The Brand Finance Insurance 100 – 2025: Life Insurance Corporation of India Remarkable Performance

Discover how LIC (Life Insurance Corporation of India) achieved a remarkable milestone in the Brand Finance Insurance 100 – 2025, ranking as the world’s 3rd strongest insurance brand. Learn about its 36% surge in brand value, strong market presence, and global recognition as a trusted leader in the insurance industry

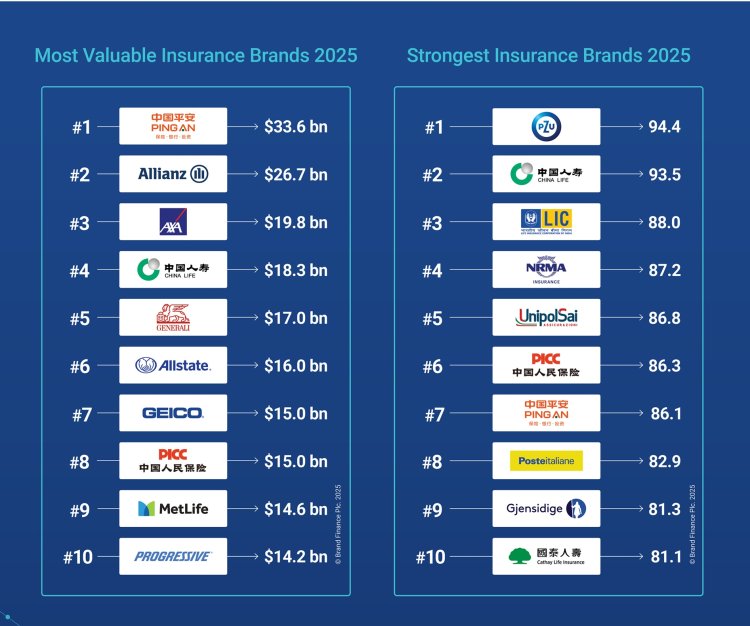

The Brand Finance Insurance 100 – 2025 report highlights significant developments in the global insurance industry, with notable performances by Indian insurers.

Life Insurance Corporation of India (LIC) Remarkable Performance

Life Insurance Corporation of India (LIC) has been ranked as the world's third strongest insurance brand, achieving a Brand Strength Index (BSI) score of 88 out of 100. This recognition underscores LIC's robust brand strength and its significant presence in the global insurance market.

In terms of brand value, LIC experienced a substantial 36% year-on-year increase, reaching USD 13.3 billion. This growth propelled LIC to the 12th position globally among the most valuable insurance brands, marking an improvement of six places from the previous year.

-

LIC secured the 3rd position in the Brand Finance Insurance 100 2025 report.

-

The ranking is based on the Brand Strength Index (BSI), where LIC scored 88.9 out of 100.

-

LIC’s brand value surged by 36%, reaching $11.1 billion in 2025.

-

The report highlights LIC’s strong market presence, customer trust, and financial performance.

-

Ping An Insurance (China) and Allianz (Germany) retained their positions as the 1st and 2nd strongest insurance brands, respectively.

SBI Life's Upward Trajectory

SBI Life also demonstrated impressive growth, with a 27% increase in brand value, amounting to USD 1.6 billion. This surge led to a climb of 13 positions, placing SBI Life at the 74th spot globally. The brand's success is attributed to its expanded product offerings, including unit-linked plans, term insurance, and annuity products, catering to evolving customer needs.

Global Insurance Industry Trends

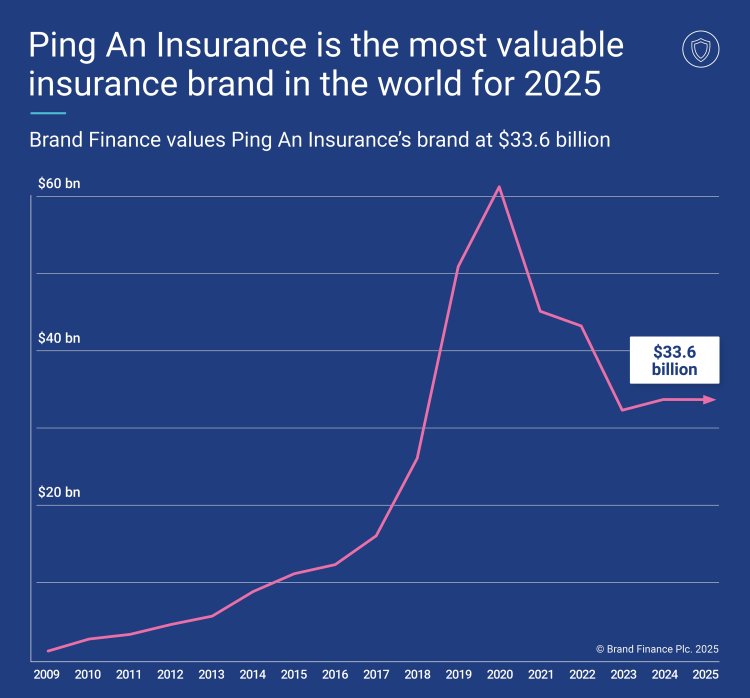

The collective brand value of the world's top 100 insurance brands grew by 9% year-on-year. Ping An Insurance retained its position as the most valuable insurance brand for the ninth consecutive year, with a brand value of USD 33.6 billion. Allianz followed, achieving a 9% increase in brand value to USD 26.7 billion, narrowing the gap at the top.

