PM Vidyalaxmi Scheme: 22 Lakh Students to Benefit from Collateral-Free Loans - Complete Details

Discover how the PM Vidyalaxmi Scheme is set to transform education by offering collateral-free and guarantor-free loans to over 22 lakh students. Get complete details on eligibility, application process, and benefits.

PM Vidyalaxmi Scheme: Collateral-Free Loans for Over 22 Lakh Students to Unlock Higher Education in India

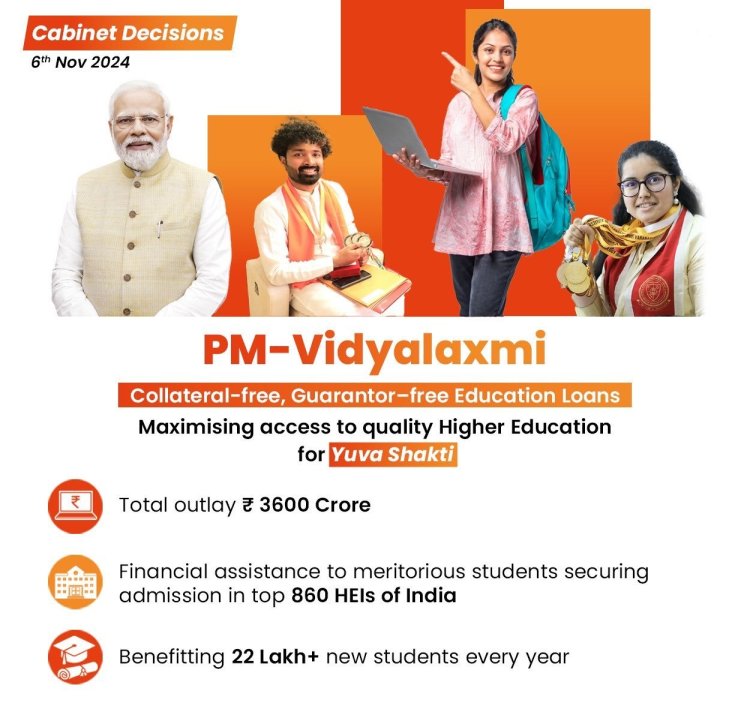

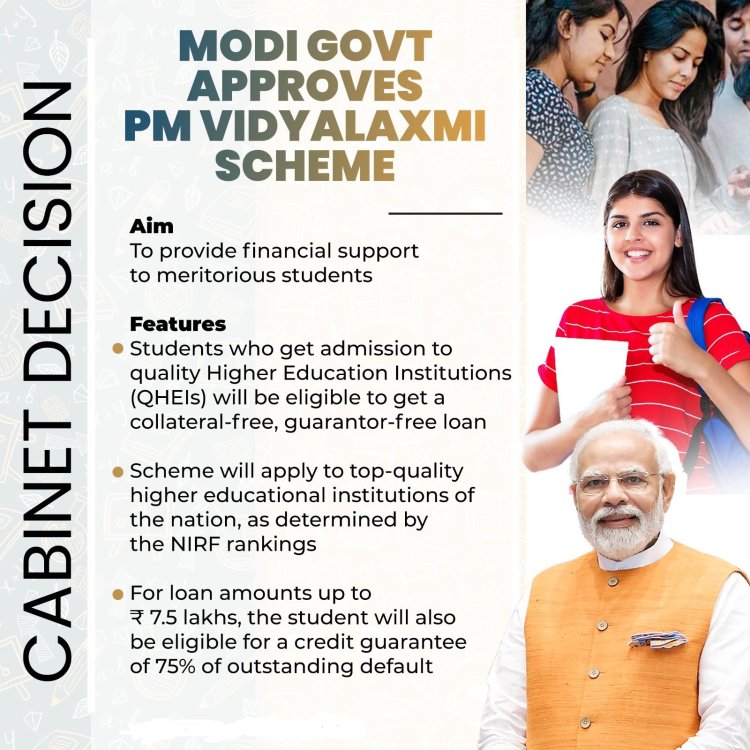

The PM Vidyalaxmi Scheme marks a transformative step in India’s higher education landscape, promising collateral- and guarantor-free loans for students seeking to enroll in quality institutes. Announced as part of a comprehensive educational reform, this scheme aims to extend financial support to over 22 lakh students, ensuring that financial constraints do not become an obstacle to higher education. Through a dedicated government portal, students admitted to quality institutions can secure loans directly from banks and financial institutions without the need for collateral or a guarantor.

This initiative addresses a critical challenge in India: the financial burden on students pursuing higher education. By offering a collateral-free, guarantor-free loan structure, the scheme seeks to empower students, particularly from economically weaker backgrounds, allowing them to focus on their studies without the added pressure of financial obstacles.

Overview of the PM Vidyalaxmi Scheme

The PM Vidyalaxmi Scheme, administered by the Government of India, is set to serve as a flagship initiative under the broader objective of inclusive education. Targeting 22 lakh students, the scheme will operate through a centralized PM-Vidyalaxmi portal, where students can apply online. A key eligibility criterion for students is admission to an institute listed in the National Institutional Ranking Framework (NIRF) or another Qualified Higher Educational Institution (QHEI), ensuring that the support reaches students in high-standard programs. This portal will streamline the application process, facilitating direct access to loans without intermediaries or additional bureaucratic hurdles.

