Fintech Powerhouse Titans: India's Journey to Becoming a Global Leader

Explore India's remarkable journey to becoming a global fintech powerhouse. Discover how innovative startups and digital transformation are positioning India as a leader in the fintech industry.

How India is Paving the Way to Become a Global Fintech Superpower

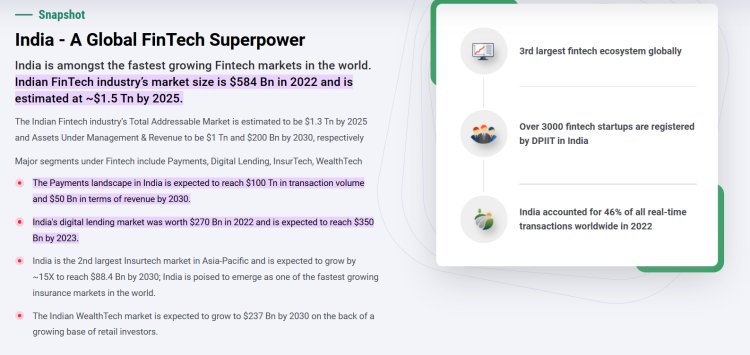

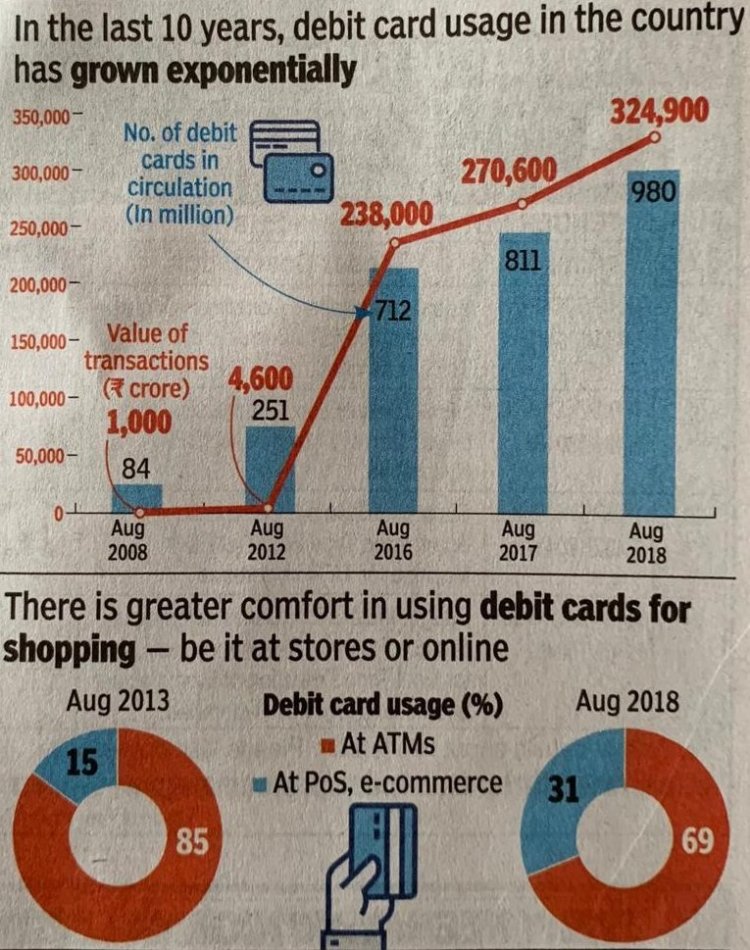

India’s fintech scene is booming! With innovations like the Unified Payments Interface (UPI) transforming digital transactions, India isn’t just keeping up with the digital finance wave—it’s leading it. Just last year, India crossed an astounding $3 trillion in digital payment transactions, demonstrating a seismic shift in how people and businesses handle money.

Backed by more than 2,000 fintech startups, India’s fintech revolution is breaking down old financial barriers. It’s creating easier access to loans, promoting financial literacy, and reshaping the financial landscape to reach millions of underserved people. The government’s ambitious goal to become a $5 trillion economy hinges on sectors like fintech that have the potential to create jobs, foster financial inclusion, and support sustainable economic growth. In short, India is poised to be a global leader in the fintech space, with a thriving ecosystem that’s setting an example for the world.

The Evolution of India’s Fintech Landscape

India’s journey in the fintech space has been remarkable, with each innovation laying the foundation for the next. Historically, the country’s financial services were cumbersome and cash-centric. However, over the last decade, major milestones like the introduction of UPI have fast-tracked India’s transition toward a digital and cashless economy. UPI, which allows easy bank-to-bank transfers using a mobile app, has revolutionized the payment landscape by making transactions seamless, safe, and almost instantaneous.

The widespread adoption of digital payments isn’t just about convenience—it’s fundamentally transforming the economy. In 2022 alone, India processed over $3 trillion in digital payments, showcasing the public's shift towards digital finance. This shift has brought fintech into the mainstream, putting India at the forefront of global financial innovation.

