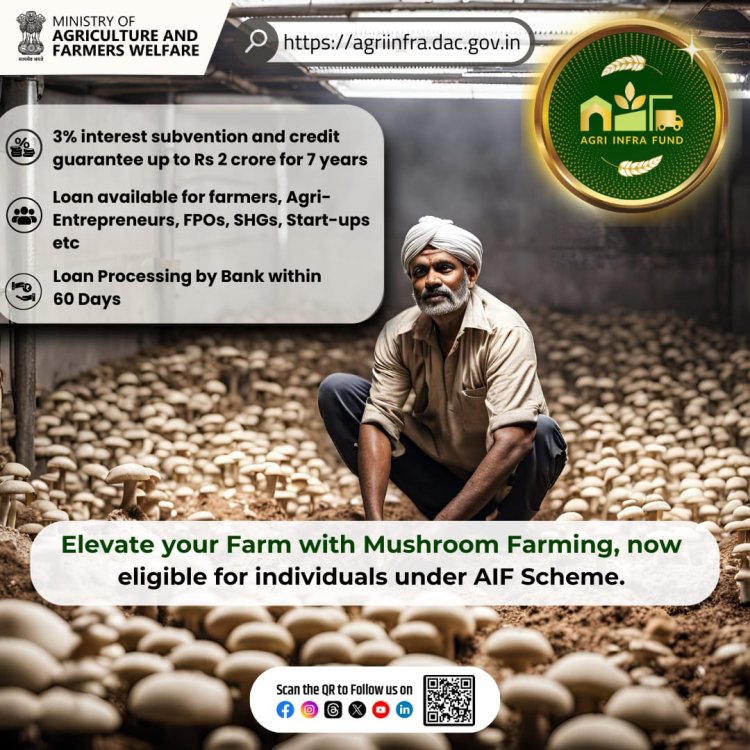

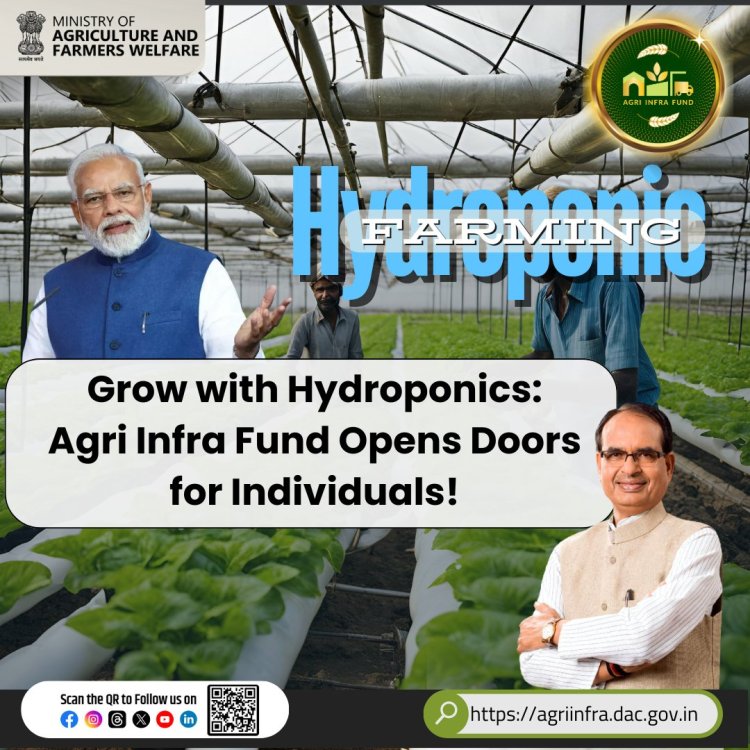

Agriculture Infrastructure Fund : Cabinet approval for progressive expansion of Central Sector Scheme

The Union Cabinet, chaired by Prime Minister Narendra Modi, has approved the progressive expansion of the Agriculture Infrastructure Fund under the Central Sector Scheme. This initiative aims to make the scheme more attractive, impactful, and inclusive, boosting agricultural growth and sustainability

Infrastructure has a critical role in the growth of agriculture and in elevating the production dynamics. Infrastructure development is the only way to ensure that produce is used to its full potential, providing farmers with a fair deal and opportunities for value addition, particularly during the post-harvest period.

The creation of this infrastructure must also take into account the whims of the natural world, regional differences, the advancement of human resources, and the realisation of our finite land resource's full potential.