Nissay/Nippon Life Insurance emerged as the fastest-growing insurance brand, with a remarkable 94% increase in brand value, reaching USD 9.2 billion. This growth is attributed to rising revenues and strategic expansions beyond its domestic market, including the acquisition of a 20% stake in U.S.-based Corebridge Financial.

PZU was recognized as the strongest insurance brand, achieving a BSI score of 94.4 out of 100, placing it among the world's strongest brands across all sectors.

These developments reflect a dynamic global insurance landscape, with Indian insurers like LIC and SBI Life making significant strides in brand strength and value.

-

The global insurance industry saw a 9% growth in brand value in 2025.

-

Ping An Insurance (China) remained the most valuable insurance brand, with a brand value of $33.3 billion.

-

Allianz (Germany) and LIC (India) followed as the 2nd and 3rd strongest brands, respectively.

-

The report highlights the resilience of insurance brands in adapting to economic uncertainties and evolving customer needs.

A Look at the World’s Leading Insurance Brands in 2025

The global insurance industry is witnessing steady growth, with nine of the top ten brands strengthening their market presence and increasing their brand value in 2025. At the forefront, Ping An Insurance and Allianz continue to dominate, holding on to their positions as the two most valuable insurance brands worldwide.

Ping An Insurance: Holding Steady at the Top

China’s Ping An Insurance remains the world’s most valuable insurance brand, maintaining a brand value of USD 33.6 billion. The company saw steady revenue growth, thanks to its solid performance in key sectors like life, health, and property and casualty (P&C) insurance. However, challenges in profitability throughout 2023 slowed its overall brand expansion. Despite these hurdles, Ping An’s strong foothold in the market keeps it firmly in the number one spot.

Allianz Narrows the Gap

Germany’s Allianz recorded an impressive 9% growth, bringing its brand value up to USD 26.7 billion. This growth helped Allianz close in on Ping An, reducing the gap between the two leading insurance giants. Allianz’s diversified income stream has played a crucial role in its success, with strong performances across all business segments. Notably, its P&C segment thrived, alongside an increase in new business premiums in life and health insurance.

AXA Breaks into the Top Three

France’s AXA climbed into the top three, surpassing China Life Insurance after an impressive 20% surge in brand value, reaching USD 19.8 billion. China Life Insurance, despite experiencing 5% growth (now valued at USD 18.3 billion), couldn’t keep up with AXA’s momentum.

AXA’s strong global presence contributed significantly to this ranking shift. The brand is particularly well-recognized for its solid market performance and strong consumer perception. AXA’s influence is especially notable in regions like Türkiye, Thailand, and Indonesia, where it has gained substantial traction.

Generali and Allstate Make a Big Leap

Two brands that stood out with exceptional growth in 2025 are Generali Group and Allstate.

-

Generali Group saw an outstanding 47% jump in brand value, reaching USD 17 billion. This growth propelled the Italian insurance giant up seven spots, securing a place in the top ten.

-

Similarly, Allstate experienced a 39% increase, bringing its brand value to USD 16 billion and also rising seven ranks to enter the top ten.

Generali’s success was driven by strategic expansions in both life and P&C insurance. A major factor in its growth was the acquisition of Liberty Seguros, which bolstered its presence in Spain and Portugal, strengthening its earnings and boosting its P&C segment.

Additionally, Generali’s deep-rooted regional focus helped it build strong connections with customers, particularly in Italy, Austria, and Spain. The brand enjoys a high level of emotional engagement, with particularly strong “brand love” scores in Italy and Austria, showcasing its strong customer loyalty and relevance in these markets.

PZU Tops the Charts as the World's Strongest Insurance Brand

PZU has secured its position as the world's strongest insurance brand, earning an impressive Brand Strength Index (BSI) score of 94.4 out of 100. With a top-tier AAA+ rating, PZU now stands among the strongest brands across all industries worldwide.

A key trend among the top ten strongest insurance brands is that they primarily operate within a single market. This highlights the major advantage local brands have when it comes to brand equity and customer trust.

PZU’s dominance is largely driven by its deep-rooted presence in Poland, where it enjoys strong brand familiarity and is a preferred choice among customers. High recommendation rates and strong consumer consideration further reinforce its reputation as a leading insurance provider.

China Life Insurance, another powerhouse in the industry, also holds a AAA+ rating with a BSI score of 93.5 out of 100. Like PZU, it benefits from a strong home-market focus. Its overwhelming presence in China's life insurance sector has made it one of the most recognized brands in the country, earning a perfect score for "brand I know well", a testament to its widespread market familiarity.

Meanwhile, MAPFRE (which saw a 15% increase in brand value, reaching USD 4.6 billion) is an example of an insurance brand with a broader international reach. Though based in Spain, MAPFRE has successfully expanded across Europe and the Americas, maintaining a solid presence in multiple markets. In Spain, it enjoys strong familiarity and consideration, while in Latin America, it has cemented its foothold by consistently growing its presence.

A key move in MAPFRE’s expansion strategy was the 2023 acquisition of Insignia Life, which is expected to further strengthen its brand equity in the Latin American market in the coming years.

With brands like PZU, China Life Insurance, and MAPFRE leading the way, the global insurance landscape is becoming increasingly competitive, proving that strong local dominance and strategic global expansions are key to long-term brand strength.

Final Thoughts

The insurance industry’s strongest brands prove that customer familiarity, trust, and localized dominance are essential factors in brand strength. While PZU and China Life continue to lead with their home-market focus, MAPFRE demonstrates how strategic expansion can also drive brand value on a global scale. LIC’s brand value surged by 36%, reaching $11.1 billion in 2025. As these brands evolve, their ability to maintain consumer trust and adapt to new markets will be key to their continued success.

Editor

Editor