Key Players in the Indian Fintech Ecosystem

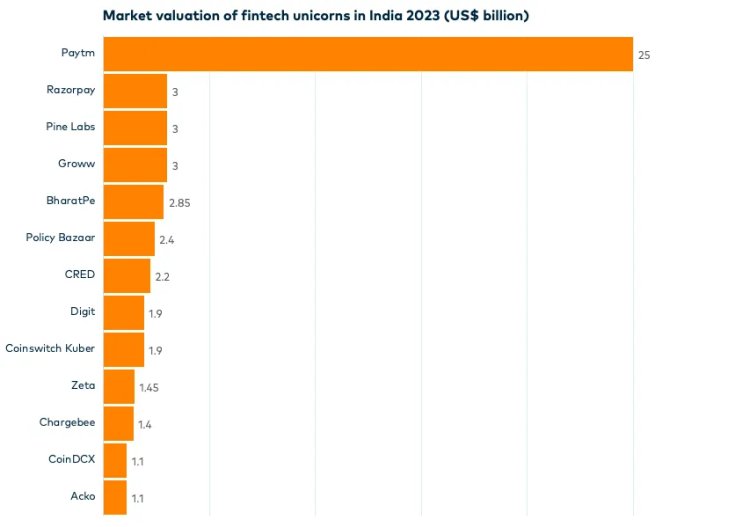

India’s fintech ecosystem is diverse, comprising over 2,000 startups that are reshaping the financial services sector. These companies are not only offering innovative solutions but are also driving intense competition, which is ultimately beneficial for consumers.

Prominent players include Riskcovry and InsureTech, which are simplifying insurance processes, as well as Naffa Innovations Private Limited and ToneTag, which focus on mobile banking solutions. Established financial institutions and emerging fintech companies both play critical roles. While traditional banks provide stability and regulatory compliance, fintech startups bring in agility and innovation. This blend of experience and fresh ideas is one of India’s biggest strengths in the fintech world.

Top Fintech Companies in India

- Paytm

- PhonePe

- PayPal

- Intuit

- Stripe

- Visa

- Slice

- Wise

Payment Systems in India: Understanding the Framework

The Reserve Bank of India (RBI) has built a robust payment system infrastructure that underpins the fintech industry’s growth. Two primary components of this system are Real-Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT). These systems are pivotal for secure, regulated transactions, offering speed and convenience that make digital payments practical on a large scale.

RTGS is used for high-value transactions, providing instant transfer of funds above a specific threshold, while NEFT is ideal for smaller amounts and operates in hourly batches. Together with UPI and other digital payment solutions, these systems offer a comprehensive framework that’s making India a cashless economy.

Innovations Driving Financial Inclusion

One of the most impactful contributions of fintech in India has been in the area of financial inclusion. Millions who were once underserved or entirely unbanked now have access to essential financial services. Initiatives aimed at improving financial literacy and increasing access to credit are creating a more financially inclusive India.

For example, the Buy Now, Pay Later (BNPL) model has changed how people manage their expenses, especially among younger generations and those with limited access to traditional credit. Open banking has democratized financial services by allowing secure sharing of customer information, enabling more personalized financial products. With innovations like neo-banking and micro-lending platforms, even rural and remote populations now have tools to manage and grow their finances.

The Role of Government and Regulatory Bodies

The Indian government has been proactive in promoting fintech growth. Organizations like the National Payments Corporation of India (NPCI) play a pivotal role by managing UPI and other digital payment systems that drive the fintech ecosystem forward. Government recognition through initiatives like the National Startup Awards encourages fintech innovation and rewards startups making a positive impact.

Furthermore, regulatory bodies have provided guidance on data security, KYC requirements, and customer protection policies. By setting these standards, the government has created an environment where fintech companies can innovate safely and responsibly, ensuring consumer trust and sustainability.

Challenges Facing the Fintech Sector in India

While India’s fintech industry has experienced phenomenal growth, it also faces significant challenges. One of the biggest concerns is cybersecurity. With a surge in digital transactions, protecting customer data and preventing fraud are top priorities. Fintech companies must invest heavily in cybersecurity to keep pace with evolving threats and maintain customer trust.

Another challenge is competition from global players. Companies from around the world are eyeing India’s fintech market, adding pressure on local firms to stay innovative and competitive. Balancing innovation with compliance is a delicate dance, and as the sector matures, these challenges will continue to shape its evolution.

Future Outlook: India’s Path to a $5 Trillion Economy

Looking ahead, the fintech industry’s growth trajectory is promising. India’s fintech market is projected to continue expanding, with increased investment in digital banking, micro-lending, and AI-driven financial solutions. Fintech is expected to play a crucial role in driving economic growth, job creation, and financial inclusion.

India’s target of becoming a $5 trillion economy will require every sector to contribute, and fintech is uniquely positioned to do so by fostering digital transformation across industries. As more people gain access to digital financial tools, the overall economy benefits from increased consumer spending, higher savings rates, and greater financial stability.

Conclusion

India’s fintech journey is a testament to what can be achieved with vision, innovation, and collaboration. From a cash-dependent society to a leader in digital finance, India’s rise in fintech has set a new global standard. With over 2,000 startups, cutting-edge technology like UPI, and government backing, India is well on its way to becoming a global fintech powerhouse.

The road to a $5 trillion economy is filled with opportunities, and the fintech sector will be instrumental in reaching this milestone. As India continues to break down financial barriers, create jobs, and foster inclusion, the nation is shaping a financial landscape that could inspire other economies around the world.

Editor

Editor