54th GST Council Meeting Decisions - Key Recommendations

Discover the key recommendations from the 54th GST Council Meeting held on September 9, 2024. Learn about the proposed GST rate rationalization, compliance measures, and trade facilitation initiatives aimed at improving the GST framework

54th GST Council Meeting Decisions - Key Recommendations

The 54th GST Council Meeting, held on September 9, 2024, brought forth several pivotal recommendations aimed at enhancing the Goods and Services Tax (GST) framework in India. Key highlights include proposed GST rate rationalization, new compliance measures, and initiatives to facilitate trade. These decisions are expected to streamline tax processes, boost economic efficiency, and foster a more business-friendly environment.

Implementation Mechansim for 16(5) & 16(6)

Special procedure to be notified to provide clarifications to taxpayers to avail the benefits of Section 16(5) availing ITC post cut off date and Section 16(6) for availing input tax credit for the period between the cancellation of GST registration and revocation of cancellation.

It will include where noitices are served u/s 73 & 74 and where adverse orders are served u/s 73, 74, 107 & 108.

Procedure for newly notified Section 128A - Wavier of interst & penalty

Special procedures for waiver of penalties and interest for FYs 2017-18, 2018-19, and 2019-20

- Likely to be notified from 1st Nov 2024

- New Rule - 168 to be inserted in CGST Rules

- The effective date for availing the benifit is likely to be 31st March 2025

- Forms and procedure to be provided

- Circular to be issued

Clarification on eligibility of Refund in case where IGST is paid subsequently on imports

When inputs are imported without paying integrated tax and compensation cess by utilizing benefits under Notification No. 78/2017-Customs or Notification No. 79/2017-Customs.

If IGST and compensation cess on these imported inputs are later paid, with applicable interest, and the Bill of Entry is reassessed by customs authorities, then The IGST paid on exports refunded to the exporter will not violate sub-rule (10) of rule 96 of CGST Rules.

Clarification on eligibility of Refund in case where IGST is paid subsequently on imports

Additionally, the Council noted challenges faced by exporters due to:

- Restrictions on refunds for exports as per rule 96(10), rule 89(4A), and rule 89(4B) of CGST Rules, 2017.

To address these challenges, the Council recommended:

- The prospective omission of rule 96(10),rule 89(4A), and rule 89(4B) from the CGST Rules, 2017.

- This change aims to simplify and expedite the refund process for such exports.

Applicability of RCM - Commerical Rent

Commercial space provided by unregistered person to a registered person

The Recipient, Registered under GST has to pay GST under Reverse Charge Mechanism.

Introduction of RCM for commercial property rentals from unregistered to registered persons.

GST Services - Ancillary/Intermediate Services

Services provided by GTA while transporting goods like loading/unloading, packing/unpacking, transshipment, temporary warehousing etc. will be treated as composite supply.

The Recipeint has to pay for the above services under RCM similar to GTA if the are provided as part of GTA services, if not they will not be falling under RCM

Applicability of RCM - Scrap Sale

The buyer, registered under GST has to pay under Reverse Charge Mechansim if the seller who is selling scrap is unregistered under GST.

GST TDS at a rate of 2% will be applicable to the supply of scrap in B2B transactions.

Introduction of Reverse Charge Mechanism (RCM) for metal scrap transactions from unregistered suppliers

GST - Preferential Location Charges

Preferential Location charges will be taxes as composite supply as they are part of the cost of resiedential/ commerical/ industrail complex as they are naturally bundled. The tax rate will be ase as that of the main supply.

Applicability of GST - Affiliation Services

Affiliation services provided by educational boards such as CBSE are taxable.

Affiliation services offered by State/Central educational boards, educational councils, and similar bodies to Government Schools will be exempted prospectively.

- Issues arising from the past period (01.07.2017 to 17.06.2021) will be regularized on an "as is where is" basis.

- GST at a rate of 18% is applicable to these affiliation services provided by universities.