A ₹1 lakh crore Agri Infrastructure Fund was launched by the Honourable Finance Minister on May 15, 2020, for farmers to use for farm-gate infrastructure in light of the aforementioned. A ₹1,00,000 crore financing facility will be made available to finance farm-gate and aggregation point financing for agriculture infrastructure projects. Farmers Producer Organisations, Primary Agricultural Cooperative Societies, and Agriculture.

Therefore, DA&FW formulated a Central Sector Scheme to mobilize medium to long term debt financing facilities through incentives and financial support for investments in viable projects related to post-harvest management infrastructure and community agricultural assets.

Subsequently, in the Budget announcement dated February 1, 2021, it was decided to extend the benefits of this scheme to APMCs as well. Therefore, with Cabinet approval, changes were made in the scheme to make it more inclusive.

Objectives of the Scheme

Mobilize medium and long-term debt financing facilities for viable post-harvest infrastructure projects and investments in agricultural commons through incentives and financial assistance to improve agricultural infrastructure in the country. This financing facility will achieve multiple objectives for all stakeholders in the agricultural ecosystem.

Farmers (including FPOs, PACS, Marketing Cooperative Societies, Multipurpose cooperative societies, State Agencies, Agricultural Produce Market Committees (Mandis), National & State Federations of Cooperatives, Federations of FPOs and Federations of Self Help Groups (SHGs) etc.).

- Improved marketing infrastructure to allow farmers to sell directly to a larger base of consumers and hence, increase value realization for the farmers. This will improve the overall income of farmers.

- With investments in logistics infrastructure, farmers will be able to sell in the market with reduced post-harvest losses and a smaller number of intermediaries. This further will make farmers independent through improved access to market.

- With modern packaging and cold storage system access, farmers will be able to further decide when to sell in the market and improve realization.

- Community farming assets for improved productivity and optimization of inputs will result in substantial savings to farmers.

Government Objective

1.Government will be able to direct priority sector lending in the currently unviable projects by supporting through interest subvention, incentive through convergence and credit guarantee. This will initiate the cycle of innovation and private sector investment in agriculture.

2. Due to improvements in post-harvest infrastructure, government will further be able to reduce national food wastage percentage thereby enable agriculture sector to become competitive with current global levels.

3. Central/State Government Agencies or local bodies will be able to structure viable projects on their own or PPP projects for attracting investment in agriculture infrastructure.

Benefits For Agri-entrepreneurs and startups

- With a dedicated source of funding, entrepreneurs will push for innovation in agriculture sector by leveraging new age technologies including IoT, AI, etc.

- It will also connect the players in ecosystem and hence, improve avenues for collaboration between entrepreneurs and farmers.

Role Of Banking ecosystem

- With Credit Guarantee, convergence and interest subvention lending institutions will be able to lend with a lower risk. This scheme will help to enlarge their customer base and diversification of portfolio.

- Refinance facility will enable larger role for cooperative banks and RRBs.

Benefits For Consumers

With reduced inefficiencies in post-harvest ecosystem, key benefit for consumers will be a larger share of produce reaching the market and hence, better quality and prices. Overall, the investment via the financing facility in agriculture infrastructure will benefit all the stakeholders in the eco-system.

Implementation Period of Scheme Agriculture Infrastructure Fund

The programme will be implemented from 2020-21 to 2032-33. Disbursements under the programme will be completed within six years. h. By the end of financial year 2025-26. As on December 31, 2022, 14,118 crore has been approved of which 9,117 crore has been disbursed under the scheme. The remaining 98,300 crore of the 1 lakh crore will be disbursed during the remaining period from 2022-23 to 2025-26. The repayment period covered under the loan scheme is up to seven years with a grace period of up to two years.

Eligible Projects For Agriculture Infrastructure Fund

The scheme will facilitate setting up and modernization of key elements of the value chain including.

Following projects are eligible for all beneficiaries including private entities as well as groups such as FPOs, PACS, SHGs, JLGs, Cooperatives, National and State Level Federation of Co-operatives, FPOs federations, Federations of SHGs, National and State Level Agencies.

A. Post-Harvest Management Projects

- Supply chain services including e-marketing platforms

- Warehouse & Silos

- Cold Stores and Cold Chain

- Packaging Units

- Assaying Units

- Sorting and grading units

- Logistic Facilities- Reefer Van & Insulated vehicles

- Ripening Chambers

- Farm residue/waste management infrastructures

- Primary Processing activities

B. Community Farming Assets

- Organic inputs production – Vermicomposting etc.

- Compressed Biogas ( CBG) Plant

- Bio stimulant production units

- Infrastructure for smart and precision agriculture

- Purchase of drones, putting up specialized sensors on field, Blockchain and AI in agriculture etc.

