ownership and access to financial services but also financial inclusion of various segments of the population. While the program has made great strides towards true financial inclusion, it is clear that improving policy communication, broadening and deepening progress in low-income states, and addressing the deficiencies of the banking agent model will be crucial as the challenge becomes more difficult.

On 28 August 2017, on the eve of the third anniversary of the program, Prime Minister Narendra Modi said that at least 300 million households have newly acquired Jan Dhan accounts and that close to 650 billion (US$7.8 billion) has been deposited.

The program has been criticized by the opposition for putting unnecessary strain on public banks. Critics argue that offers such as zero balance, free insurance, and overdraft facilities lead to duplication of work.

Many who already had bank accounts may have opened accounts in their own names, attracted by the insurance coverage and overdraft facilities. Under this program, few people could obtain life insurance worth 30,000 (US$360) with a validity period of just five years.

Overdraft claims were left entirely to the banks. According to a government notification, only those whose transaction history shows satisfactory transactions in their accounts for some time can receive overdraft facilities. In March 2018, the Indian government announced that around 20% of Jan Dhan accounts were inactive.

Editor

Editor