Applicability of GST - Affilation Services

A circular will clarify that:

- Affiliation services provided by universities to their constituent colleges are not included in the exemptions offered to educational institutions under notification No. 12/2017-CT(R) dated 28.06.2017.

GST - Supply of Research & Developlment Services

Supply of research and development services by a Government Entity or a research association, university, college, or other institution notified under clauses (ii) or (iii) of sub-section (1) of section 35 of the Income Tax Act, 1961, utilizing Government or private grants.

Past demands related to this exemption will be regularized on an "as is where is" basis.

Import of Services - Foreign Airlines - Exempted Supply

Import of services by an establishment of a foreign airline company from a related person or any of its establishments outside India when provided without consideration will be treated as exempted supply.

Past periods related to this exemption will be regularized on an "as is where is" basis.

e-invoice - B2C Supplies

e-invoice to be implemented for B2C suipplies

Will be implemted on voluntary basis for selected sectors and states.

Customers can verify the same in GST Returns filed by the supplier on the GST Portal.

Introduction of new RCM, ITC Reclaim ledgers, and Invoice Management System for taxpayers

Clarifications - to be provided

- Clarification on the Place of Supply of advertising services provided by Indian advertising companies to foreign entities.

- Clarification regarding the availability of Input Tax Credit on demo vehicles for dealers of vehicle manufacturers.

- Clarification on the Place of Supply of data hosting services provided by service providers in India to cloud computing service providers located outside India.

GST - Life & Health Insurance

Referred to Group of Ministers (GOM)

Report to be submitted by end of October 2024

GST - Flying Training Services

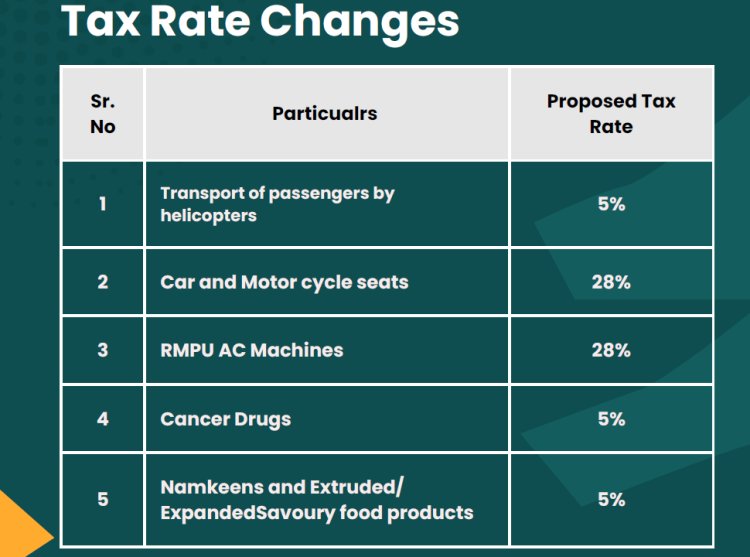

Flying training courses will be exempt from GST if they are approved by DGCA-recognized Flying Training Organizations (FTOs).

Exemption for DGCA-approved flying training courses from GST

54th GST Council Meeting Key Recommendations

- Inform the team about the recommended changes and assess their potential impact on business operations and software systems.

- Stay updated and implement any adjustments as relevant notifications or circulars are issued over time.

- Revise and update the contracts accordingly to reflect these changes.

The 54th GST Council meeting's recommendations showcase a thoughtful strategy to streamline tax compliance, offer relief to specific sectors, and address ambiguities in the GST law. By prioritizing rate rationalization, reducing the tax burden on essential sectors like healthcare and education, and enhancing compliance mechanisms, the Council aims to make the GST system more efficient and user-friendly.

Looking ahead, further reforms from the Group of Ministers (GoM) on life and health insurance, along with ongoing efforts to simplify business processes, promise a more effective and equitable GST framework for taxpayers in the coming months.

Editor

Editor