Key Features of the PM Vidyalaxmi Scheme

The PM Vidyalaxmi Scheme offers a maximum loan amount of ₹10 lakh, covering a range of education-related expenses, from tuition fees to essential educational materials. The scheme places an emphasis on merit-based assistance, with preference for students admitted to top-ranked institutions.

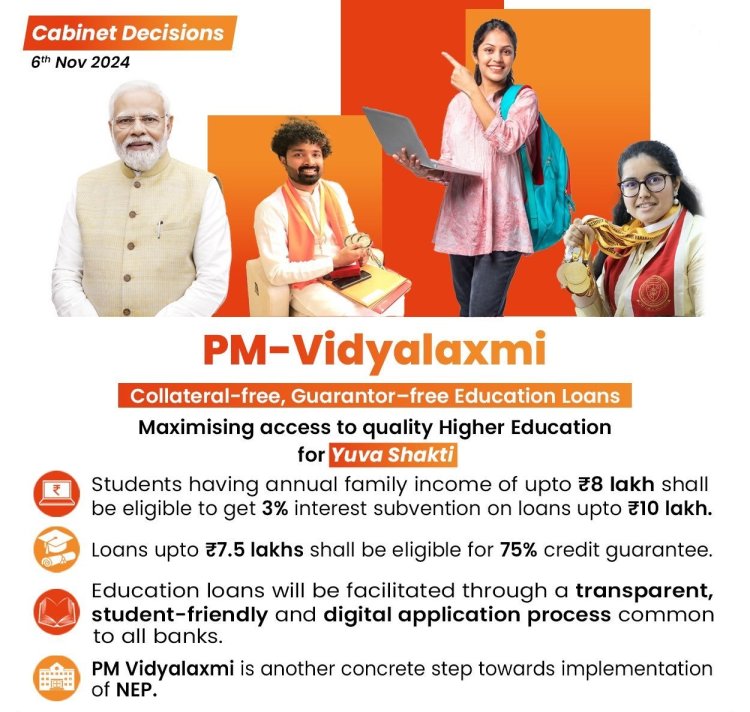

Eligibility criteria are designed to ensure that support reaches students from families with limited financial resources. For instance, students whose annual family income does not exceed ₹8 lakh are eligible for an interest subvention during the moratorium period. This targeted approach ensures that the scheme is accessible to students who might otherwise struggle to finance their education.

Interest Subvention Details and Credit Guarantee Mechanism

The scheme’s financial structure includes a 3% interest subvention on loans for eligible students during the moratorium period. This means students will not face interest costs on their loans until they complete their studies, alleviating financial pressure during the critical phase of their education. Additionally, the scheme’s credit guarantee mechanism, covering loans up to ₹7.5 lakh, reduces the risk burden for banks and financial institutions, encouraging them to participate actively in the scheme.

Through this credit guarantee, banks are more willing to offer loans to students without collateral, fostering a supportive lending environment for education. These benefits collectively enhance accessibility and affordability for students from various economic backgrounds.

Application Process via Vidyalaxmi Portal

The Vidyalaxmi portal simplifies the loan application process, allowing students to apply from anywhere in the country. To apply, students must first register on the portal, providing essential personal and academic information. They then complete an online application form, uploading necessary documentation, such as proof of admission, income certificate, and academic records. This digitalized system aims to

provide a seamless experience, minimizing processing times and ensuring quick loan disbursement to eligible students.

Support Structure for PM Vidyalaxmi Scheme Applicants

The PM Vidyalaxmi Scheme aligns with existing educational support frameworks, such as the Central Sector Interest Subsidy Scheme (CSIS). Together, these schemes provide additional layers of support, especially for students pursuing professional and technical courses. By offering interest subsidies and other benefits, the support structure underlines the government’s commitment to making higher education accessible to students from economically disadvantaged backgrounds.

Annual Support and Future Aspirations For PM Vidyalaxmi Scheme

Each year, the scheme aims to support at least one lakh students across India, ensuring that a new generation of learners can access quality higher education without financial constraints. The annual support goal reflects the government’s dedication to expanding educational opportunities in response to the growing demand for skilled professionals in the Indian economy. Furthermore, by focusing on students in accredited and highly-ranked institutions, the scheme prioritizes quality education as a fundamental right.

Long-term Vision of the PM Vidyalaxmi Scheme

The PM Vidyalaxmi Scheme aligns closely with the National Education Policy 2020, which emphasizes equitable access to quality higher education. This new educational loan framework reflects the government’s broader vision of enhancing financing options for higher education. By investing in accessible, affordable education loans, the scheme aims to bridge financial gaps that often hinder students from achieving their academic potential. This initiative also reinforces India’s commitment to building a skilled, educated workforce that can drive future economic growth.

Conclusion

The PM Vidyalaxmi Scheme represents a landmark initiative in India’s educational policy, providing essential financial support for students pursuing higher education. By offering collateral- and guarantor-free loans through a streamlined, accessible platform, the scheme eliminates financial barriers and empowers students to achieve academic success. Students and their families are encouraged to explore and utilize this scheme to unlock a future filled with educational opportunities. The government’s commitment to providing financial support for over 22 lakh students showcases a vision of inclusivity, resilience, and growth, laying the groundwork for a more educated, empowered India.

Editor

Editor