- Remote sensing and Internet of Things (IOT) such as automatic weather station, Farm advisory services through GIS applications.

- Nursery

- Tissue culture

- Seed Processing

- Custom Hiring Center –farm machinery/ implements ( minimum 4 in quantity)

- Farm/Harvest Automation (combine harvestor , sugarcane harvestor, boom sprayers etc. )

- Standalone solar pumping system (PM-KUSUM component B)

- Solarization of grid connected agri-pump under (PM-KUSUM component C)

- Integrated Spirulina production & processing units

- Sericulture processing unit

- Honey processing

- Plant quarantine units

- Projects identified for providing supply chain infrastructure for clusters of crops

including export clusters.

- Projects promoted by Central/State/Local Governments or their agencies under PPP

for building community farming assets or post-harvest management projects.

Following projects are eligible for only groups such as FPOs, PACS, SHGs, JLGs, Cooperatives, National and State Level Federation of Co-operatives, FPOs federations, Federations of SHGs, National and State Level Agencies as they qualify as community farming assets:

- Hydroponic Farming

- Mushroom farming

- Vertical farming

- Aeroponic farming

- Poly house/ Greenhouse

- Logistics facilities (including non-refrigerated/insulated vehicles)

- Tractors

Size of the financing facility and eligible beneficiaries:

10,000 crore will be provided as loans by banks and financial institutions to Primary Agricultural Credit Societies (PACS), Marketing Cooperative Societies, Farmer Producer Organizations (FPOs), Self-Help Groups (SHGs), Farmers, Joint Liability Groups (JLGs) and Multipurpose Societies.

Cooperative Societies, Agricultural Entrepreneurs, Start-ups, Central/State or Local Government sponsored Public-Private Partnership projects, State Authorities, Agricultural Produce Market Committees (Mandis), National and State Cooperative Societies, Associations of FPOs (Farmer Producer Organizations) and Associations of Self-Help Groups (SHGs) of Agricultural Producer Organizations will also be forgiven. APMCs running regulated markets for allied sectors including agriculture and fisheries will also be covered.

Preference will be given to PACS under this program which rely on digitalisation to process their operations.

Number of Projects per entity eligible under the scheme

Under this scheme, interest subsidy is allowed on loans up to Rs 20 crore per location. Multiple projects in one location are also permitted with a total limit of Rs 20 crore. If an eligible entity sets up projects at different locations, all such projects will be eligible for loans up to Rs 20 crore under this scheme.

However, in case of private entities like farmers, agribusinesses, start-ups etc, there is a limit of maximum 25 such projects. This limit of 25 projects does not apply to government entities, cooperatives, national and state cooperatives, FPOs, FPO associations, SHGs and SHG associations. A location is the physical boundary of a village or city with a unique LGD (Local Government Directory) code. Each of these projects should be located in a place with its own LGD (Local Government Directory) code.

APMCs can get approval for multiple projects of different types of infrastructure in their designated market area. In such cases, interest subsidy on loans up to Rs 20 crore will be provided per project of different kinds of infrastructure (cold storage, sorting, classification and inspection units, silos etc.) in the designated market area by the APMC.

Documents Required

1) Bank’s loan application form / Customer Request Letter for AIF Loan duly filled and signed

2) Passport size photographs of the promoter/partners/director

3) Identity proof – Voter ID card/PAN card/Aadhaar card/Driving license

4) Address Proof :

• Residence: Voter ID card/Passport/Aadhaar card/Driving license/Electricity Bill/Latest property Tax Bill

• Business Office/Registered Office: Electricity Bill/Latest Property Tax Receipt/Certificate of Incorporation in case of Companies/Certificate of Registration in ca of partnership Firms

5) Proof of Registration:

• In case of Company : Article of Association

• In case of Partnership : Certificate of Registration of Firm with Registrar of Firm

• In case of MSMEs : Certificate of Registration with District Industries Centre (DIC)/Udyog Aadhar Copy

6) Income Tax Return for last three years, If available.

7) Audited Balance Sheet of last 3 Years, If available.

8) GST Certificate, if applicable.

9) Land ownership records – title deed/lease deed. If applicable, then Permission to mortgage the Immovable Property from the Lessor in case the Property is Leasehold (for primary security)

10) ROC Search Report of the Company

11) KYC documents of the promoter/firm/company

12) Copy of Bank Statement for last one year (If available)

13) Repayment track record of existing loans (Loan Statement)

14) Net Worth Statements of promoter

15) Detailed Project Report

16) As applicable - Local authority permissions, Layout plans/estimates, Building sanction

Editor

Editor